Answered step by step

Verified Expert Solution

Question

1 Approved Answer

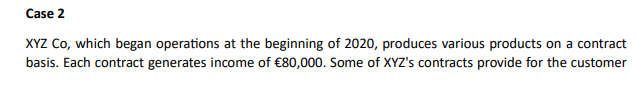

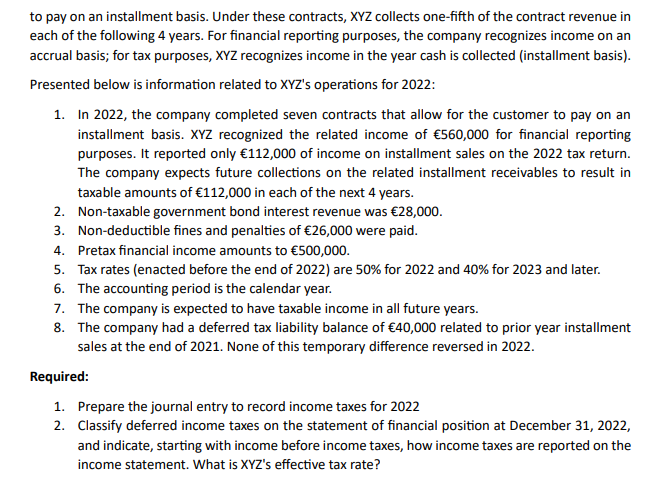

XYZ Co, which began operations at the beginning of 2020 , produces various products on a contract basis. Each contract generates income of 80,000. Some

XYZ Co, which began operations at the beginning of 2020 , produces various products on a contract basis. Each contract generates income of 80,000. Some of XYZ's contracts provide for the customer to pay on an installment basis. Under these contracts, XYZ collects one-fifth of the contract revenue in each of the following 4 years. For financial reporting purposes, the company recognizes income on an accrual basis; for tax purposes, XYZ recognizes income in the year cash is collected (installment basis). Presented below is information related to XYZ 's operations for 2022: 1. In 2022, the company completed seven contracts that allow for the customer to pay on an installment basis. XYZ recognized the related income of 560,000 for financial reporting purposes. It reported only 112,000 of income on installment sales on the 2022 tax return. The company expects future collections on the related installment receivables to result in taxable amounts of 112,000 in each of the next 4 years. 2. Non-taxable government bond interest revenue was 28,000. 3. Non-deductible fines and penalties of 26,000 were paid. 4. Pretax financial income amounts to 500,000. 5. Tax rates (enacted before the end of 2022) are 50% for 2022 and 40% for 2023 and later. 6. The accounting period is the calendar year. 7. The company is expected to have taxable income in all future years. 8. The company had a deferred tax liability balance of 40,000 related to prior year installment sales at the end of 2021. None of this temporary difference reversed in 2022. Required: 1. Prepare the journal entry to record income taxes for 2022 2. Classify deferred income taxes on the statement of financial position at December 31, 2022, and indicate, starting with income before income taxes, how income taxes are reported on the income statement. What is XYZ's effective tax rate

XYZ Co, which began operations at the beginning of 2020 , produces various products on a contract basis. Each contract generates income of 80,000. Some of XYZ's contracts provide for the customer to pay on an installment basis. Under these contracts, XYZ collects one-fifth of the contract revenue in each of the following 4 years. For financial reporting purposes, the company recognizes income on an accrual basis; for tax purposes, XYZ recognizes income in the year cash is collected (installment basis). Presented below is information related to XYZ 's operations for 2022: 1. In 2022, the company completed seven contracts that allow for the customer to pay on an installment basis. XYZ recognized the related income of 560,000 for financial reporting purposes. It reported only 112,000 of income on installment sales on the 2022 tax return. The company expects future collections on the related installment receivables to result in taxable amounts of 112,000 in each of the next 4 years. 2. Non-taxable government bond interest revenue was 28,000. 3. Non-deductible fines and penalties of 26,000 were paid. 4. Pretax financial income amounts to 500,000. 5. Tax rates (enacted before the end of 2022) are 50% for 2022 and 40% for 2023 and later. 6. The accounting period is the calendar year. 7. The company is expected to have taxable income in all future years. 8. The company had a deferred tax liability balance of 40,000 related to prior year installment sales at the end of 2021. None of this temporary difference reversed in 2022. Required: 1. Prepare the journal entry to record income taxes for 2022 2. Classify deferred income taxes on the statement of financial position at December 31, 2022, and indicate, starting with income before income taxes, how income taxes are reported on the income statement. What is XYZ's effective tax rate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started