Answered step by step

Verified Expert Solution

Question

1 Approved Answer

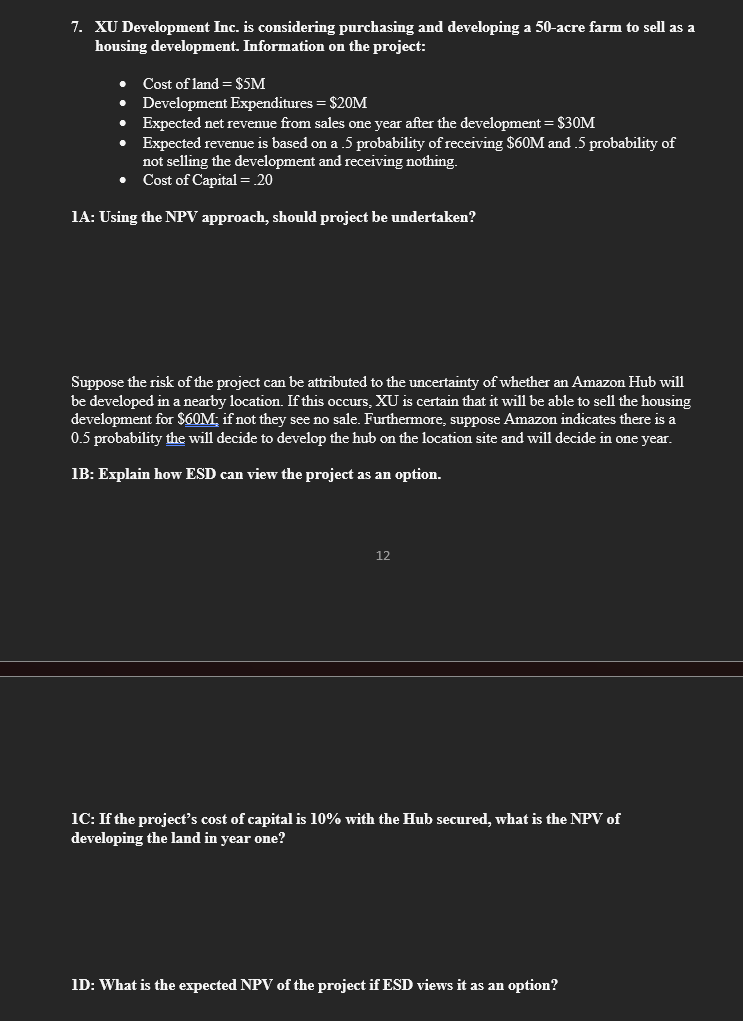

XU Development Inc. is considering purchasing and developing a 5 0 - acre farm to sell as a housing development. Information on the project: Cost

XU Development Inc. is considering purchasing and developing a acre farm to sell as a

housing development. Information on the project:

Cost of land $

Development Expenditures $

Expected net revenue from sales one year after the development $

Expected revenue is based on a probability of receiving $ and probability of

not selling the development and receiving nothing.

Cost of Capital

A: Using the NPV approach, should project be undertaken?

Suppose the risk of the project can be attributed to the uncertainty of whether an Amazon Hub will

be developed in a nearby location. If this occurs, XU is certain that it will be able to sell the housing

development for $; if not they see no sale. Furthermore, suppose Amazon indicates there is a

probability the will decide to develop the hub on the location site and will decide in one year.

B: Explain how ESD can view the project as an option.

C: If the project's cost of capital is with the Hub secured, what is the NPV of

developing the land in year one?

D: What is the expected NPV of the project if ESD views it as an option?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started