Answered step by step

Verified Expert Solution

Question

1 Approved Answer

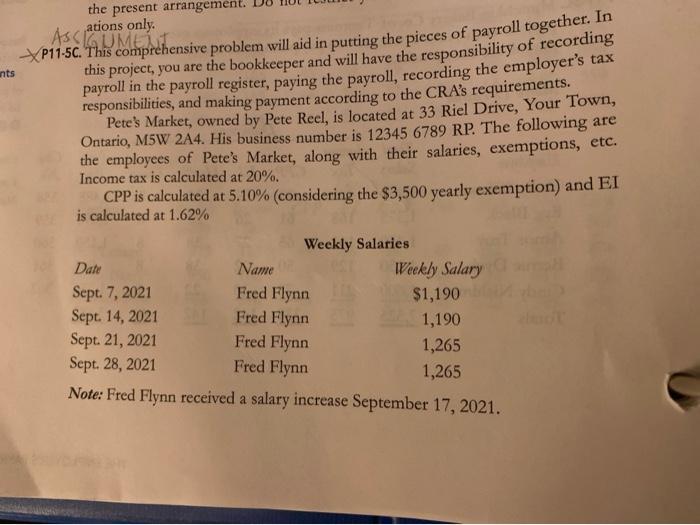

ants the present arrangement ations only. P11-5C. This comprehensive problem will aid in putting the pieces of payroll together. In this project, you are

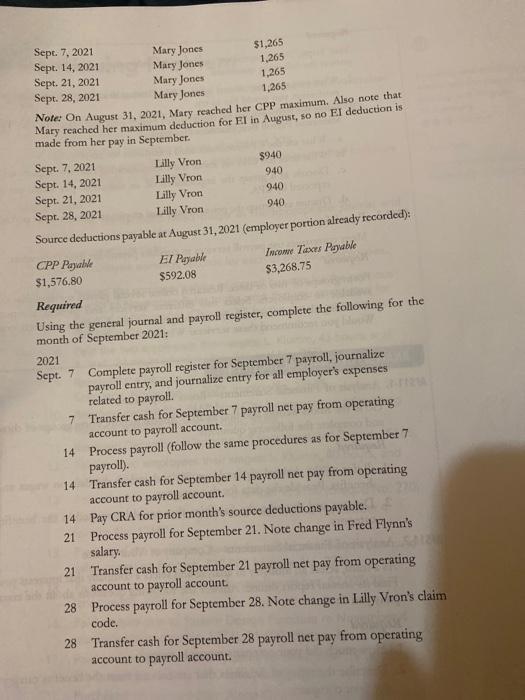

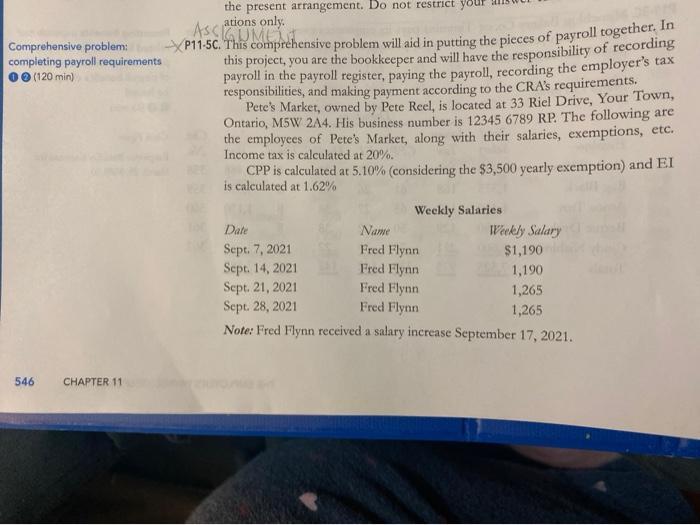

ants the present arrangement ations only. P11-5C. This comprehensive problem will aid in putting the pieces of payroll together. In this project, you are the bookkeeper and will have the responsibility of recording payroll in the payroll register, paying the payroll, recording the employer's tax responsibilities, and making payment according to the CRA's requirements. Pete's Market, owned by Pete Reel, is located at 33 Riel Drive, Your Town, Ontario, M5W 2A4. His business number is 12345 6789 RP. The following are the employees of Pete's Market, along with their salaries, exemptions, etc. Income tax is calculated at 20%. CPP is calculated at 5.10% (considering the $3,500 yearly exemption) and EI is calculated at 1.62% Weekly Salaries Date Sept. 7, 2021 Sept. 14, 2021 Sept. 21, 2021 Sept. 28, 2021 Note: Fred Flynn received a salary increase September 17, 2021. Name Fred Flynn Fred Flynn Fred Flynn Fred Flynn Weekly Salary $1,190 1,190 1,265 1,265 Sept. 7, 2021. Sept. 14, 2021 Sept. 21, 2021 Sept. 28, 2021 Sept. 7, 2021 Sept. 14, 2021 Sept. 21, 2021 Sept. 28, 2021 Note: On August 31, 2021, Mary reached her CPP maximum. Also note that Mary reached her maximum deduction for EI in August, so no EI deduction is made from her pay in September. Mary Jones: Mary Jones Mary Jones Mary Jones Lilly Vron. Lilly Vron Lilly Vron Lilly Vron Source deductions payable at August 31, 2021 (employer portion already recorded): CPP Payable $1,576.80 $1,265 1,265 1,265 1,265 14 El Payable $592.08 14 14 21 $940 940 940 940 Required Using the general journal and payroll register, complete the following for the month of September 2021: 21 28 28 2021 Sept. 7 Complete payroll register for September 7 payroll, journalize payroll entry, and journalize entry for all employer's expenses related to payroll. Income Taxes Payable $3,268.75 7 Transfer cash for September 7 payroll net pay from operating account to payroll account. Process payroll (follow the same procedures as for September 7 payroll). Transfer cash for September 14 payroll net pay from operating account to payroll account. Pay CRA for prior month's source deductions payable. Process payroll for September 21. Note change in Fred Flynn's salary. Transfer cash for September 21 payroll net pay from operating account to payroll account. Process payroll for September 28. Note change in Lilly Vron's claim code. Transfer cash for September 28 payroll net pay from operating account to payroll account. Comprehensive problem: completing payroll requirements 00 (120 min) 546 CHAPTER 11 the present arrangement. Do not restrict ations only. ASSIGNMENT P11-5C. This comprehensive problem will aid in putting the pieces of payroll together. In this project, you are the bookkeeper and will have the responsibility of recording payroll in the payroll register, paying the payroll, recording the employer's tax responsibilities, and making payment according to the CRA's requirements. Pete's Market, owned by Pete Reel, is located at 33 Riel Drive, Your Town, Ontario, M5W 2A4. His business number is 12345 6789 RP. The following are the employees of Pete's Market, along with their salaries, exemptions, etc. Income tax is calculated at 20%. CPP is calculated at 5.10% (considering the $3,500 yearly exemption) and EI is calculated at 1.62% Date Sept. 7, 2021 Sept. 14, 2021 Weekly Salaries Name Fred Flynn Fred Flynn Fred Flynn Fred Flynn Weekly Salary $1,190 1,190 1,265 1,265 Sept. 21, 2021 Sept. 28, 2021 Note: Fred Flynn received a salary increase September 17, 2021.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

2018 Employee Sep 7 Fred Flynn 7 Mary Jones 7 Lilly Vron 2018 Employee Sep 14 Fred Flynn ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started