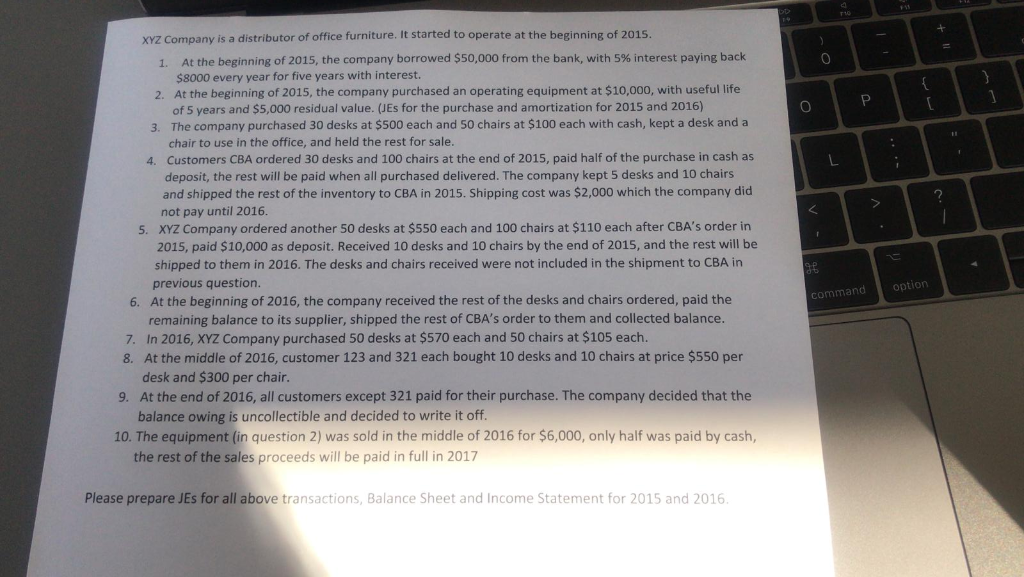

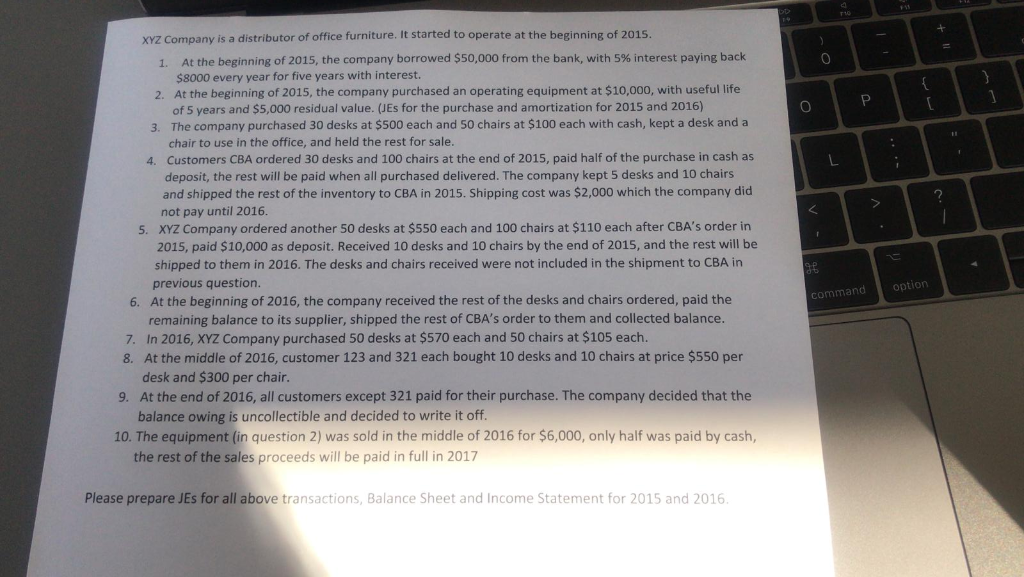

XYZ Company is a distributor of office furniture. It started to operate at the beginning of 2015 At the beginning of 2015, the company borrowed $50,000 from the bank, with 5% interest paying back $8000 every year for five years with interest. At the beginning of 2015, the company purchased an operating equipment at $10,000, with useful life f 5 years and $5,000 residual value. (JEs for the purchase and amortization for 2015 and 2016) 3. The company purchased 30 desks at $500 each and 50 chairs at $100 each with cash, kept a desk and a chair to use in the office, and held the rest for sale. 4. Customers CBA ordered 30 desks and 100 chairs at the end of 2015, paid half of the purchase in cash as deposit, the rest will be paid when all purchased delivered. The company kept 5 desks and 10 chairs and shipped the rest of the inventory to CBA in 2015. Shipping cost was $2,000 which the company did 1 2 L .nduu not pay until 2016. 5. XYZ Company ordered another 50 desks at $550 each and 100 chairs at $110 each after CBA's order in 2015, paid $10,000 as deposit. Received 10 desks and 10 chairs by the end of 2015, and the rest will be shipped to them in 2016. The desks and chairs received were not included in the shipment to CBA in previous question. 6. At the beginning of 2016, the company received the rest of the desks and chairs ordered, paid the remaining balance to its supplier, shipped the rest of CBA's order to them and collected balance. 7. In 2016, XYZ Company purchased 50 desks at $570 each and 50 chairs at $105 each. 8. At the middle of 2016, customer 123 and 321 each bought 10 desks and 10 chairs at price $550 per option command dd desk and $300 per chair. 9. At the end of 2016, all customers except 321 paid for their purchase. The company decided that the balance owing is uncollectible and decided to write it off. 10. The equipment (in question 2) was sold in the middle of 2016 for $6,000, only half was paid by cash, the rest of the sales proceeds will be paid in full in 2017 Please prepare JEs for all above transactions, Balance Sheet and Income Statement for 2015 and 2016. XYZ Company is a distributor of office furniture. It started to operate at the beginning of 2015 At the beginning of 2015, the company borrowed $50,000 from the bank, with 5% interest paying back $8000 every year for five years with interest. At the beginning of 2015, the company purchased an operating equipment at $10,000, with useful life f 5 years and $5,000 residual value. (JEs for the purchase and amortization for 2015 and 2016) 3. The company purchased 30 desks at $500 each and 50 chairs at $100 each with cash, kept a desk and a chair to use in the office, and held the rest for sale. 4. Customers CBA ordered 30 desks and 100 chairs at the end of 2015, paid half of the purchase in cash as deposit, the rest will be paid when all purchased delivered. The company kept 5 desks and 10 chairs and shipped the rest of the inventory to CBA in 2015. Shipping cost was $2,000 which the company did 1 2 L .nduu not pay until 2016. 5. XYZ Company ordered another 50 desks at $550 each and 100 chairs at $110 each after CBA's order in 2015, paid $10,000 as deposit. Received 10 desks and 10 chairs by the end of 2015, and the rest will be shipped to them in 2016. The desks and chairs received were not included in the shipment to CBA in previous question. 6. At the beginning of 2016, the company received the rest of the desks and chairs ordered, paid the remaining balance to its supplier, shipped the rest of CBA's order to them and collected balance. 7. In 2016, XYZ Company purchased 50 desks at $570 each and 50 chairs at $105 each. 8. At the middle of 2016, customer 123 and 321 each bought 10 desks and 10 chairs at price $550 per option command dd desk and $300 per chair. 9. At the end of 2016, all customers except 321 paid for their purchase. The company decided that the balance owing is uncollectible and decided to write it off. 10. The equipment (in question 2) was sold in the middle of 2016 for $6,000, only half was paid by cash, the rest of the sales proceeds will be paid in full in 2017 Please prepare JEs for all above transactions, Balance Sheet and Income Statement for 2015 and 2016