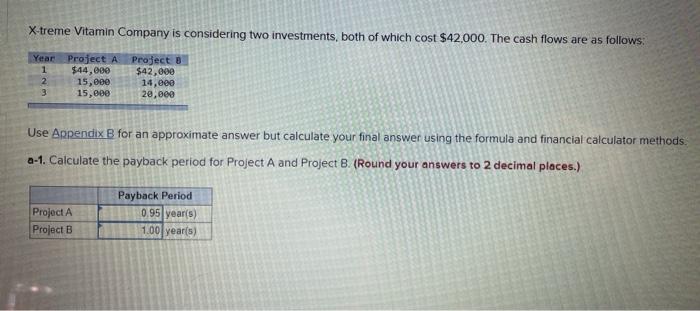

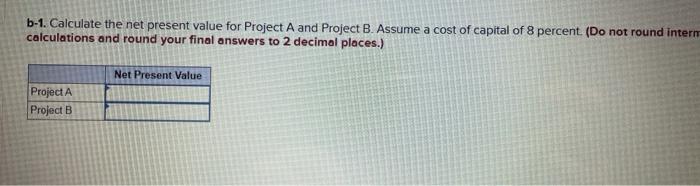

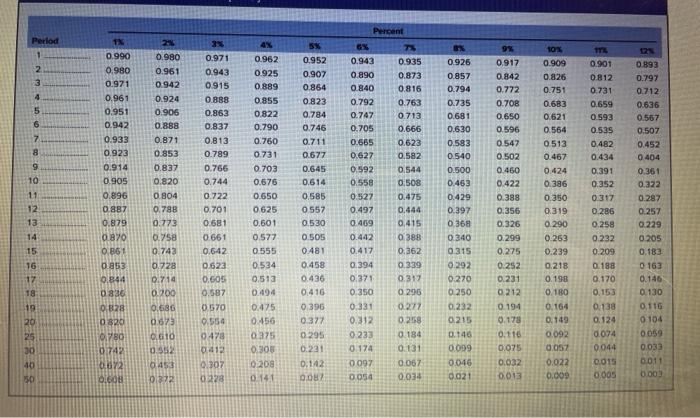

X-treme Vitamin Company is considering two investments, both of which cost $42,000. The cash flows are as follows: Year 1 2 3 Project A $44,000 15,000 15,000 Project B $42,000 14,000 20,000 Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a-1. Calculate the payback period for Project A and Project B. (Round your answers to 2 decimal places.) Payback Period Project A Project B 0,95 year(s) 1.00 year(s) b-1. Calculate the net present value for Project A and Project B. Assume a cost of capital of 8 percent. (Do not round interm calculations and round your final answers to 2 decimal places.) Net Present Value Project A Project B Percent Period SX 9% 10X TA 1 2. 3 4 5 6 7 8 0.909 0.826 0.751 0.6B3 0.621 0.564 0513 0.467 0.424 0.386 0.350 9 10 24 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.900 0.686 0.67 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0836 0.28 0.820 0.780 0.742 62 160 11 12 13 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0681 0.661 0.642 0.623 0.605 0.587 0570 0.554 0478 0.412 0.307 0228 0.962 0.925 0889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0375 0.305 0.208 0 141 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0557 0.530 0.505 0.481 0.458 0.436 0416 0.396 0377 0295 0.221 0.142 00 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0409 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0233 0.174 0 097 0094 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0,508 0.475 0.444 0,415 0388 0.362 0.339 0.31% 0 290 0277 0.268 0.184 0.131 0.067 0.034 0.926 0.857 0.794 0.735 0.681 0.630 0.593 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.917 0.842 0.772 0.708 0.650 0.596 0547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0212 0.194 0.178 0.116 0.075 0.032 0.013 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0317 0.286 0.258 0232 0.209 0.188 0.170 0.153 0.138 0.124 0094 0044 0.015 0.005 12 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0 163 0.146 0 130 0,116 0 104 0059 0.033 0.011 0.003 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 14 15 16 17 18 19 20 0.610 25 30 0.952 0.140 0.099 0.046 0.021 40 5453 50 01392