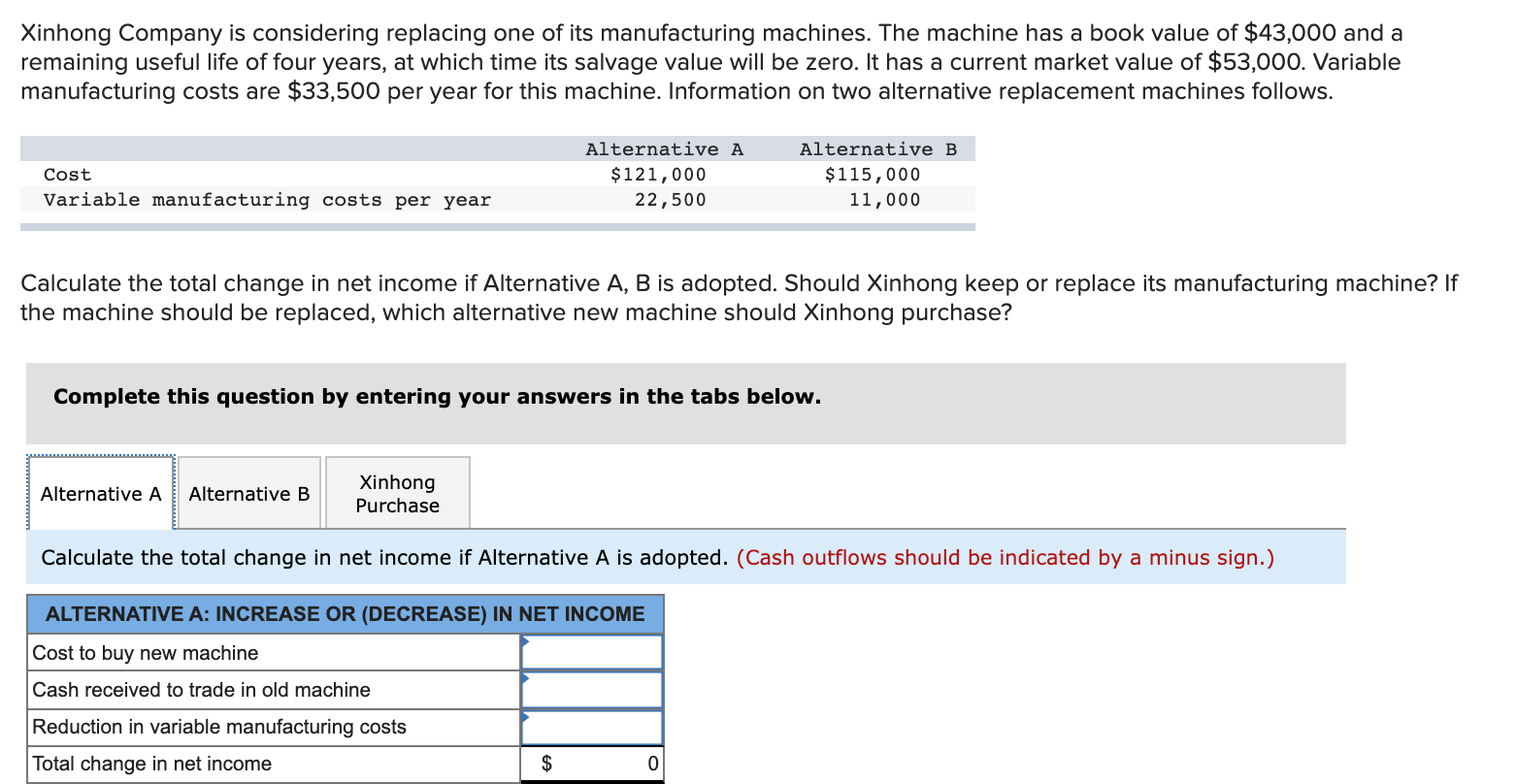

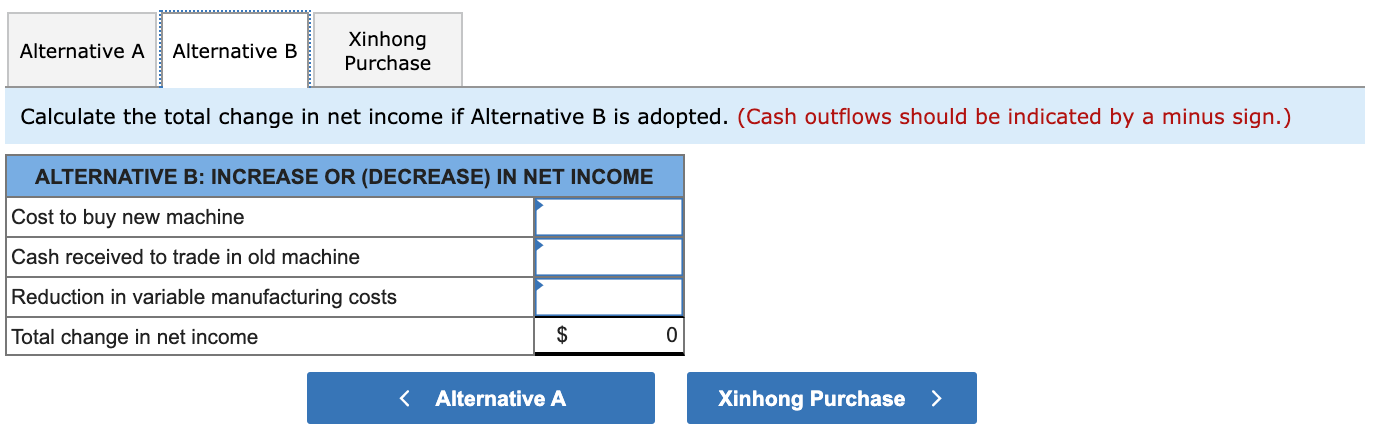

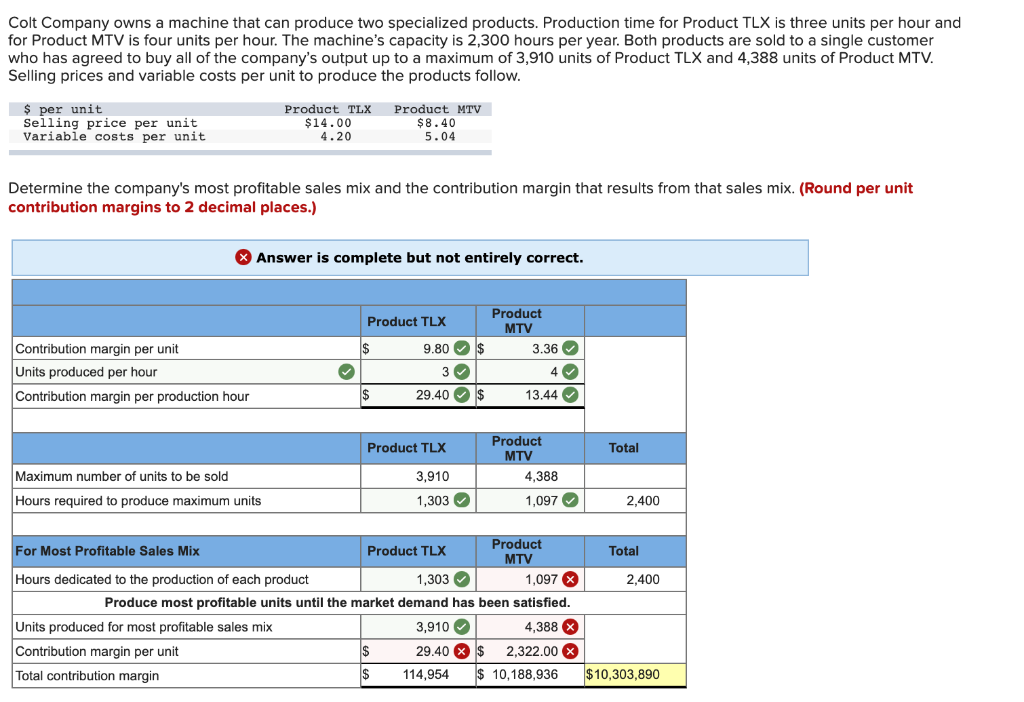

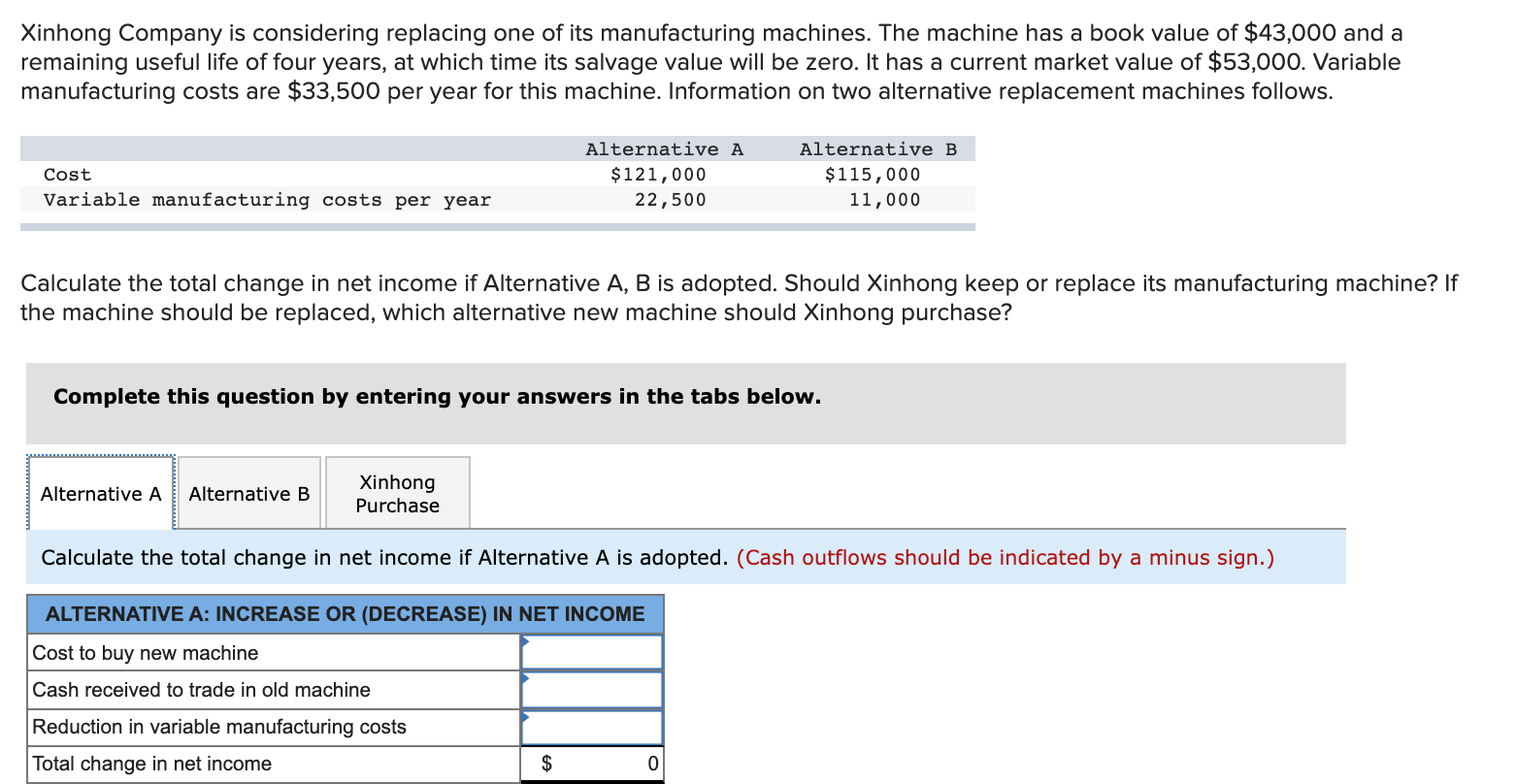

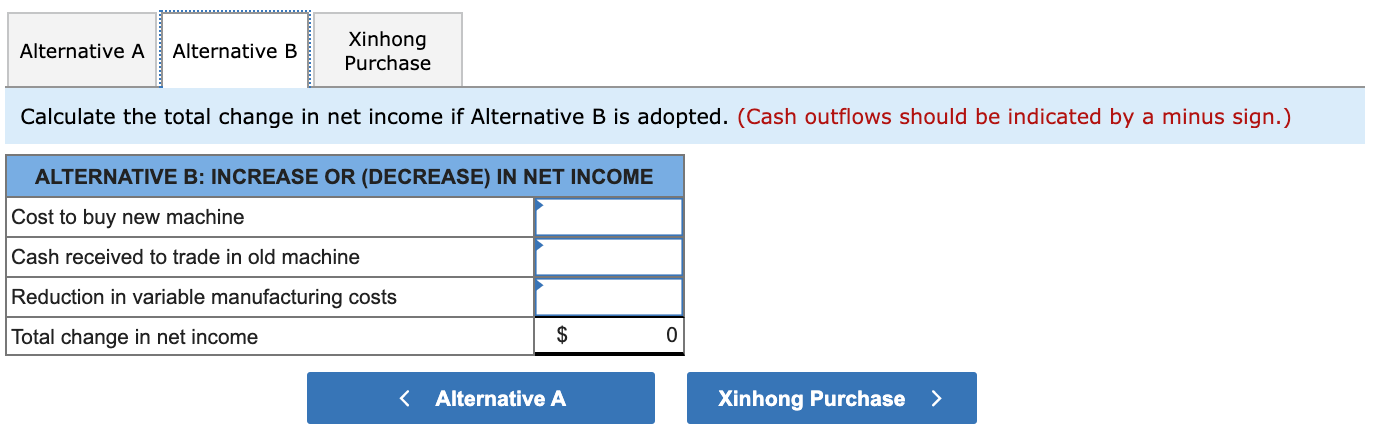

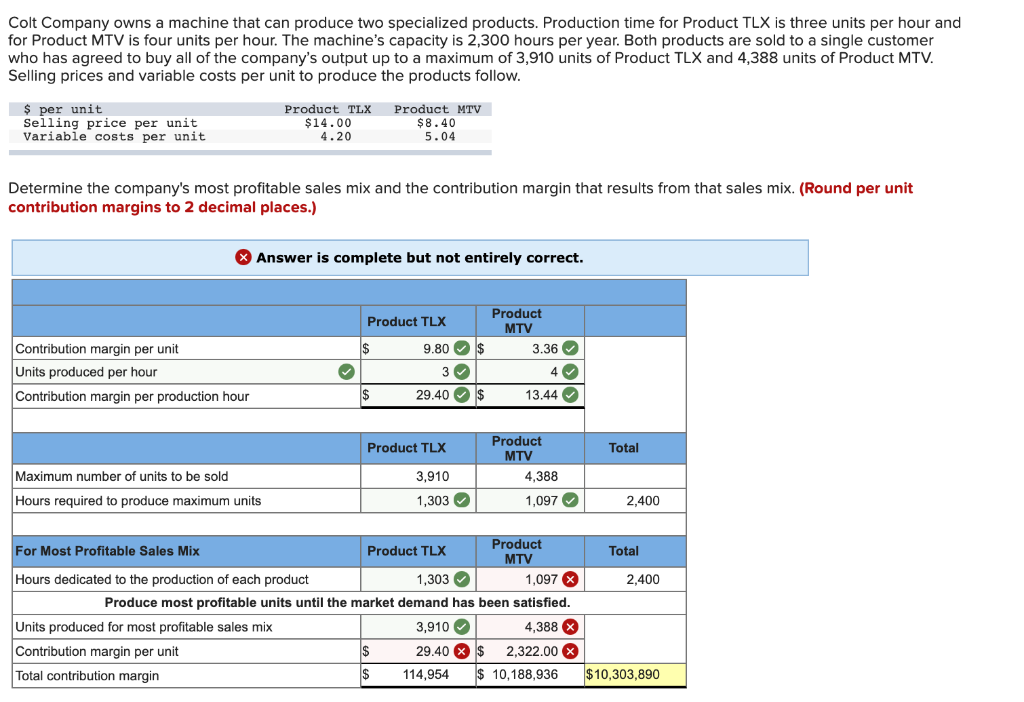

Xinhong Company is considering replacing one of its manufacturing machines. The machine has a book value of $43,000 and a remaining useful life of four years, at which time its salvage value will be zero. It has a current market value of $53,000. Variable manufacturing costs are $33,500 per year for this machine. Information on two alternative replacement machines follows. Cost Variable manufacturing costs per year Alternative A $121,000 22,500 Alternative B $115,000 11,000 Calculate the total change in net income if Alternative A, B is adopted. Should Xinhong keep or replace its manufacturing machine? If the machine should be replaced, which alternative new machine should Xinhong purchase? Complete this question by entering your answers in the tabs below. Alternative A Alternative B Xinhong Purchase Calculate the total change in net income if Alternative A is adopted. (Cash outflows should be indicated by a minus sign.) ALTERNATIVE A: INCREASE OR (DECREASE) IN NET INCOME Cost to buy new machine Cash received to trade in old machine Reduction in variable manufacturing costs Total change in net income $ 0 Alternative A Alternative B Xinhong Purchase Calculate the total change in net income if Alternative B is adopted. (Cash outflows should be indicated by a minus sign.) ALTERNATIVE B: INCREASE OR (DECREASE) IN NET INCOME Cost to buy new machine Cash received to trade in old machine Reduction in variable manufacturing costs Total change in net income $ 0 Colt Company owns a machine that can produce two specialized products. Production time for Product TLX is three units per hour and for Product MTV is four units per hour. The machine's capacity is 2,300 hours per year. Both products are sold to a single customer who has agreed to buy all of the company's output up to a maximum of 3,910 units of Product TLX and 4,388 units of Product MTV. Selling prices and variable costs per unit to produce the products follow. $ per unit Selling price per unit Variable costs per unit Product TLX $14.00 4.20 Product MTV $8.40 5.04 Determine the company's most profitable sales mix and the contribution margin that results from that sales mix. (Round per unit contribution margins to 2 decimal places.) Answer is complete but not entirely correct. Product Product TLX MTV 9.80$ 3.36 Contribution margin per unit Units produced per hour Contribution margin per production hour 3 4 13.44 $ 29.40 $ Product TLX Total Maximum number of units to be sold Hours required to produce maximum units 3,910 1,303 Product MTV 4,388 1,097 2,400 For Most Profitable Sales Mix Product Product TLX Total MTV Hours dedicated to the production of each product 1,303 1,097 X 2,400 Produce most profitable units until the market demand has been satisfied. Units produced for most profitable sales mix 3,910 4,388 X Contribution margin per unit $ 29.40 X $ 2,322.00 X Total contribution margin $ 114,954 $ 10,188,936 $10,303,890