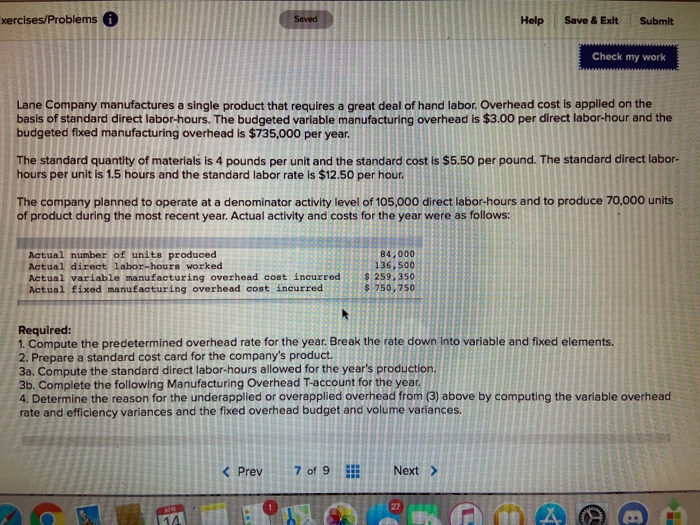

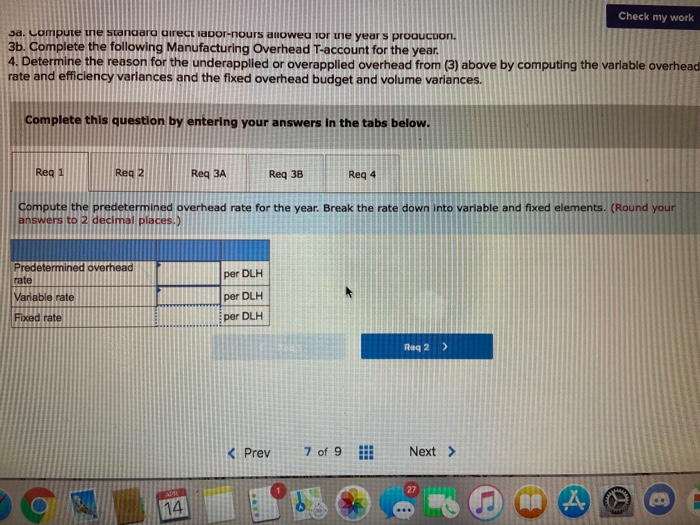

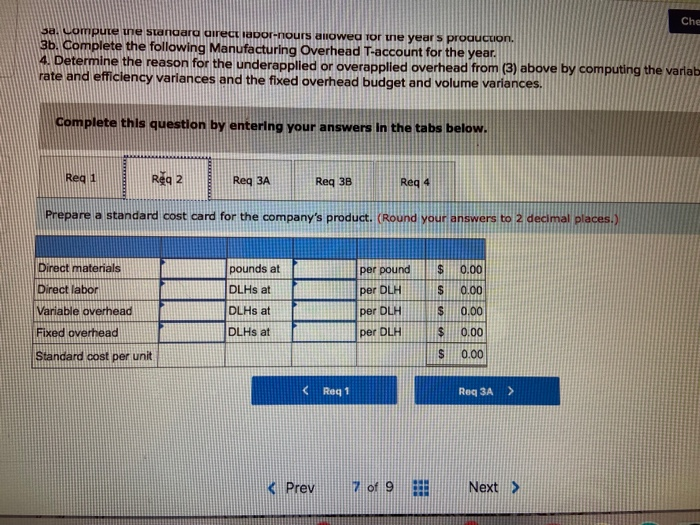

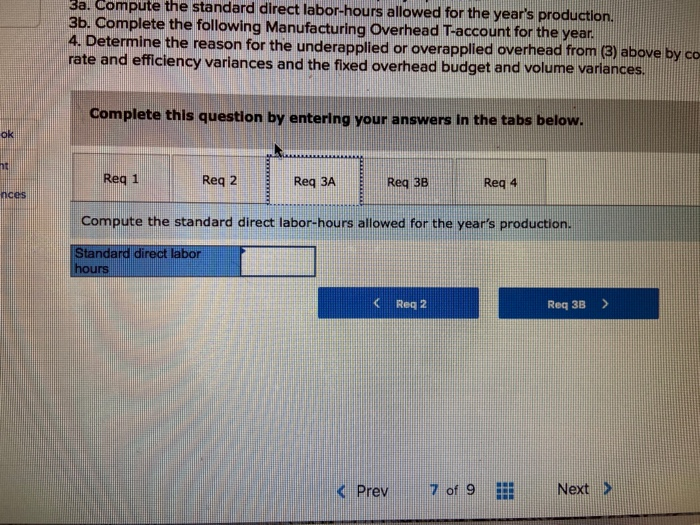

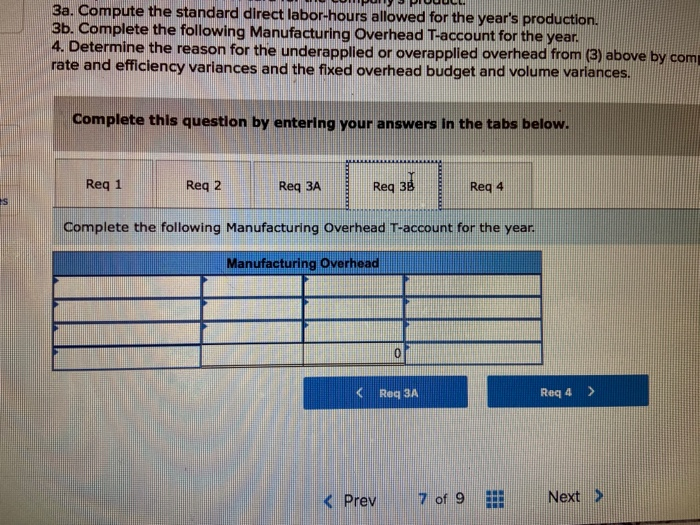

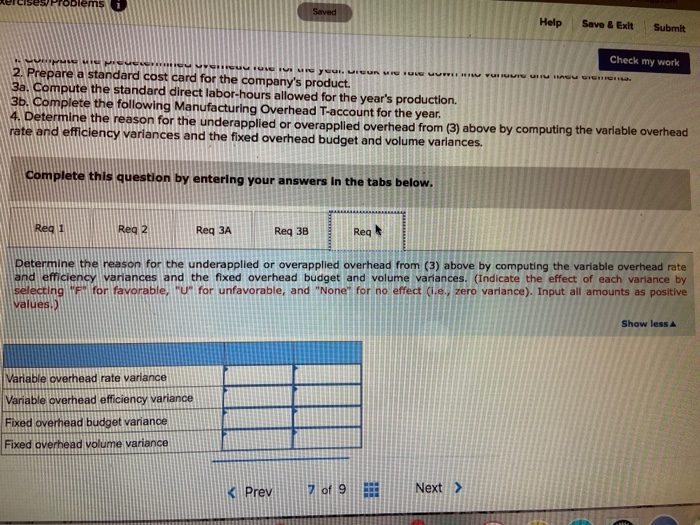

xercises/Problems i Help Save & Exit Submit Check my work Lane Company manufactures a single product that requires a great deal of hand labor. Overhead cost is applied on the basis of standard direct labor-hours. The budgeted variable manufacturing overhead is $3.00 per direct labor-hour and the budgeted fixed manufacturing overhead is $735,000 per year. The standard quantity of materials is 4 pounds per unit and the standard cost is $5.50 per pound. The standard direct labor hours per unit is 1.5 hours and the standard labor rate is $12.50 per hour. The company planned to operate at a denominator activity level of 105,000 direct labor-hours and to produce 70,000 units of product during the most recent year. Actual activity and costs for the year were as follows: amber olbor-ho toring head con Actual number of units produced 5. Actual direct labor-hours worked Actual variable manufacturing overhead cost incurred Actual fixed manufacturing overhead coat incurred 3 84.000 38 136,500 $ 259, 350 $750, 750 Required: 1. Compute the predetermined overhead rate for the year. Break the rate down into variable and fixed elements. 2. Prepare a standard cost card for the company's product. 3a. Compute the standard direct labor-hours allowed for the year's production 3b. Complete the following Manufacturing Overhead T-account for the year. 4. Determine the reason for the underapplied or overapplied overhead from (3) above by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances. nado Check my work 3a. Compute me standard direct labor-nours anowe for me years production. 3b. Complete the following Manufacturing Overhead T-account for the year. 4. Determine the reason for the underapplied or overapplied overhead from (3) above by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances, Complete this question by entering your answers in the tabs below Reg 1 Reg 2 Reg 3A Reg 38 Reg 4 Compute the predetermined overhead rate for the year. Break the rate down into variable and fixed elements. (Round your answers to 2 decimal places.) Predetermined overhead rate Reg 2 > Che sa compute une standard direct labor-nours allowed for the years producon. 36. Complete the following Manufacturing Overhead T-account for the year. 4. Determine the reason for the underapplied or overapplied overhead from (3) above by computing the variat rate and efficiency variances and the fixed overhead budget and volume variances. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3A Req 3B Reg Prepare a standard cost card for the company's product. (Round your answers to 2 decimal places.) pounds at 8 Direct labor DLHs at 8 per pound per DLH per DLH per DLH Variable overhea DLHs at 8 Fixed overhead DLHs at 8 Standard cost per unit 0.00 3a. Compute the standard direct labor-hours allowed for the year's production, 3b. Complete the following Manufacturing Overhead T-account for the year. 4. Determine the reason for the underapplied or overapplied overhead from (3) above by co rate and efficiency variances and the fixed overhead budget and volume variances. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req 3A Req 3B Reg 4 news Compute the standard direct labor-hours allowed for the year's production. Standard direct labor hours Reg 2 Req3B > PUPUULL 3a. Compute the standard direct labor-hours allowed for the year's production. 3b. Complete the following Manufacturing Overhead T-account for the year. 4. Determine the reason for the underapplied or overapplied overhead from (3) above by com rate and efficiency variances and the fixed overhead budget and volume variances. Complete this question by entering your answers in the tabs below. Req 1 Req 2 Reg 3A Req 38 Complete the following Manufacturing Overhead T-account for the year. Manufacturing Overhead MATEMALARIDIA NUA Prev 7 of 9 Next welcises Problems Help Save & Exit Submit Check my work MUUTMIMI MIYUEC Meniu IMI ME you. 2. Prepare a standard cost card for the company's product. 3a. Compute the standard direct labor-hours allowed for the year's production. 35. Complete the following Manufacturing Overhead T-account for the year. 4. Determine the reason for the underapplied or overapplied overhead from (3) above by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req Reg 38 Reg Determine the reason for the underapplied or overapplied overhead from (3) above by computing the variable overhead rate and efficiency Varances and the fixed overhead budget and volume variances. (Indicate the effect of each variance by selecting for Yavorable, Mu" for unfavorable, and "None' for no effect (.e., zero variance). Input all amounts as positive Values Show less le overhead rate variance Variable overhead efficiency variand Fixed overhead budget variance Fixed overhead volume variance Prev 7 of 9 Next >