Answered step by step

Verified Expert Solution

Question

1 Approved Answer

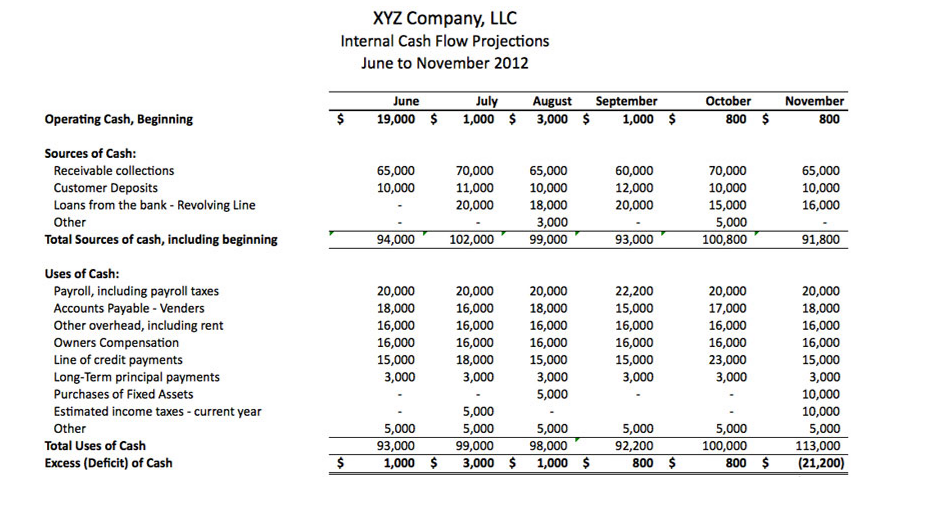

XYZ Company, LLC Below is a cash flow projection for XYZ Company for June to November, with the following assumptions: Key Assumptions 75% of sales

XYZ Company, LLC

Below is a cash flow projection for XYZ Company for June to November, with the following assumptions:

Key Assumptions

- 75% of sales will be collected the month after the sale

- 25% of sales will be collected the 2nd month after the sale

- Pyables are due in 25 days

- 60% of eligible receivables can be used for the revolving line of credit

1. What billing strategies should be considered if this occurs in a low socio-economic area?

2. What actions could you take now (in June) to prevent the forecasted cash deficit in November? Describe at least three potential actions.

3. Assuming that the strategies described by yourself in question 1) were either a) not possible or b) non effective, what could you do in November to alleviate the deficit?

Operating Cash, Beginning Sources of Cash: Receivable collections Customer Deposits Loans from the bank - Revolving Line Other Total Sources of cash, including beginning Uses of Cash: Payroll, including payroll taxes Accounts Payable - Venders Other overhead, including rent Owners Compensation Line of credit payments Long-Term principal payments Purchases of Fixed Assets Estimated income taxes - current year Other Total Uses of Cash Excess (Deficit) of Cash XYZ Company, LLC Internal Cash Flow Projections June to November 2012 $ $ June July August September 19,000 $ 1,000 $3,000 $ 1,000 $ 65,000 10,000 94,000 20,000 18,000 16,000 16,000 15,000 3,000 5,000 93,000 1,000 $ 70,000 65,000 11,000 10,000 20,000 18,000 3,000 99,000 102,000 20,000 20,000 16,000 18,000 16,000 16,000 16,000 15,000 3,000 5,000 16,000 18,000 3,000 5,000 5,000 99,000 3,000 $ 5,000 98,000 1,000 $ 60,000 12,000 20,000 93,000 22,200 15,000 16,000 16,000 15,000 3,000 5,000 92,200 800 $ October November 800 $ 800 70,000 10,000 15,000 5,000 100,800 20,000 17,000 16,000 16,000 23,000 3,000 5,000 100,000 800 $ 65,000 10,000 16,000 91,800 20,000 18,000 16,000 16,000 15,000 3,000 10,000 10,000 5,000 113,000 (21,200)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started