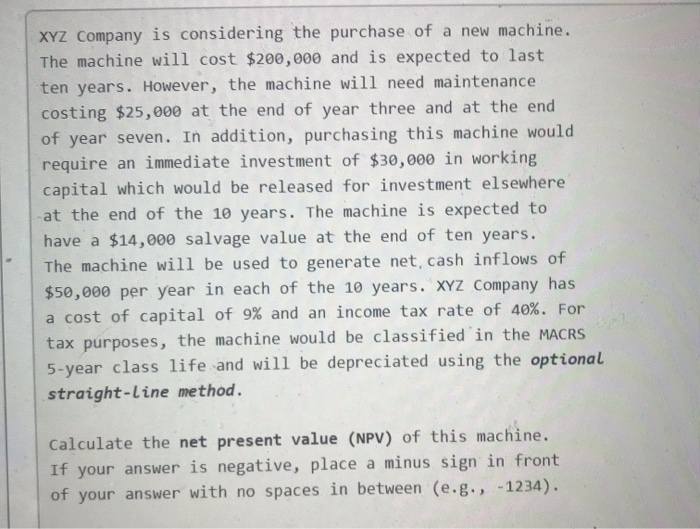

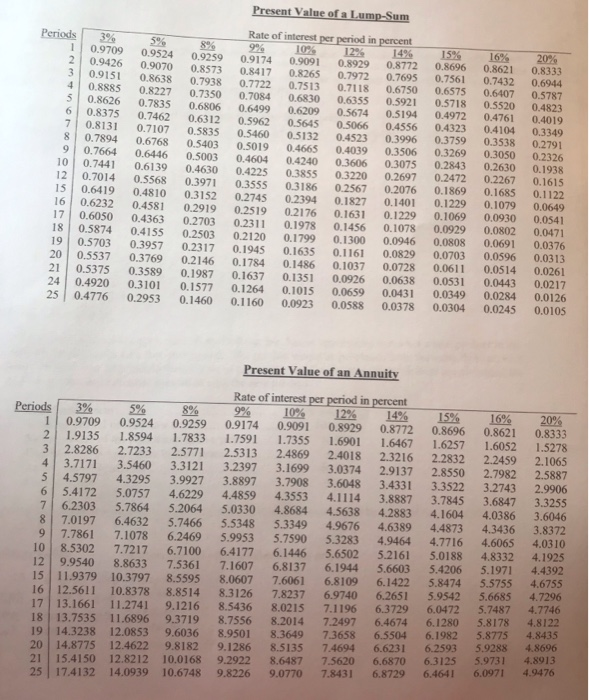

XYZ Company is considering the purchase of a new machine. The machine will cost $200,000 and is expected to last ten years. However, the machine will need maintenance costing $25,000 at the end of year three and at the end of year seven. In addition, purchasing this machine would require an immediate investment of $30,000 in working capital which would be released for investment elsewhere -at the end of the 10 years. The machine is expected to have a $14,000 salvage value at the end of ten years. The machine will be used to generate net, cash inflows of $50,000 per year in each of the 10 years. XYZ Company has a cost of capital of 9% and an income tax rate of 40%. For tax purposes, the machine would be classified in the MACRS 5-year class life and will be depreciated using the optional straight-line method. Calculate the net present value (NPV) of this machine. If your answer is negative, place a minus sign in front of your answer with no spaces in between (e.g., -1234). Present Value of a Lump-Sum Periods 9% 2 4 5 6 7 8 9 10 12 15 16 17 18 19 20 21 24 25 3% 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 0.7014 0.6419 0.6232 0.6050 0.5874 0.5703 0.5537 0.5375 0.4920 0.4776 5% 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.5568 0.4810 0.4581 0.4363 0.4155 0.3957 0.3769 0.3589 0.3101 0.2953 8% 0.9259 0.8573 0.7938 0.7350 0.6806 0.6312 0.5835 0.5403 0.5003 0.4630 0.3971 0.3152 0.2919 0.2703 0.2503 0.2317 0.2146 0.1987 0.1577 0.1460 Rate of interest per period in percent 10% 12% 14% 0.9174 0.9091 0.8929 0.8772 0.8417 0.8265 0.7972 0.7695 0.7722 0.7513 0.7118 0.6750 0.7084 0.6830 0.6355 0.5921 0.6499 0.6209 0.5674 0.5194 0.5962 0.5645 0.5066 0.4556 0.5460 0.5132 0.4523 0.3996 0.5019 0.4665 0.4039 0.3506 0.4604 0.4240 0.3606 0.3075 0.4225 0.3855 0.3220 0.2697 0.3555 0.3186 0.2567 0.2076 0.2745 0.2394 0.1827 0.1401 0.2519 0.2176 0.1631 0.1229 0.2311 0.1978 0.1456 0.1078 0.2120 0.1799 0.1300 0.0946 0.1945 0.1635 0.1161 0.0829 0.1784 0.1486 0.1037 0.0728 0.1637 0.1351 0.0926 0.0638 0.1264 0.1015 0.0659 0.0431 0.1160 0.0923 0.0588 0.0378 15% 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.1869 0.1229 0.1069 0.0929 0.0808 0.0703 0.0611 0.0531 0.0349 0.0304 16% 0.8621 0.7432 0.6407 0.5520 0.4761 0.4104 0.3538 0.3050 0.2630 0.2267 0.1685 0.1079 0.0930 0.0802 0.0691 0.0596 0.0514 0.0443 0.0284 0.0245 20% 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.1122 0.0649 0.0541 0.0471 0.0376 0.0313 0.0261 0.0217 0.0126 0.0105 Periods 3% 0.9709 2 1.9135 3 2.8286 4 3.7171 5 4.5797 6 5.4172 7 6.2303 8 7.0197 9 7.7861 10 8.5302 12 9.9540 15 11.9379 16 12.5611 17 13.1661 18 | 13.7535 19 14.3238 20 14.8775 21 15.4150 25 17.4132 5% 0.9524 1.8594 2.7233 3.5460 4.3295 5.0757 5.7864 6.4632 7.1078 7.7217 8.8633 10.3797 10.8378 11.2741 11.6896 12.0853 12.4622 12.8212 14.0939 8% 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7100 7.5361 8.5595 8.8514 9.1216 9.3719 9.6036 9.8182 10.0168 10.6748 Present Value of an Annuity Rate of interest per period in percent 9% 10% 12% 14% 0.9174 0.9091 0.8929 0.8772 1.7591 1.7355 1.6901 1.6467 2.5313 2.4869 2.4018 2.3216 3.2397 3.1699 3.0374 2.9137 3.8897 3.7908 3.6048 3.4331 4.4859 4.3553 4.1114 3.8887 5.0330 4.8684 4.5638 4.2883 5.5348 5.3349 4.9676 4.6389 5.9953 5.7590 5.3283 4.9464 6.4177 6.1446 5.6502 5.2161 7.1607 6.8137 6.1944 5.6603 8.0607 7.6061 6.8109 6.1422 8.3126 7.8237 6.9740 6.2651 8.5436 8.0215 7.1196 6.3729 8.7556 8.2014 7.2497 6.4674 8.9501 8.3649 7.3658 6.5504 9.1286 8.5135 7.4694 6.6231 9.2922 8.6487 7.5620 6.6870 9.8226 9.0770 7.8431 6.8729 15% 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 5.4206 5.8474 5.9542 6.0472 6.1280 6.1982 6.2593 6.3125 6.4641 16% 0.8621 1.6052 2.2459 2.7982 3.2743 3.6847 4.0386 4.3436 4.6065 4.8332 5.1971 5.5755 5.6685 5.7487 5.8178 5.8775 5.9288 5.9731 6.0971 20% 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 4.4392 4.6755 4.7296 4.7746 4.8122 4.8435 4.8696 4.8913 4.9476