Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Xespresso is launching a new type of espresso coffee machine. Production requires an initial investment of 85m in year zero. The project is expected to

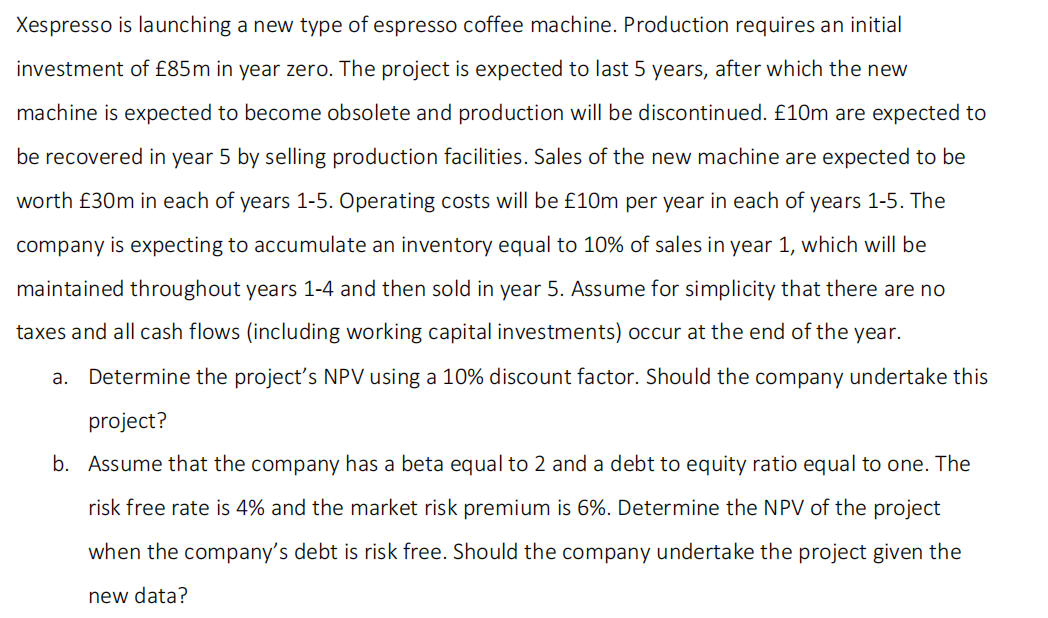

Xespresso is launching a new type of espresso coffee machine. Production requires an initial investment of 85m in year zero. The project is expected to last 5 years, after which the new machine is expected to become obsolete and production will be discontinued. 10m are expected to be recovered in year 5 by selling production facilities. Sales of the new machine are expected to be worth 30m in each of years 1-5. Operating costs will be 10m per year in each of years 15. The company is expecting to accumulate an inventory equal to 10% of sales in year 1 , which will be maintained throughout years 1-4 and then sold in year 5. Assume for simplicity that there are no taxes and all cash flows (including working capital investments) occur at the end of the year. a. Determine the project's NPV using a 10\% discount factor. Should the company undertake this project? b. Assume that the company has a beta equal to 2 and a debt to equity ratio equal to one. The risk free rate is 4% and the market risk premium is 6%. Determine the NPV of the project when the company's debt is risk free. Should the company undertake the project given the new data

Xespresso is launching a new type of espresso coffee machine. Production requires an initial investment of 85m in year zero. The project is expected to last 5 years, after which the new machine is expected to become obsolete and production will be discontinued. 10m are expected to be recovered in year 5 by selling production facilities. Sales of the new machine are expected to be worth 30m in each of years 1-5. Operating costs will be 10m per year in each of years 15. The company is expecting to accumulate an inventory equal to 10% of sales in year 1 , which will be maintained throughout years 1-4 and then sold in year 5. Assume for simplicity that there are no taxes and all cash flows (including working capital investments) occur at the end of the year. a. Determine the project's NPV using a 10\% discount factor. Should the company undertake this project? b. Assume that the company has a beta equal to 2 and a debt to equity ratio equal to one. The risk free rate is 4% and the market risk premium is 6%. Determine the NPV of the project when the company's debt is risk free. Should the company undertake the project given the new data Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started