Answered step by step

Verified Expert Solution

Question

1 Approved Answer

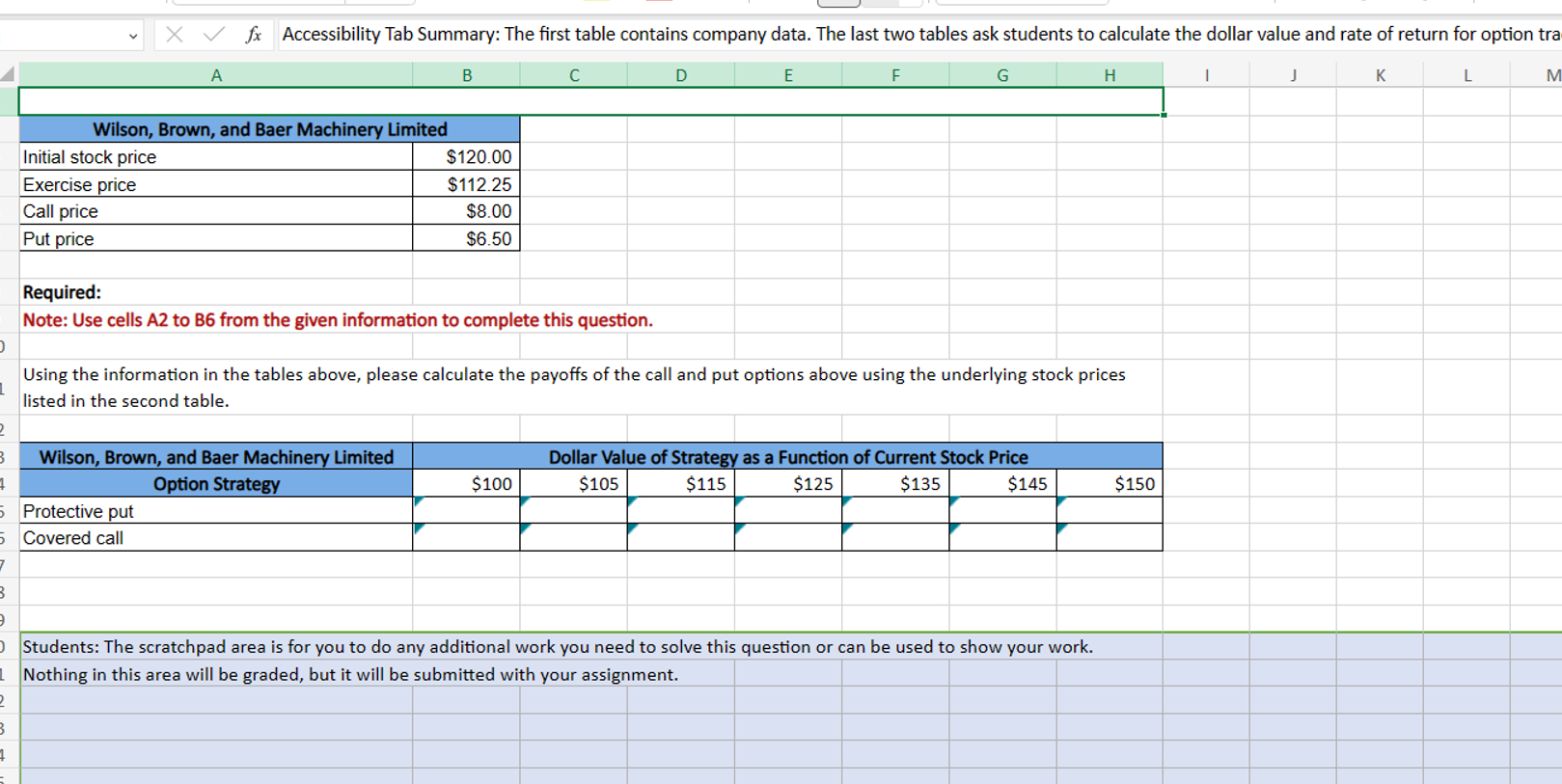

Xfx Accessibility Tab Summary: The first table contains company data. The last two tables ask students to calculate the dollar value and rate of

Xfx Accessibility Tab Summary: The first table contains company data. The last two tables ask students to calculate the dollar value and rate of return for option tra A B D E F G H I J K L M Wilson, Brown, and Baer Machinery Limited Initial stock price $120.00 Exercise price Call price Put price Required: $112.25 $8.00 $6.50 , 1 Note: Use cells A2 to B6 from the given information to complete this question. Using the information in the tables above, please calculate the payoffs of the call and put options above using the underlying stock prices listed in the second table. 2 3 Wilson, Brown, and Baer Machinery Limited Option Strategy $100 Dollar Value of Strategy as a Function of Current Stock Price $105 $115 $125 $135 $145 $150 5 Protective put 5 Covered call 7 B 9 O Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work. 1 Nothing in this area will be graded, but it will be submitted with your assignment. 2 B 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started