Answered step by step

Verified Expert Solution

Question

1 Approved Answer

So the question is: complete a Form 1040 -- with Schedules A, B, C, SE, and Forms 2441, 3800, 5884, and 8826. I especially need

So the question is: complete a Form 1040 -- with Schedules A, B, C, SE, and Forms 2441, 3800, 5884, and 8826.

I especially need help with the form 5884. Please help me. Thank you!

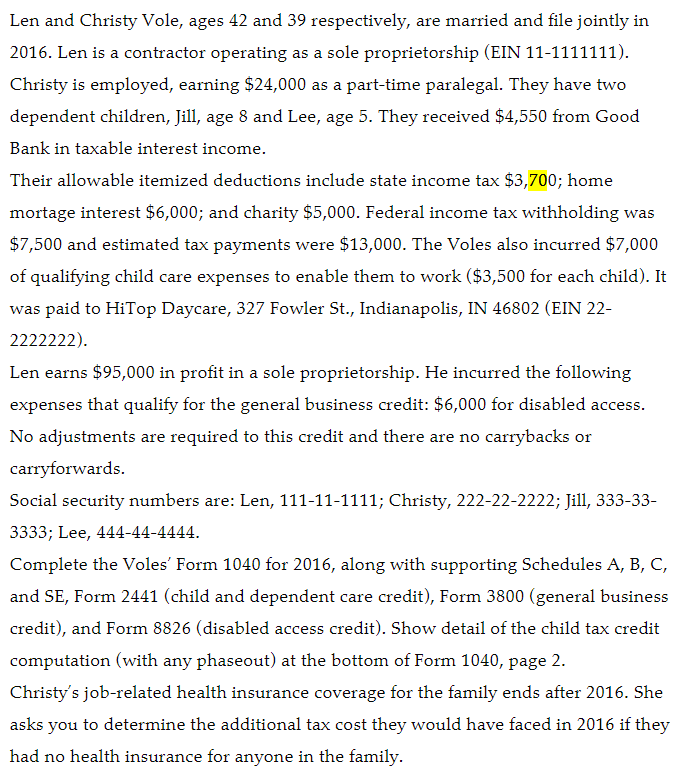

Len and Christy Vole, ages 42 and 39 respectively, are married and file jointly in 2016. Len is a contractor operating as a sole proprietorship (EIN 11-1111111). Christy is employed, earning $24,000 as a part-time paralegal. They have two dependent children, Jill, age 8 and Lee, age 5. They received $4,550 from Good Bank in taxable interest income. Their allowable itemized deductions include state income tax $3,700; home mortage interest $6,000; and charity $5,000. Federal income tax withholding was $7,500 and estimated tax payments were $13,000. The Voles also incurred $7,000 of qualifying child care expenses to enable them to work ($3,500 for each child). It was paid to HiTop Daycare, 327 Fowler St., Indianapolis, IN 46802 (EIN 22- 2222222) Len earns $95,000 in profit in a sole proprietorship. He incurred the following expenses that qualify for the general business credit: $6,000 for disabled access No adjustments are required to this credit and there are no carrybacks or carryforwards. Social security numbers are: Len, 111-11-1111; Christy, 222-22-2222; Jill, 333-33- 3333; Lee, 444-44-4444 Complete the Voles Form 1040 for 2016, along with supporting Schedules A, B, C, and SE, Form 2441 (child and dependent care credit), Form 3800 (general business credit), and Form 8826 (disabled access credit). Show detail of the child tax credit computation (with any phaseout) at the bottom of Form 1040, page 2 Christy's job-related health insurance coverage for the family ends after 2016. She asks you to determine the additional tax cost they would have faced in 2016 if they had no health insurance for anyone in the familyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started