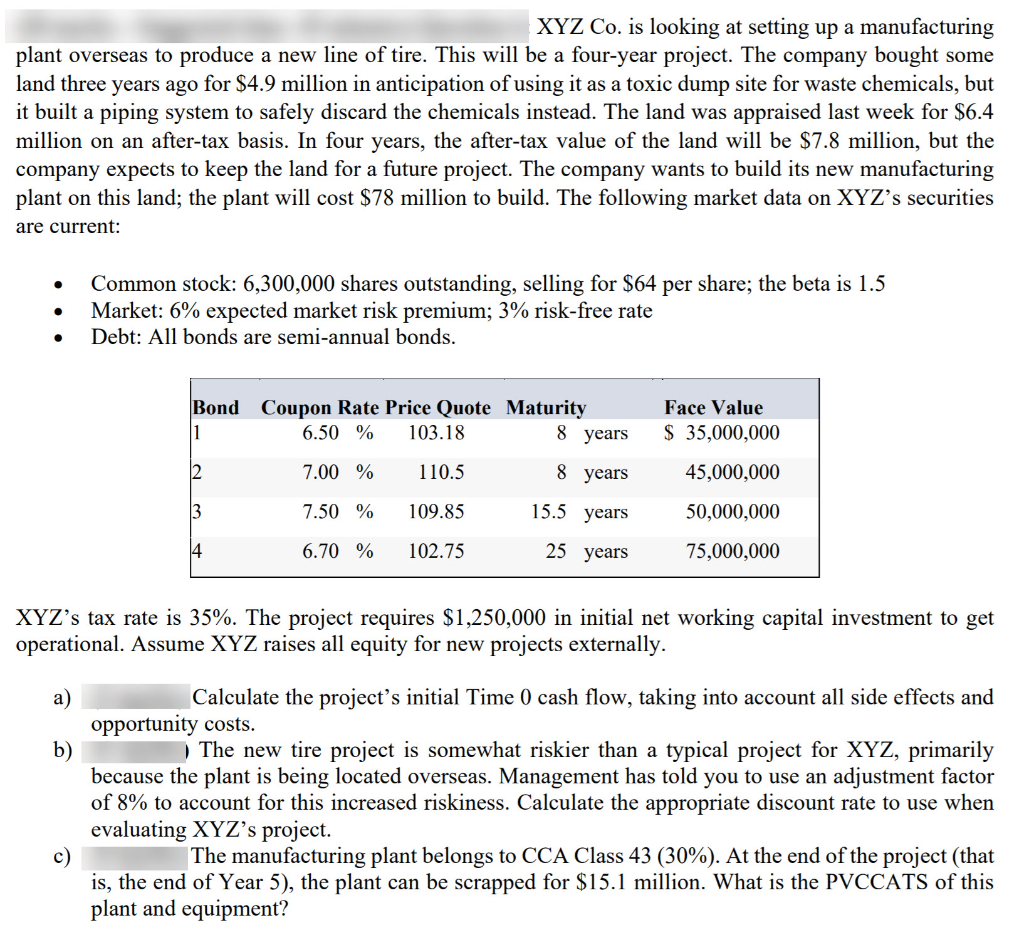

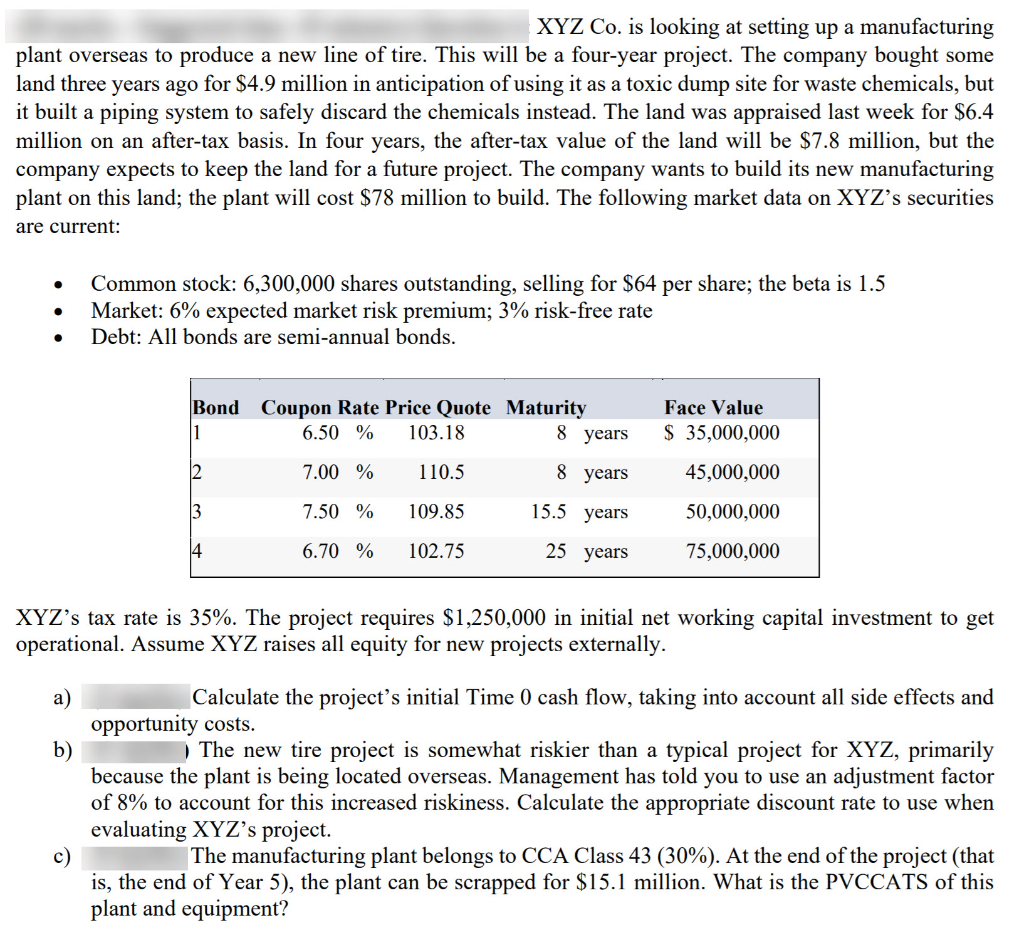

XYZ Co. is looking at setting up a manufacturing plant overseas to produce a new line of tire. This will be a four-year project. The company bought some land three years ago for $4.9 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $6.4 million on an after-tax basis. In four years, the after-tax value of the land will be $7.8 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant will cost $78 million to build. The following market data on XYZ's securities are current: . . Common stock: 6,300,000 shares outstanding, selling for $64 per share; the beta is 1.5 Market: 6% expected market risk premium; 3% risk-free rate Debt: All bonds are semi-annual bonds. Bond Coupon Rate Price Quote Maturity 6.50 % 103.18 Face Value $ 35,000,000 8 years 2 7.00 % 110.5 8 years 45,000,000 3 7.50 % 109.85 15.5 years 50,000,000 14 6.70 % 102.75 25 years 75,000,000 XYZ's tax rate is 35%. The project requires $1,250,000 in initial net working capital investment to get operational. Assume XYZ raises all equity for new projects externally. a) b) Calculate the project's initial Time 0 cash flow, taking into account all side effects and opportunity costs. ) The new tire project is somewhat riskier than a typical project for XYZ, primarily because the plant is being located overseas. Management has told you to use an adjustment factor of 8% to account for this increased riskiness. Calculate the appropriate discount rate to use when evaluating XYZ's project. The manufacturing plant belongs to CCA Class 43 (30%). At the end of the project (that is, the end of Year 5), the plant can be scrapped for $15.1 million. What is the PVCCATS of this plant and equipment? XYZ Co. is looking at setting up a manufacturing plant overseas to produce a new line of tire. This will be a four-year project. The company bought some land three years ago for $4.9 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $6.4 million on an after-tax basis. In four years, the after-tax value of the land will be $7.8 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant will cost $78 million to build. The following market data on XYZ's securities are current: . . Common stock: 6,300,000 shares outstanding, selling for $64 per share; the beta is 1.5 Market: 6% expected market risk premium; 3% risk-free rate Debt: All bonds are semi-annual bonds. Bond Coupon Rate Price Quote Maturity 6.50 % 103.18 Face Value $ 35,000,000 8 years 2 7.00 % 110.5 8 years 45,000,000 3 7.50 % 109.85 15.5 years 50,000,000 14 6.70 % 102.75 25 years 75,000,000 XYZ's tax rate is 35%. The project requires $1,250,000 in initial net working capital investment to get operational. Assume XYZ raises all equity for new projects externally. a) b) Calculate the project's initial Time 0 cash flow, taking into account all side effects and opportunity costs. ) The new tire project is somewhat riskier than a typical project for XYZ, primarily because the plant is being located overseas. Management has told you to use an adjustment factor of 8% to account for this increased riskiness. Calculate the appropriate discount rate to use when evaluating XYZ's project. The manufacturing plant belongs to CCA Class 43 (30%). At the end of the project (that is, the end of Year 5), the plant can be scrapped for $15.1 million. What is the PVCCATS of this plant and equipment