Question

XYZ Company has provided the following data for the month recently ended July 2020: Beginning inventory 200 units Actual Production 7,500 units Sales @ $130

XYZ Company has provided the following data for the month recently ended July 2020:

Beginning inventory 200 units

Actual Production 7,500 units

Sales @ $130 per unit 7,300 units

Ending inventory 400 units

Variable costs per unit:

Direct materials $35

Direct labour $40

Variable manufacturing overheads $2

Variable Selling & Admin $4

Fixed Costs:

Actual fixed manufacturing overheads $243,800

Actual fixed selling and administrative $85,000

Show all relevant working:

[Adjust the number of rows in the table to suit your working]

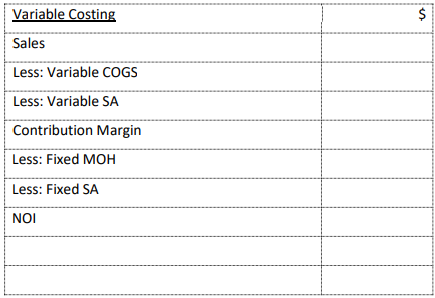

Part A: Using the variable costing format, prepare the income statement for July 2020 and hence compute the contribution margin and net operating income for July 2020. Also compute the ending finished goods inventory (FG) using variable costing format.

Ending FG inventory =

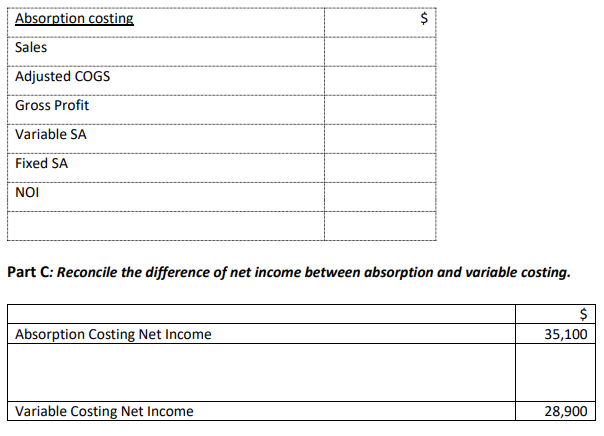

Part B: XYZ Company uses the normal costing system where annual budgeted fixed manufacturing overheads is $2.976m and annual budgeted production is 96,000 units.

Compute the PFOHR (predetermined fixed manufacturing overhead rate) where allocation base is units produced.

Compute the AC product cost per unit.

Compute the amount of over/underapplied overheads for July 2020.

Compute the adjusted COGS after closing the over/underapplied overheads to COGS.

Determine the net income for July 2020 using absorption costing

[You can assume that the total unit product cost in the beginning inventory is the same as the units produced in July 2020]

Part D: Assume that XYZ produces 1,000 additional units in July 2020. All other information remaining the same, what would have been the net income under absorption and variable costing for the month of July 2020. You are not required to prepare full income statements.

Part E: If XYZ were to use the actual costing system, determine the unit product cost in absorption costing, then compute the value of the ending inventory.

Variable Costing Sales Less: Variable COGS Less: Variable SA Contribution Margin Less: Fixed MOH Less: Fixed SA NOI Part C: Reconcile the difference of net income between absorption and variable costing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started