Answered step by step

Verified Expert Solution

Question

1 Approved Answer

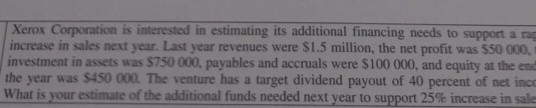

Xerox Corporation is interested in estimating its additional financing needs to support a ra increase in sales next year. Last year revenues were $1.5 million,

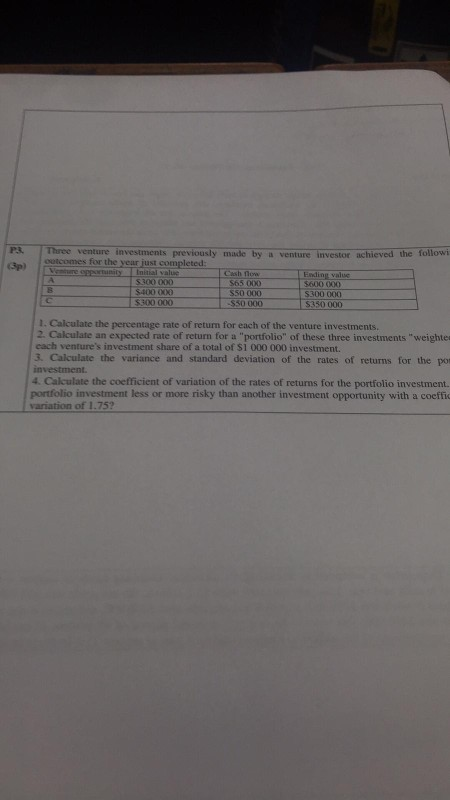

Xerox Corporation is interested in estimating its additional financing needs to support a ra increase in sales next year. Last year revenues were $1.5 million, the net profit was $50 000. investment in assets was $750 000. payables and accruals were $100 000, and equity at the end the year was $450 000. The venture has a target dividend payout of 40 percent of net ince What is your estimate of the additional funds needed next year to support 25% increase in sale Venture investor achieved the follow Three venture investments previously made by outcomes for the year just completed Cash flow S 300 000 S5 000 $400 OXXO S50 000 $300 000 S50 000 Ewing value 5600 000 5300 000 5350 000 1. Calculate the percentage rate of return for each of the venture investments. 2. Calculate an expected rate of return for a "portfolio of these three investments "weighte cach venture's investment share of a total of 81 000 000 investment. 3. Calculate the variance and standard deviation of the rates of returns for the po investment. 4. Calculate the coefficient of variation of the rates of returns for the portfolio investment. portfolio investment less or more risky than another investment opportunity with a coeffic variation of 1.75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started