Question

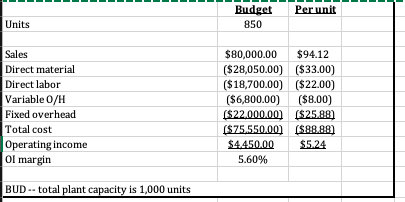

XXX makes high-end step ladders. Its budget is below, and your boss is not happy with the low operating margin. Current capacity is 1,000 ladders.

| XXX makes high-end step ladders. Its budget is below, and your boss is not happy with the low operating margin. Current capacity is 1,000 ladders. A salesperson just came in with a one-time opportunity to sell 100 ladders for $70.00 per unit. Your bosses first reaction is, why would be sell a ladder for $70.00 when our current unit cost is $88.88/ladder? Operations has suggested that we can use a cheaper material thatll save $3.00/unit. And, since this is a one-time order, the inspection department says that we can skip final inspection thatll cost $2.00/unit. New tooling will be required that will cost $300. Manufacturing says that fixed overhead costs will not be affected by taking this order. What is your recommendation fully analyze and support. Make sure to assess qualitative factors.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started