Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Inc's total common shares outstanding are 77,640 on Dec 31, Year 3, and 90,870 on Dec 31, Year 4. The company also has $538,990

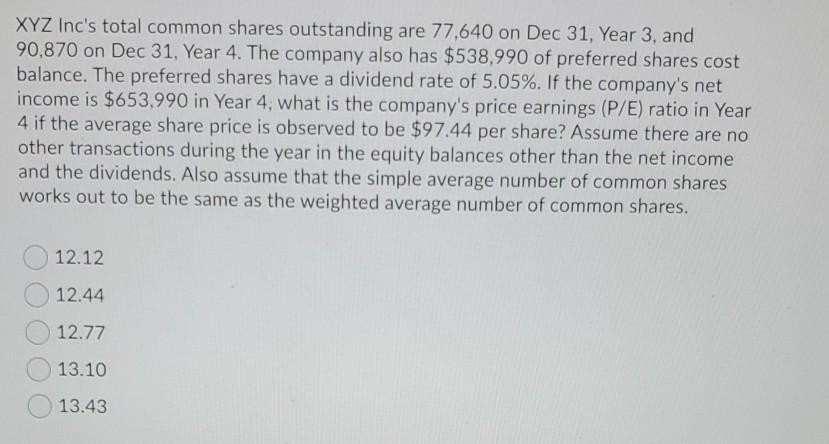

XYZ Inc's total common shares outstanding are 77,640 on Dec 31, Year 3, and 90,870 on Dec 31, Year 4. The company also has $538,990 of preferred shares cost balance. The preferred shares have a dividend rate of 5.05%. If the company's net income is $653,990 in Year 4, what is the company's price earnings (P/E) ratio in Year 4 if the average share price is observed to be $97.44 per share? Assume there are no other transactions during the year in the equity balances other than the net income and the dividends. Also assume that the simple average number of common shares works out to be the same as the weighted average number of common shares. 12.12 12.44 12.77 13.10 13.43

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started