Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Xexercise 1 (LO 3,4) Entry of a new partner under the goodwill method. Pearson and Murphy have partner capital balances, at book value, of $45,000

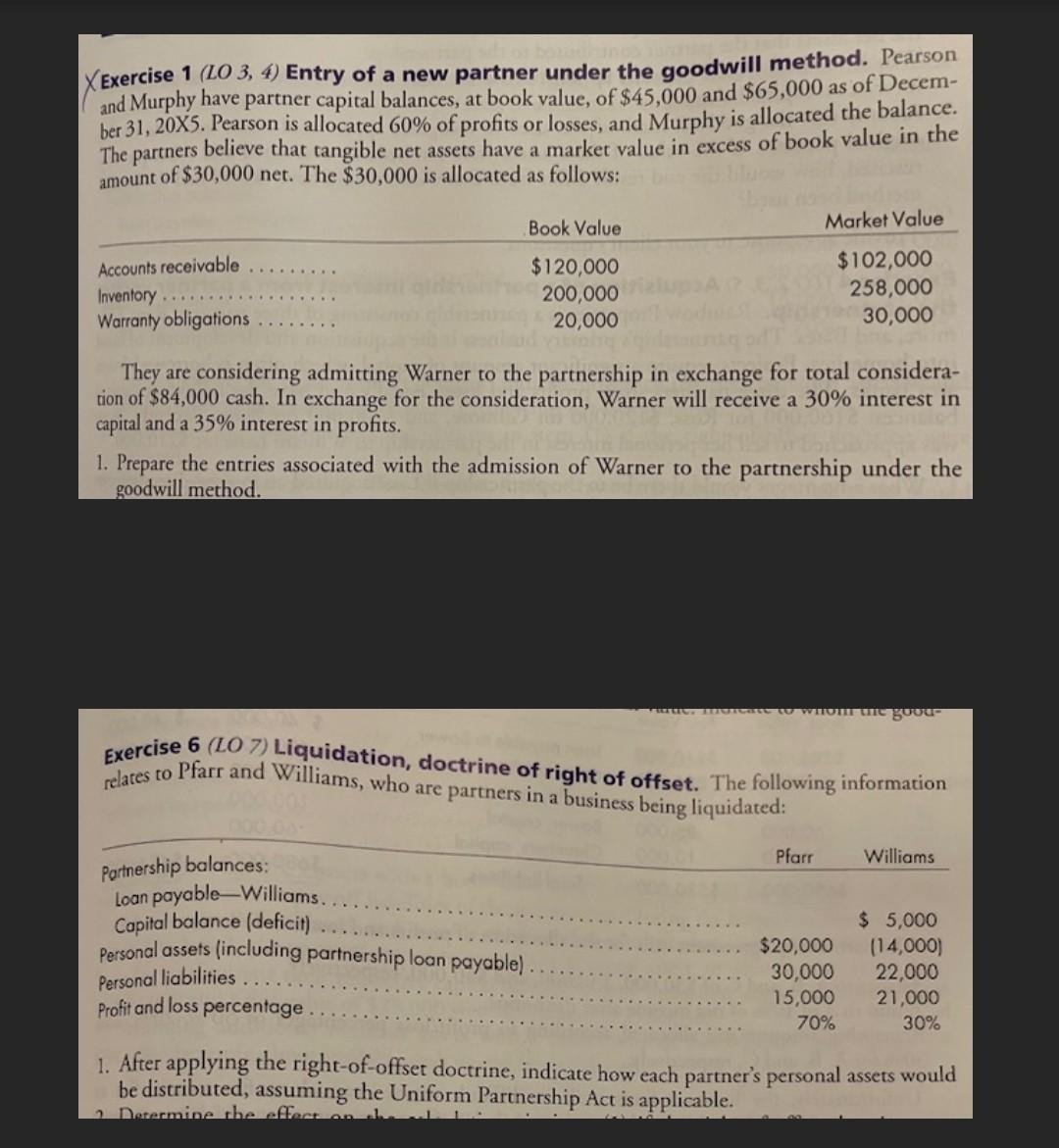

Xexercise 1 (LO 3,4) Entry of a new partner under the goodwill method. Pearson and Murphy have partner capital balances, at book value, of $45,000 and $65,000 as of December 31,20X5. Pearson is allocated 60% of profits or losses, and Murphy is allocated the balance. The partners believe that tangible net assets have a market value in excess of book value in the amount of $30,000 net. The $30,000 is allocated as follows: They are considering admitting Warner to the partnership in exchange for total consideration of $84,000 cash. In exchange for the consideration, Warner will receive a 30% interest in capital and a 35% interest in profits. 1. Prepare the entries associated with the admission of Warner to the partnership under the goodwill method. Exercise 6(LO)7) Liquidation, doctrine of right of offset. The following information relates to Pfarr and Williams, who are partners in a business being liquidated: 1. After applying the right-of-offset doctrine, indicate how each partner's personal assets would be distributed, assuming the Uniform Partnership Act is applicable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started