XYZ Company issued 3-year, 8%, $200,000 bonds on January 1, 2020. The bond pays interest every June 30 and December 31, with the principal to be paid in 3 years. The market rate at the time of issuance is 10%, and the company uses the effective-interest method of amortization. a. Compute the initial selling price of the bonds on January 1, 2020 b. Provide the journal entry for the SECOND interest payment c. On December 31, 2020, XYZ Company buys back all of the bonds at 103 (after all interest payments and amortization have been recorded for 2020). Prepare the journal entry for this early retirement; show your calculations.

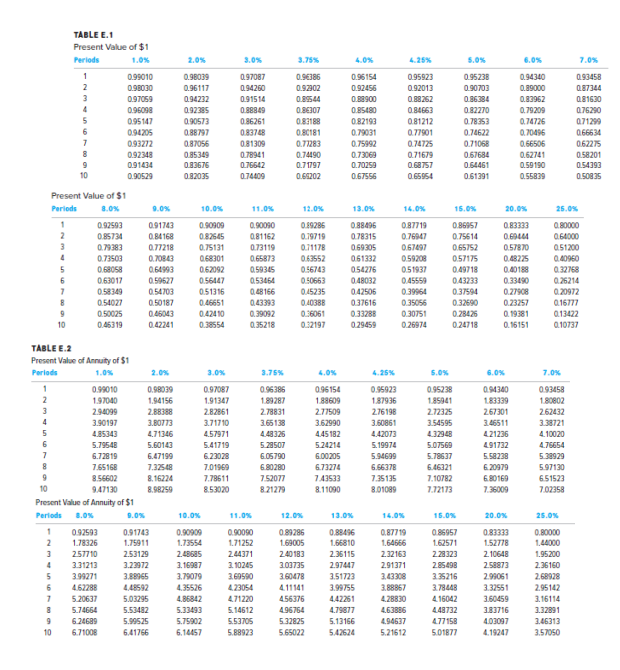

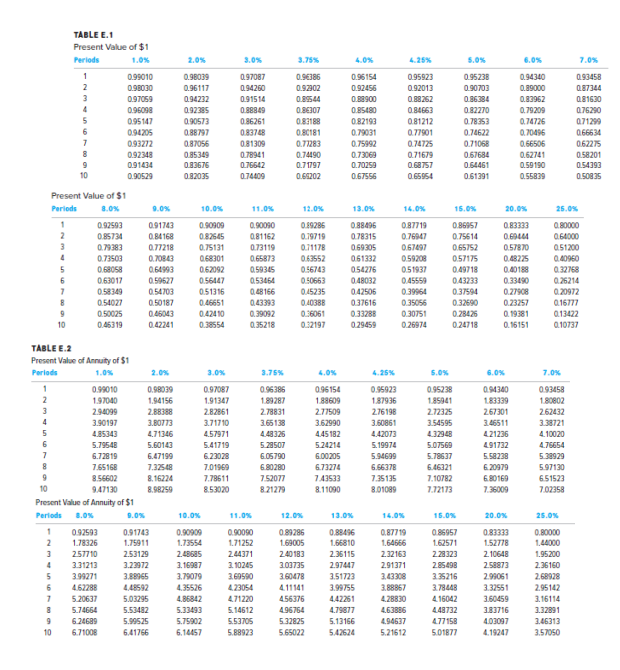

2.0% 3.0% 4.0% 4.25% 5.0% 0.94340 0.96386 0.92302 0.96154 092456 TABLE E.1 Present Value of $1 Periods 099010 098030 097059 0.96099 095147 0.94205 093272 0.92348 0.91634 090529 0.99900 095.080 0.98039 0.96117 0.94222 092285 0.90573 0.88797 0.87056 0.85349 0.82675 0.82025 0.97087 0.94260 091514 01999.49 086261 083768 0.81309 0.78941 0.76542 0.76609 06307 092199 080181 072283 0.74490 071797 061202 092193 0.79031 0.75992 0.73069 070259 0.95923 092013 0.88252 0.84663 091212 077901 076725 0.71679 0.68757 065954 0.95238 0.90703 0.86284 0.82270 0.78353 0.74622 0.71068 0.67684 064461 051391 0.82952 0.79209 0.74726 0.70496 066505 0.62741 059190 055839 0.93458 0.87344 081620 076290 071299 066634 062275 0.58201 0.54393 050935 9.0% 10.0% 11.0% 12.0% 13.0% 16.0% 20.0% 25.0% 0 Present Value of $1 Periods 0.92593 0.85734 1983 0.73503 0 68058 063017 092349 0.54027 0.50025 0.45319 0.91743 084168 0.77218 0.70813 064993 0.59627 0.54703 0.50187 046043 042241 90909 082605 075131 068301 062092 056447 0.51316 045651 0.42410 0.38554 00090 081162 073119 0.65873 059305 053054 08166 043393 Q.99092 035218 0.99286 0.19719 0.71178 063552 016763 050663 0.15235 040388 06061 0.32197 0.88496 0.78315 069205 061332 054276 0 48032 042506 037616 033288 087719 076047 067497 059208 051937 0.45559 0.39964 0.35056 0.30751 0.26974 0.86957 0.75614 065752 0.57175 0.49718 043233 0.37594 0.32690 0.28425 0.24718 0.83333 O 0.57870 0.48225 0.00188 0.33490 0.27908 0.23257 0 1981 0.16151 0.80000 064000 051200 040960 0.32768 0.26214 Q.20972 016777 013422 0.10737 TABLE E.2 Present Value of Annuity of $1 Periods 2.0% 3.0% 3.75% 5.0% 6.0% 7.0% 096386 0.99010 197040 294099 3.90197 485343 5.79548 6.72919 755168 0.99039 1.94156 2.883.98 3.80773 471346 5.60143 6.47199 7.3758 8.16224 8.98259 0.97087 1.91347 2.82861 3.71710 4.57971 5.41719 6.23028 7.01969 7.78611 952020 189287 278831 365138 4.48326 5.23507 6.05790 680280 752077 096154 188609 2.77509 362990 445182 524214 600205 6.72274 7.43533 8.11090 0.95923 187936 276198 3.60861 4.42073 5.19974 5.94699 566378 7.35135 801089 0.95238 185941 272325 354595 4.32948 5107569 5.78637 6.46221 7.10782 7.72173 094340 183339 267301 366511 421236 491732 568229 6 20979 6.80169 736009 093458 1 80802 262432 32721 4.10020 476654 529929 597130 6.51523 702358 821279 947130 Present Value of Annuity of $1 Periods 2.0 10.0% 11.04 12.08 13.0% 14.09 15.0% 20.0% 25.09 089286 169005 249193 092593 1.78326 257710 3.31213 399271 462288 5.20637 5.74664 6.24689 671008 0.91743 1.75911 2.53129 3.22972 3.89965 449592 503295 5.53482 5.99525 5.41766 0.90909 1.73554 219585 2.16987 3.79079 4.35526 496842 5.33093 5.75902 6.14657 090090 1.71252 244371 210245 3.69590 23054 471220 5.14612 5153705 5 88923 2703725 3.60478 411141 456376 496754 5122925 565022 0.89496 1.66810 2.35115 297447 3.51723 399755 442261 4.79877 5.13166 5.42624 0.87719 1.64666 2.32163 2.91371 3.63308 398867 4.28830 4.63895 4.96637 5.21612 0 86957 162571 229323 285498 275216 3.78448 416042 448732 477158 501877 0.83333 1.52778 2.10648 259873 2.99061 3.37551 3160459 3183716 403097 4.19247 0.80000 1.44000 1.95200 2.36160 2.68928 2.95142 3.16114 2.32891 2.46313 3.57050