Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Corporation, a multinational conglomerate operating in diverse sectors, is facing a critical juncture in its financial journey. As the newly appointed financial analyst

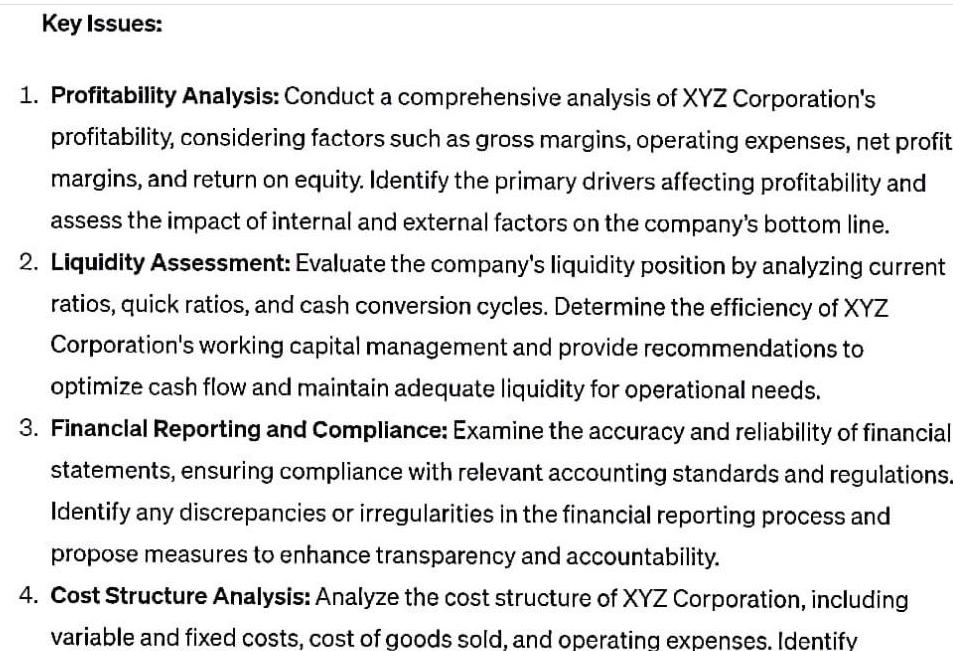

XYZ Corporation, a multinational conglomerate operating in diverse sectors, is facing a critical juncture in its financial journey. As the newly appointed financial analyst at the company, you have been tasked with evaluating the current financial health, identifying key challenges, and formulating strategic recommendations to optimize its financial performance. Background: XYZ Corporation, with a global presence, has experienced consistent growth over the past decade. However, recent market fluctuations, changes in regulatory frameworks, and evolving consumer preferences have posed significant challenges. The executive board is concerned about the company's profitability, liquidity, and long-term sustainability. Furthermore, there is a pressing need to streamline the company's accounting processes, enhance financial transparency, and align financial strategies with overall business objectives. Key Issues: 1. Profitability Analysis: Conduct a comprehensive analysis of XYZ Corporation's profitability, considering factors such as gross margins, operating expenses, net profit margins, and return on equity. Identify the primary drivers affecting profitability and assess the impact of internal and external factors on the company's bottom line. 2. Liquidity Assessment: Evaluate the company's liquidity position by analyzing current ratios, quick ratios, and cash conversion cycles. Determine the efficiency of XYZ Corporation's working capital management and provide recommendations to optimize cash flow and maintain adequate liquidity for operational needs. 3. Financial Reporting and Compliance: Examine the accuracy and reliability of financial statements, ensuring compliance with relevant accounting standards and regulations. Identify any discrepancies or irregularities in the financial reporting process and propose measures to enhance transparency and accountability. 4. Cost Structure Analysis: Analyze the cost structure of XYZ Corporation, including variable and fixed costs, cost of goods sold, and operating expenses. Identify opportunities for cost optimization, process improvement, and resource reallocation to enhance operational efficiency and reduce overall expenditures. 5. Risk Management: Assess the company's exposure to financial risks, such as market risk, credit risk, and operational risk. Develop a risk mitigation strategy to safeguard XYZ Corporation's financial assets and investments, ensuring resilience against volatile market conditions and unforeseen economic challenges. Your Task: Based on the analysis of the aforementioned issues, your task is to develop a comprehensive financial strategy for XYZ Corporation. Provide detailed recommendations and action plans to address the challenges identified in profitability, liquidity, financial reporting, cost structure, and risk management. Justify your recommendations with relevant financial data, industry benchmarks, and best practices in accounting and finance.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Profitability Analysis Detailed Financial Statement Analysis Conduct a thorough examination of the companys 1 Income Statement Analysis The income statement provides a summary of the companys revenu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started