This Mini Practice Set will aid in putting the pieces of payroll together. In this project, you

Question:

This Mini Practice Set will aid in putting the pieces of payroll together. In this project, you are the bookkeeper and will have the responsibility of recording payroll in the payroll register, paying the payroll, recording the employer's tax responsibilities, and making payment according to the CRA's requirements.

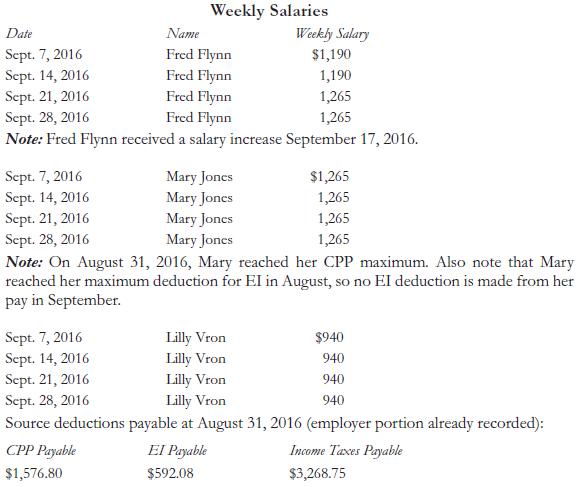

Pete's Market, owned by Pete Reel, is located at 33 Riel Drive, Your Town, Ontario, M5W 2A4. His business number is 12345 6789 RP. The following are the employees of Pete's Market, along with their salaries, exemptions, etc. Income tax is calculated at 20%.

Required

Using the general journal and payroll register, complete the following for the month of September 2016:

2016 Sept.

7 Complete payroll register for September 7 payroll, journalize payroll entry, and journalize entry for all employer's expenses related to payroll.

7 Transfer cash for September 7 payroll net pay from operating account to payroll account.

14 Process payroll (follow the same procedures as for September 7 payroll).

14 Transfer cash for September 14 payroll net pay from operating account to payroll account.

14 Pay CRA for prior month's source deductions payable.

21 Process payroll for September 21. Note change in Fred Flynn's salary.

21 Transfer cash for September 21 payroll net pay from operating account to payroll account.

28 Process payroll for September 28. Note change in Lilly Vron's claim code.

28 Transfer cash for September 28 payroll net pay from operating account to payroll account.

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 978-0134166698

13th Canadian edition

Authors: Jeffrey Slater, Debra Good