Answered step by step

Verified Expert Solution

Question

1 Approved Answer

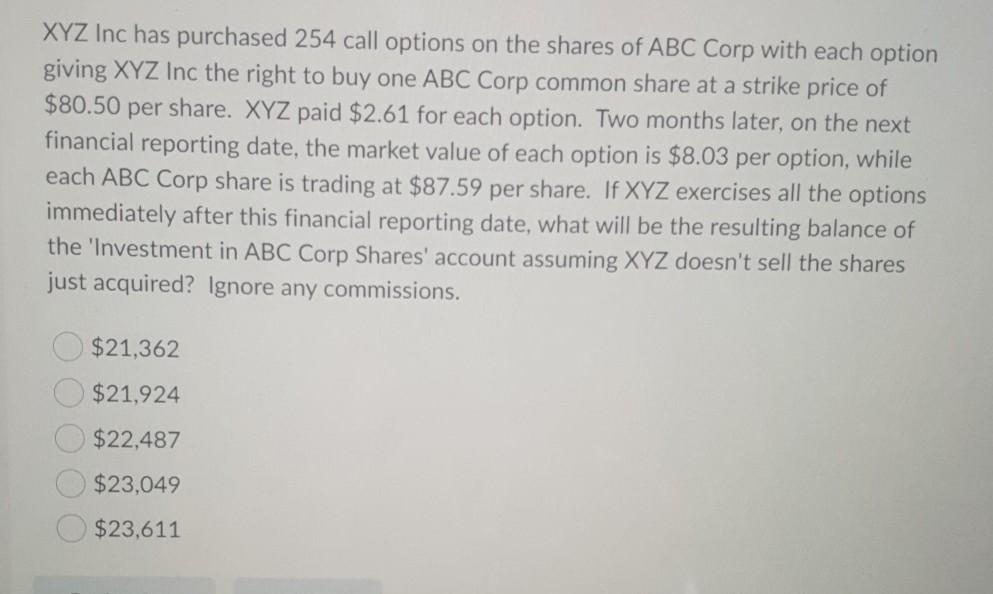

XYZ Inc has purchased 254 call options on the shares of ABC Corp with each option giving XYZ Inc the right to buy one ABC

XYZ Inc has purchased 254 call options on the shares of ABC Corp with each option giving XYZ Inc the right to buy one ABC Corp common share at a strike price of $80.50 per share. XYZ paid $2.61 for each option. Two months later, on the next financial reporting date, the market value of each option is $8.03 per option, while each ABC Corp share is trading at $87.59 per share. If XYZ exercises all the options immediately after this financial reporting date, what will be the resulting balance of the 'Investment in ABC Corp Shares' account assuming XYZ doesn't sell the shares just acquired? Ignore any commissions. $21,362 $21,924 $22,487 $23,049 $23,611

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started