Question

XOS Corporation XOS Corporation (XOS) sells accounting-related memorabilia at a small store. The company was organized and began operations on January 1, 2016. Events During

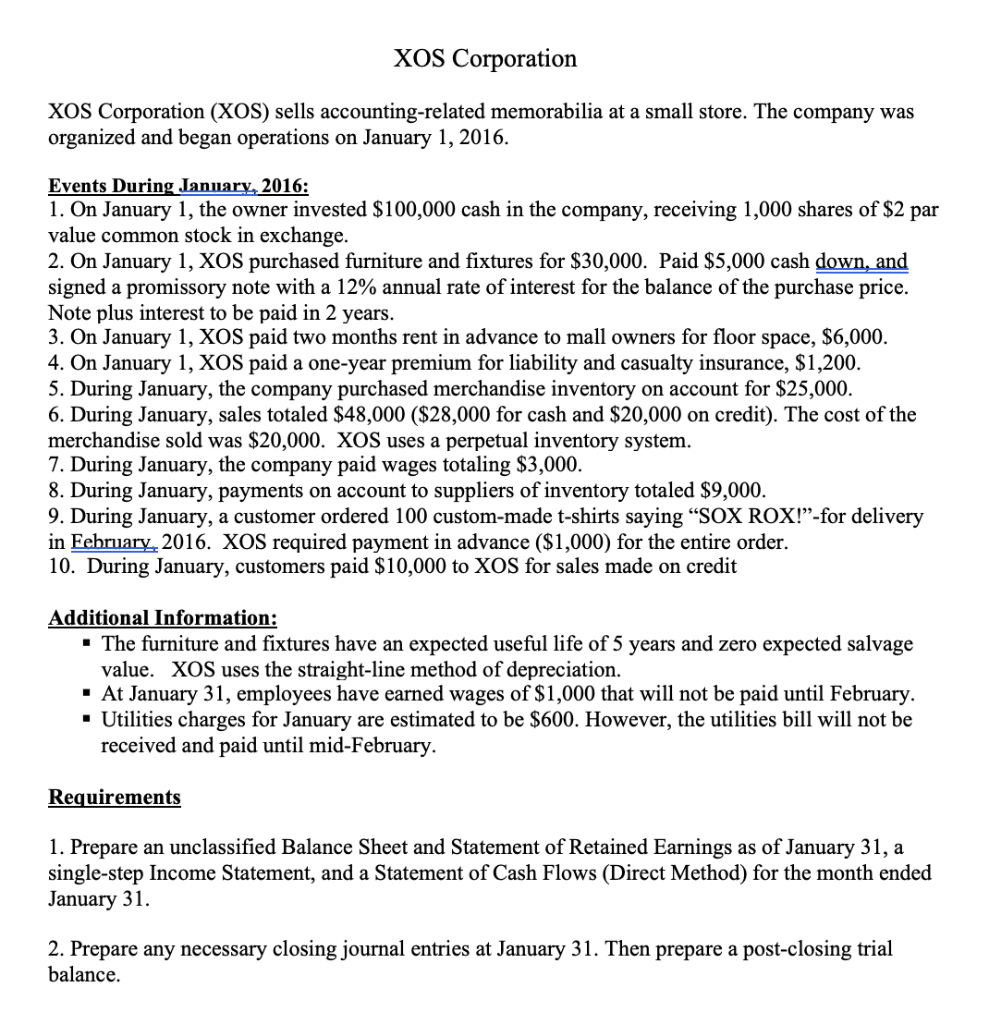

XOS Corporation

XOS Corporation (XOS) sells accounting-related memorabilia at a small store. The company was organized and began operations on January 1, 2016.

Events During January, 2016:

1. On January 1, the owner invested $100,000 cash in the company, receiving 1,000 shares of $2 par value common stock in exchange.

2. On January 1, XOS purchased furniture and fixtures for $30,000. Paid $5,000 cash down, and signed a promissory note with a 12% annual rate of interest for the balance of the purchase price. Note plus interest to be paid in 2 years.

3. On January 1, XOS paid two months rent in advance to mall owners for floor space, $6,000.

4. On January 1, XOS paid a one-year premium for liability and casualty insurance, $1,200.

5. During January, the company purchased merchandise inventory on account for $25,000.

6. During January, sales totaled $48,000 ($28,000 for cash and $20,000 on credit). The cost of the merchandise sold was $20,000. XOS uses a perpetual inventory system.

7. During January, the company paid wages totaling $3,000.

8. During January, payments on account to suppliers of inventory totaled $9,000.

9. During January, a customer ordered 100 custom-made t-shirts saying SOX ROX!-for delivery in February, 2016. XOS required payment in advance ($1,000) for the entire order.

10. During January, customers paid $10,000 to XOS for sales made on credit

Additional Information:

- The furniture and fixtures have an expected useful life of 5 years and zero expected salvage value. XOS uses the straight-line method of depreciation.

- At January 31, employees have earned wages of $1,000 that will not be paid until February.

- Utilities charges for January are estimated to be $600. However, the utilities bill will not be received and paid until mid-February.

Requirements

1. Prepare an unclassified Balance Sheet and Statement of Retained Earnings as of January 31, a single-step Income Statement, and a Statement of Cash Flows (Direct Method) for the month ended January 31.

2. Prepare any necessary closing journal entries at January 31. Then prepare a post-closing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started