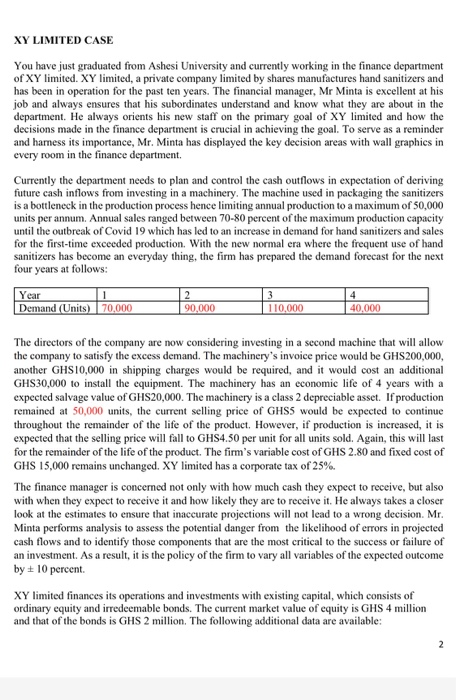

XY LIMITED CASE You have just graduated from Ashesi University and currently working in the finance department of XY limited. Xy limited, a private company limited by shares manufactures hand sanitizers and has been in operation for the past ten years. The financial manager, Mr Minta is excellent at his job and always ensures that his subordinates understand and know what they are about in the department. He always orients his new staff on the primary goal of XY limited and how the decisions made in the finance department is crucial in achieving the goal. To serve as a reminder and harness its importance, Mr. Minta has displayed the key decision areas with wall graphics in every room in the finance department. Currently the department needs to plan and control the cash outflows in expectation of deriving future cash inflows from investing in a machinery. The machine used in packaging the sanitizers is a bottleneck in the production process hence limiting annual production to a maximum of 50,000 units per annum. Annual sales ranged between 70-80 percent of the maximum production capacity until the outbreak of Covid 19 which has led to an increase in demand for hand sanitizers and sales for the first-time exceeded production. With the new normal era where the frequent use of hand sanitizers has become an everyday thing, the firm has prepared the demand forecast for the next four years at follows: Year 2 4 Demand (Units) 70,000 90.000 110,000 40,000 The directors of the company are now considering investing in a second machine that will allow the company to satisfy the excess demand. The machinery's invoice price would be GHS200,000, another GHS10,000 in shipping charges would be required, and it would cost an additional GHS30,000 to install the equipment. The machinery has an economic life of 4 years with a expected salvage value of GHS20,000. The machinery is a class 2 depreciable asset. If production remained at 50,000 units, the current selling price of GHSS would be expected to continue throughout the remainder of the life of the product. However, if production is increased, it is expected that the selling price will fall to GHS4.50 per unit for all units sold. Again, this will last for the remainder of the life of the product. The firm's variable cost of GHS 2.80 and fixed cost of GHS 15,000 remains unchanged. XY limited has a corporate tax of 25%. The finance manager is concerned not only with how much cash they expect to receive, but also with when they expect to receive it and how likely they are to receive it. He always takes a closer look at the estimates to ensure that inaccurate projections will not lead to a wrong decision. Mr. Minta performs analysis to assess the potential danger from the likelihood of errors in projected cash flows and to identify those components that are the most critical to the success or failure of an investment. As a result, it is the policy of the firm to vary all variables of the expected outcome by + 10 percent. XY limited finances its operations and investments with existing capital, which consists of ordinary equity and irredeemable bonds. The current market value of equity is GHS 4 million and that of the bonds is GHS 2 million. The following additional data are available: 2 Beta of XY Limited equity - 2.0 Bond coupon rate -16% Corporate tax rate - 25% Return on GSE-Composite Index - 14% Return on 182-day Treasury bill - 9% Return on 10-year Government bond -11% You have been tasked to evaluate the decision of investing in a second machinery and advise management accordingly. In executing your assignment, you asked yourself the the following questions: What are the relevant cash flows to consider in the project appraisal? What is the timing and risk of the cash flows? What cost of capital will be appropriate to discount the cash flows? 3. Evaluate the acquisition of the machinery based on the net present value and any other two project appraisal techniques[40 marks] 4. Perform a scenario analysis on the project. [15 marks] 5. Perform a sensitivity analysis on the sales units and cost of capital for the project. [15 marks)