Question

XYZ Inc. has received a request for a special order of 5,500 units of item PQR for $27.40 each. Item PQR's cost per unit

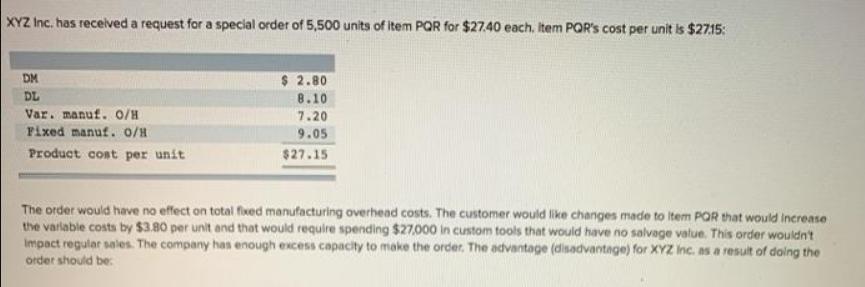

XYZ Inc. has received a request for a special order of 5,500 units of item PQR for $27.40 each. Item PQR's cost per unit is $27.15: DM DL Var. manuf. 0/H Fixed manuf. 0/H Product cost per unit 2.80 8.10 7.20 9.05 $27.15 The order would have no effect on total fixed manufacturing overhead costs. The customer would like changes made to Item POR that would increase the variable costs by $3.80 per unit and that would require spending $27,000 in custom tools that would have no salvage value. This order wouldn't Impact regular sales. The company has enough excess capacity to make the order. The advantage (disadvantage) for XYZ Inc. as a result of doing the order should be:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cost per unit of regular Item PQR is 2715 Selling price per unit for special order is 2740 Variabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost management a strategic approach

Authors: Edward J. Blocher, David E. Stout, Gary Cokins

5th edition

73526940, 978-0073526942

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App