Answered step by step

Verified Expert Solution

Question

1 Approved Answer

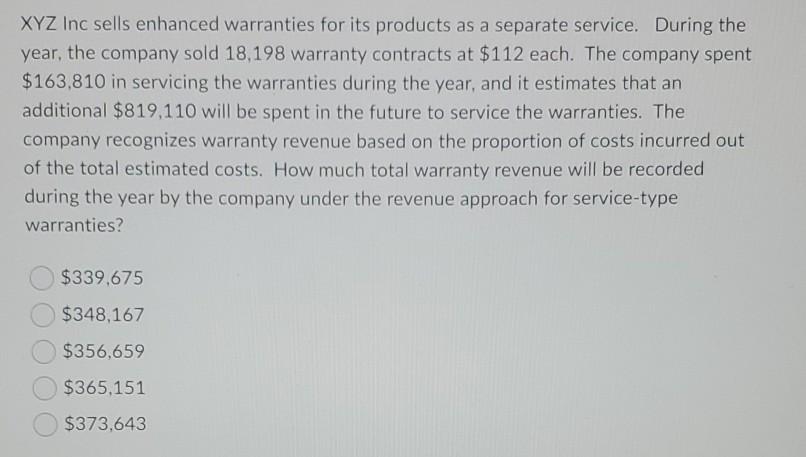

XYZ Inc sells enhanced warranties for its products as a separate service. During the year, the company sold 18,198 warranty contracts at $112 each. The

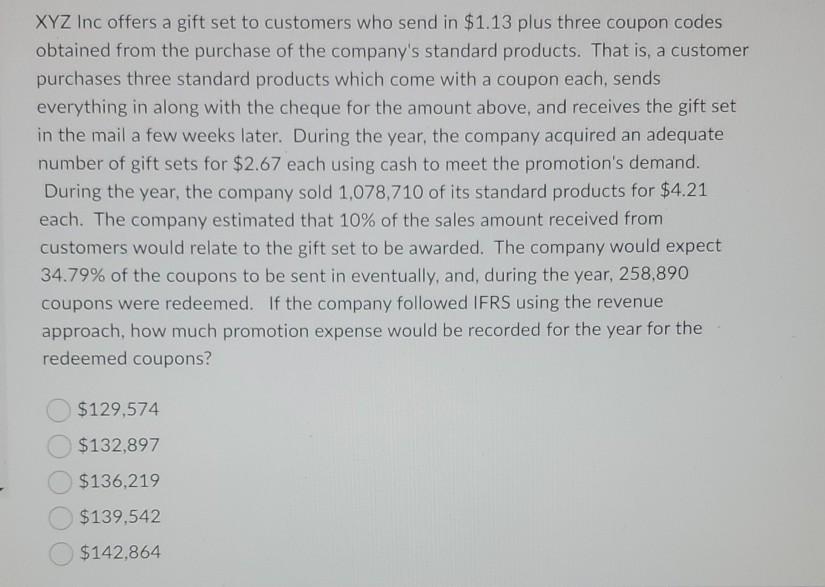

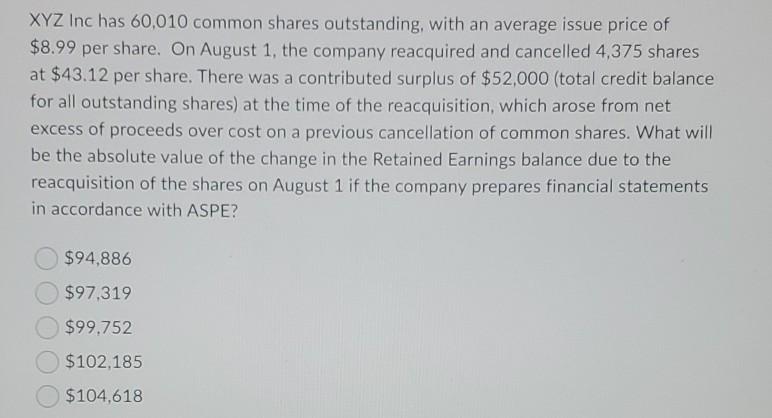

XYZ Inc sells enhanced warranties for its products as a separate service. During the year, the company sold 18,198 warranty contracts at $112 each. The company spent $ 163,810 in servicing the warranties during the year, and it estimates that an additional $819,110 will be spent in the future to service the warranties. The company recognizes warranty revenue based on the proportion of costs incurred out of the total estimated costs. How much total warranty revenue will be recorded during the year by the company under the revenue approach for service-type warranties? $339,675 $348.167 $356.659 $365,151 $373.643 XYZ Inc offers a gift set to customers who send in $1.13 plus three coupon codes obtained from the purchase of the company's standard products. That is, a customer purchases three standard products which come with a coupon each, sends everything in along with the cheque for the amount above, and receives the gift set in the mail a few weeks later. During the year, the company acquired an adequate number of gift sets for $2.67 each using cash to meet the promotion's demand. During the year, the company sold 1,078,710 of its standard products for $4.21 each. The company estimated that 10% of the sales amount received from customers would relate to the gift set to be awarded. The company would expect 34.79% of the coupons to be sent in eventually, and, during the year, 258,890 coupons were redeemed. If the company followed IFRS using the revenue approach, how much promotion expense would be recorded for the year for the redeemed coupons? $129,574 $132,897 $136,219 $139,542 $142.864 XYZ Inc has 60,010 common shares outstanding, with an average issue price of $8.99 per share. On August 1, the company reacquired and cancelled 4,375 shares at $43.12 per share. There was a contributed surplus of $52,000 (total credit balance for all outstanding shares) at the time of the reacquisition, which arose from net excess of proceeds over cost on a previous cancellation of common shares. What will be the absolute value of the change in the Retained Earnings balance due to the reacquisition of the shares on August 1 if the company prepares financial statements in accordance with ASPE? $94,886 $97,319 $99.752 $102,185 $104,618

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started