Answered step by step

Verified Expert Solution

Question

1 Approved Answer

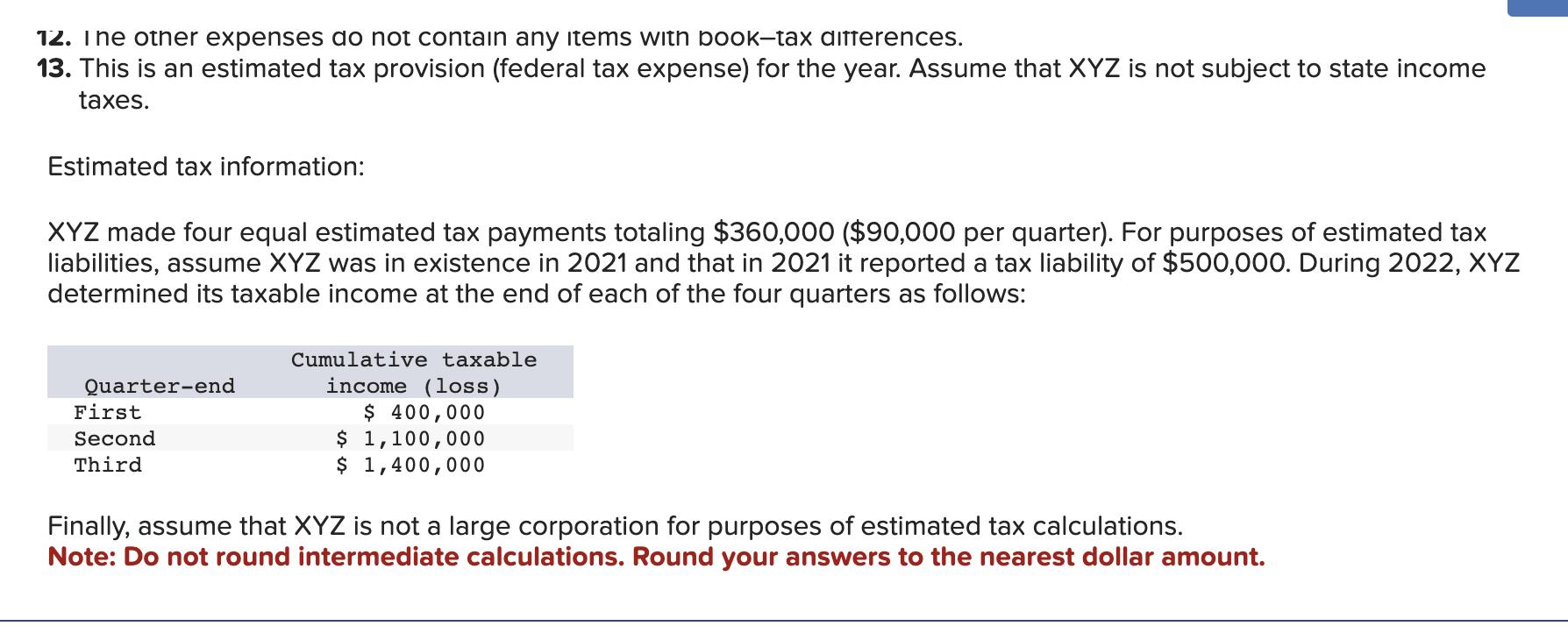

a. Compute XYZ's taxable income. b. Compute XYZ's income tax liability. c. Complete XYZ's Schedule M-1. I'm posting the correct answers myself because nobody else

a. Compute XYZ's taxable income.

b. Compute XYZ's income tax liability.

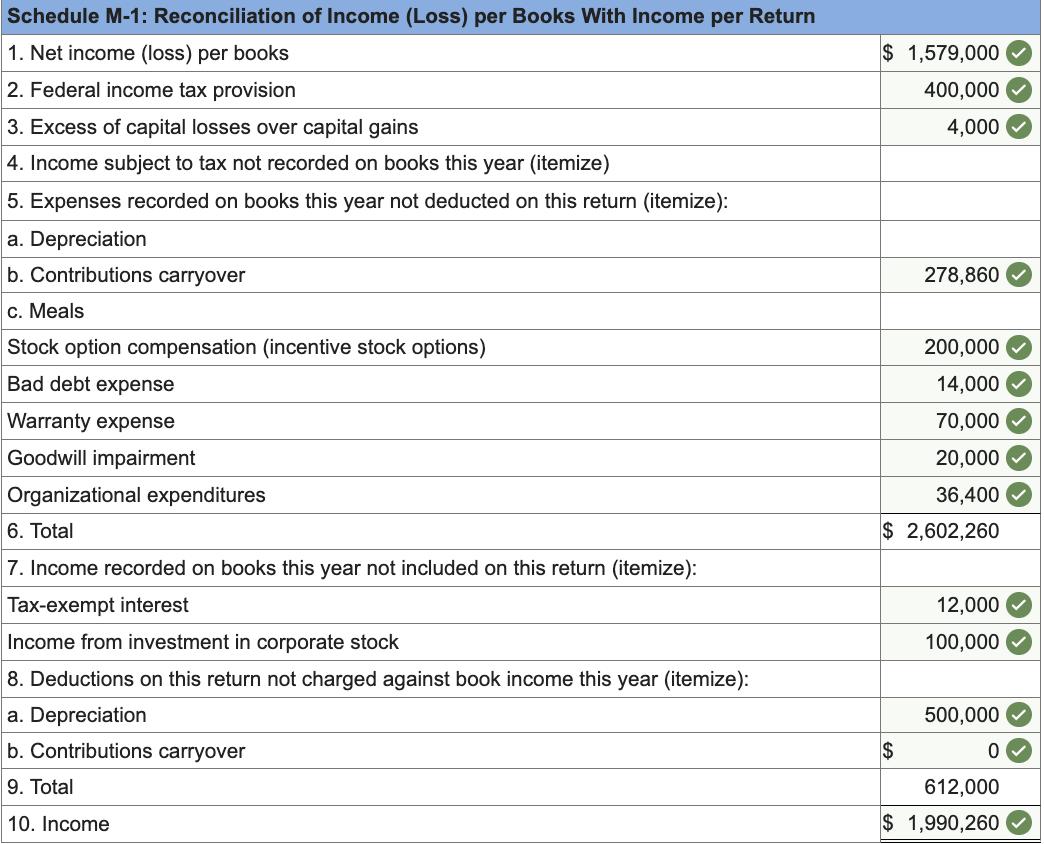

c. Complete XYZ's Schedule M-1.

I'm posting the correct answers myself because nobody else had the correct ones.

a. 1,860,260

b. 390,655

c.

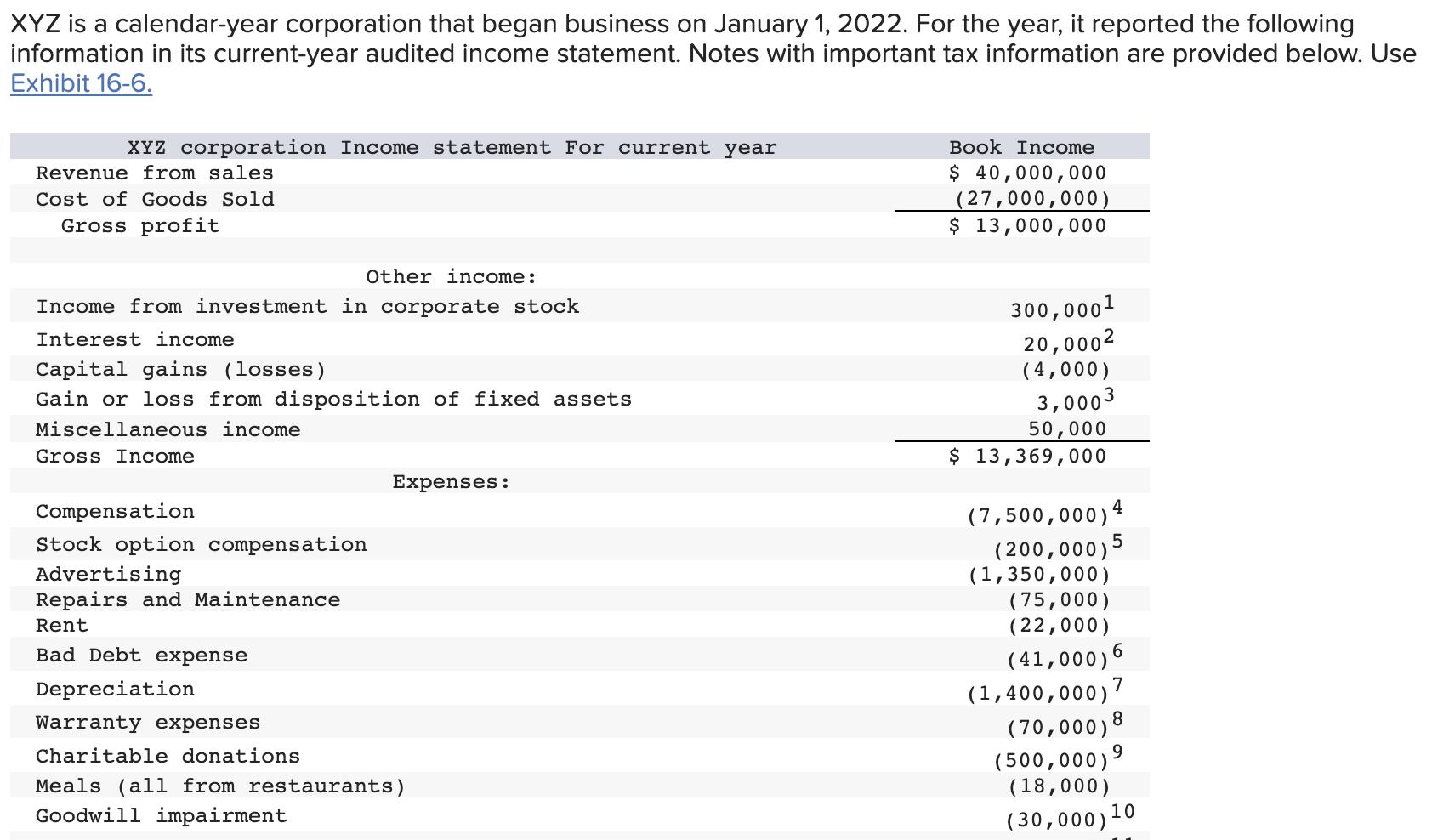

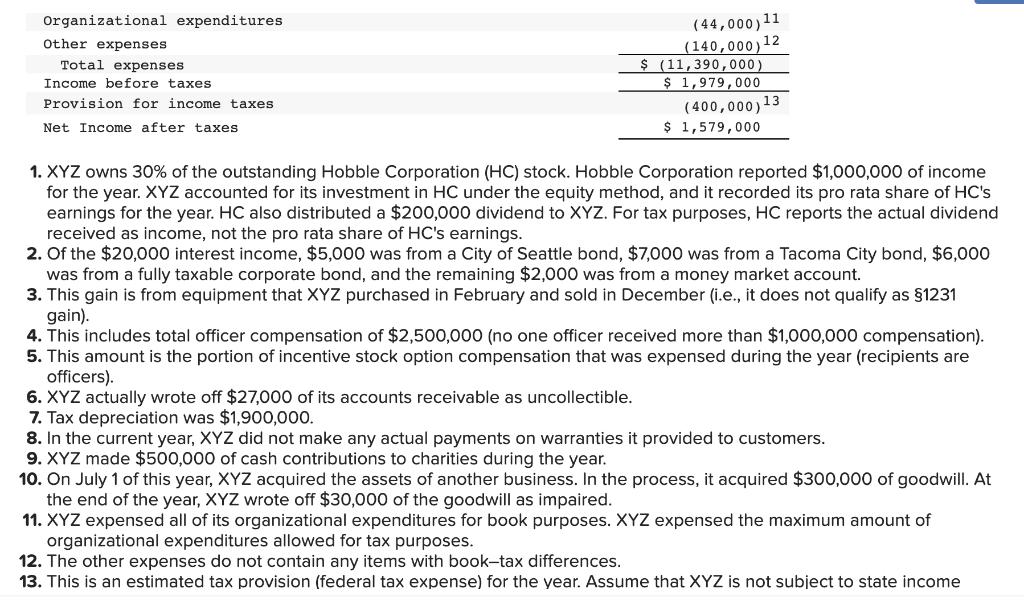

XYZ is a calendar-year corporation that began business on January 1, 2022. For the year, it reported the following information in its current-year audited income statement. Notes with important tax information are provided below. Use Exhibit 16-6. XYZ corporation Income statement For current year Revenue from sales Cost of Goods Sold Gross profit Other income: Book Income $ 40,000,000 (27,000,000) $13,000,000 Income from investment in corporate stock Interest income Capital gains (losses) Gain or loss from disposition of fixed assets Miscellaneous income Gross Income Compensation Stock option compensation Advertising Repairs and Maintenance Rent Bad Debt expense Depreciation Warranty expenses Charitable donations Expenses: Meals (all from restaurants) Goodwill impairment 300,0001 20,0002 (4,000) 3,000 50,000 $ 13,369,000 (7,500,000) 4 (200,000) 5 (1,350,000) (75,000) (22,000) (41,000) 6 (1,400,000) 7 (70,000) 8 (500,000) (18,000) (30,000) 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Compute XYZs Taxable Income Given the information we need to adjust XYZs book income to compute the taxable income Heres how Start with Net Income p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started