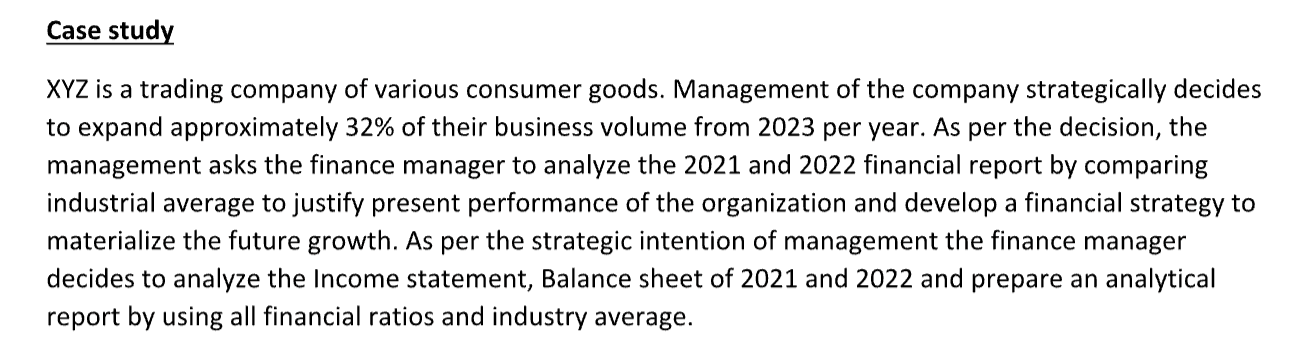

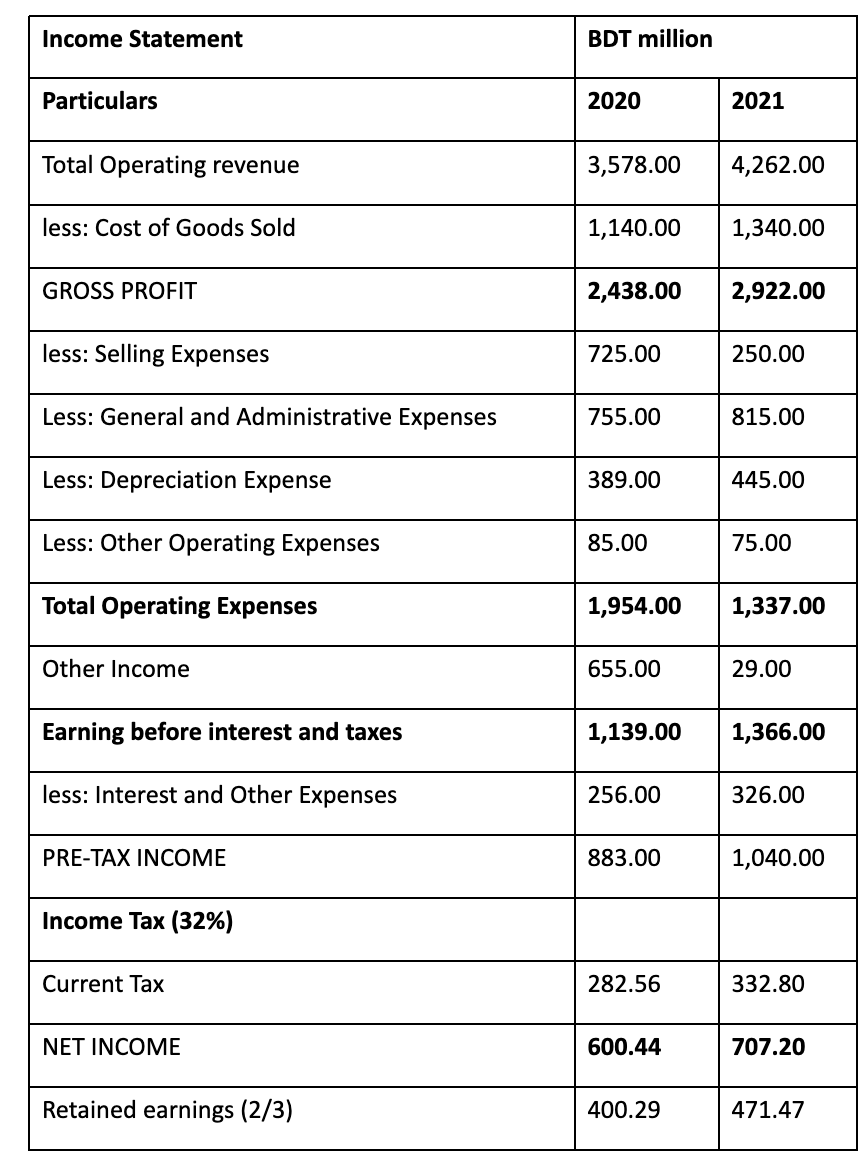

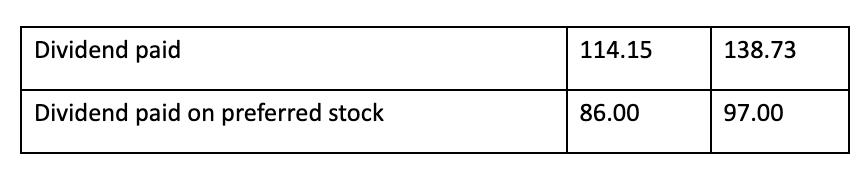

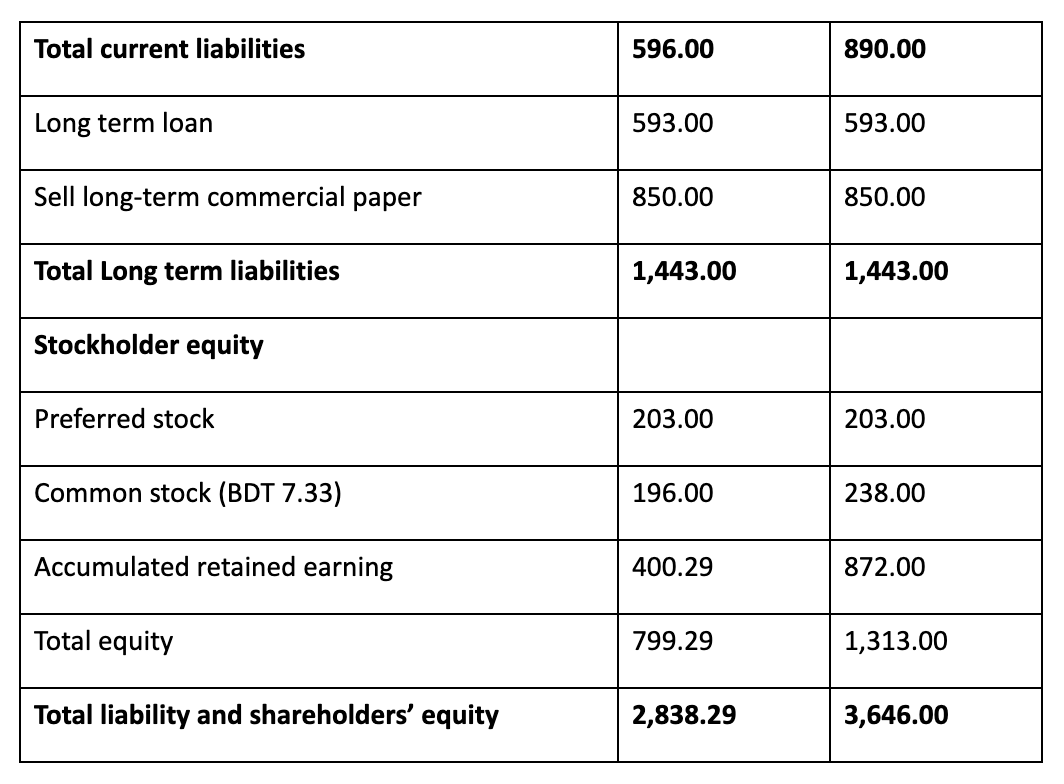

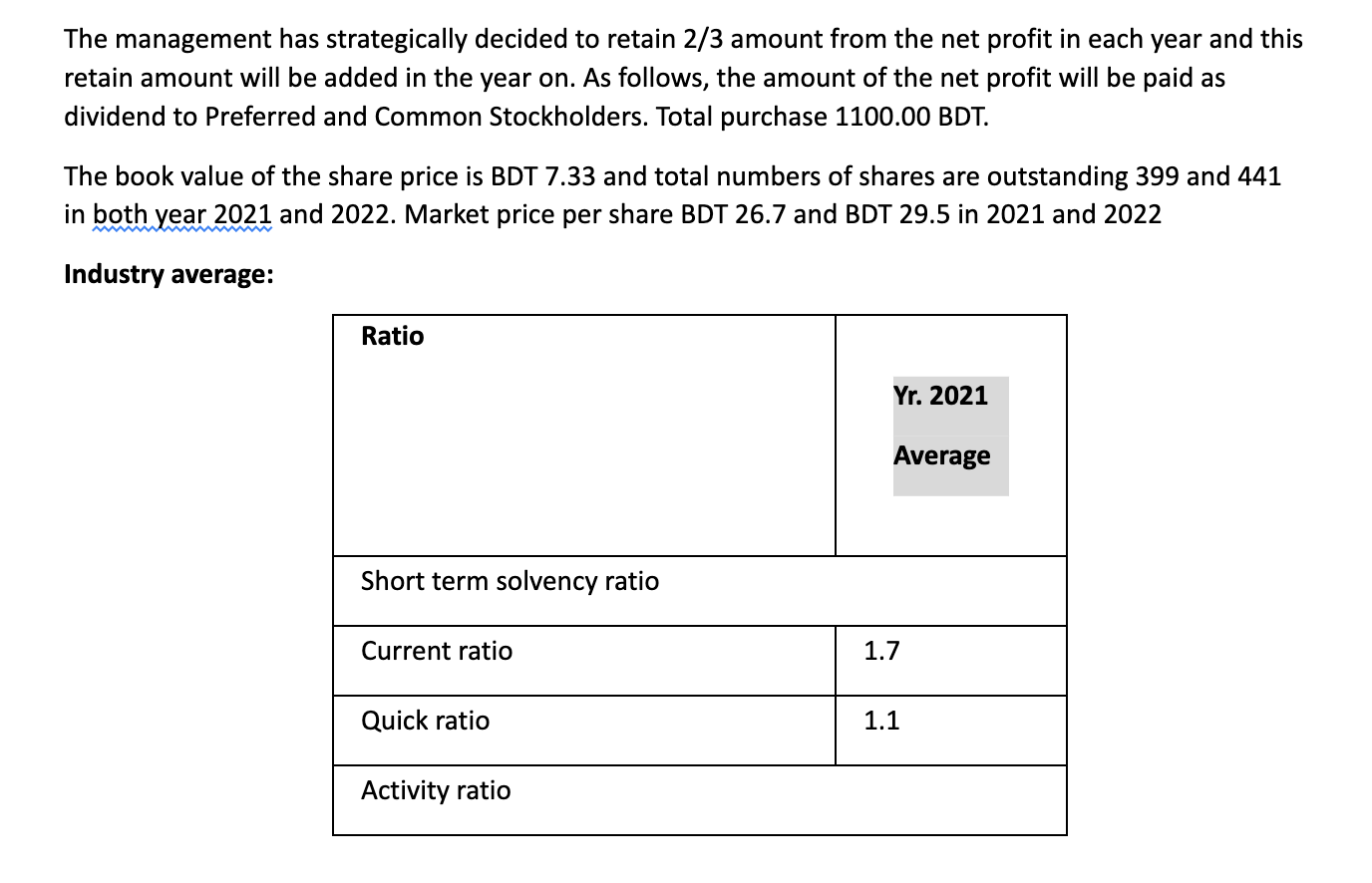

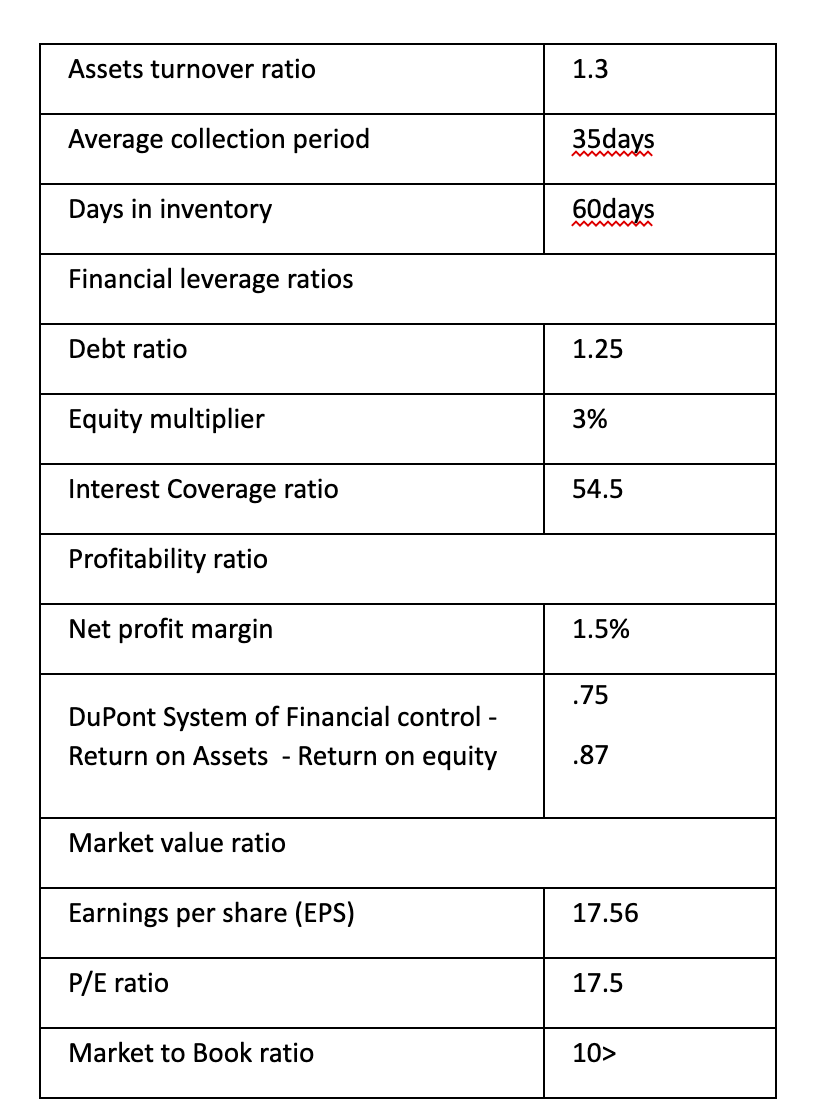

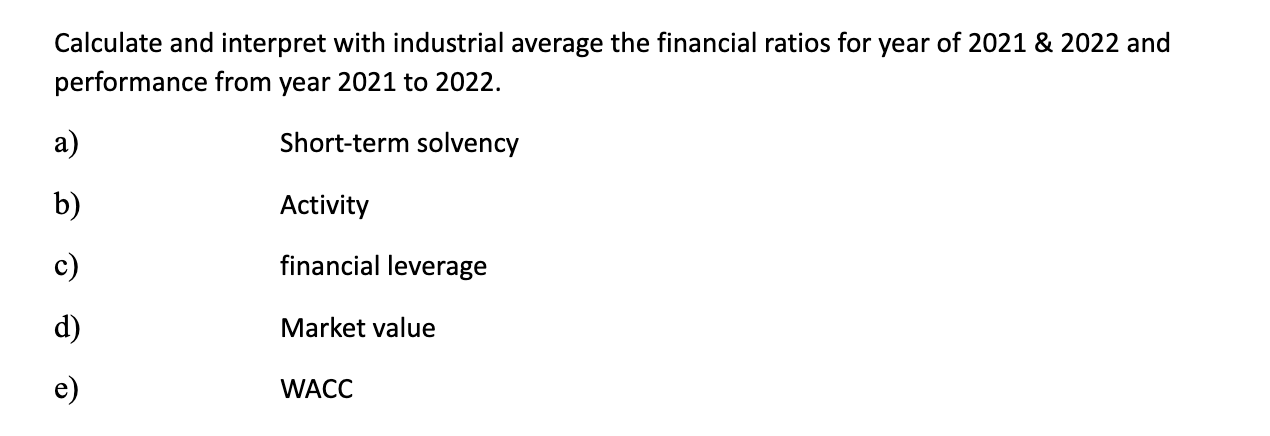

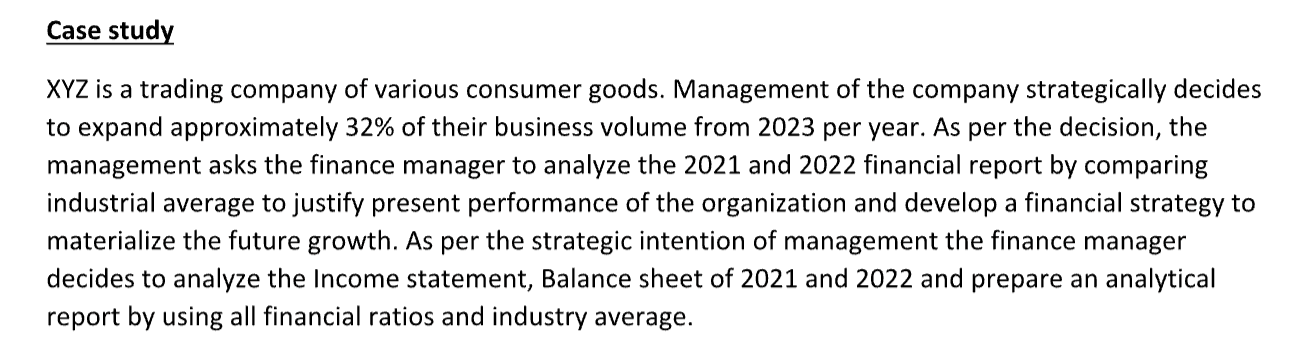

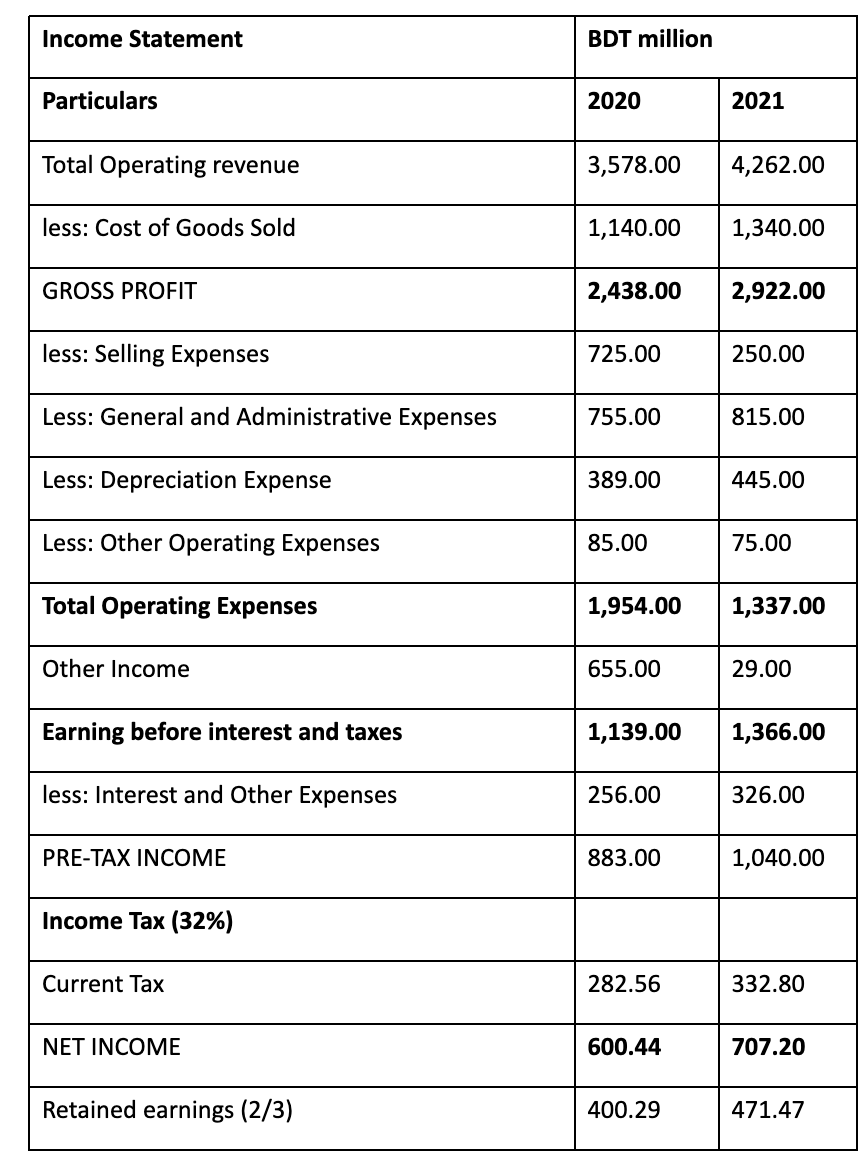

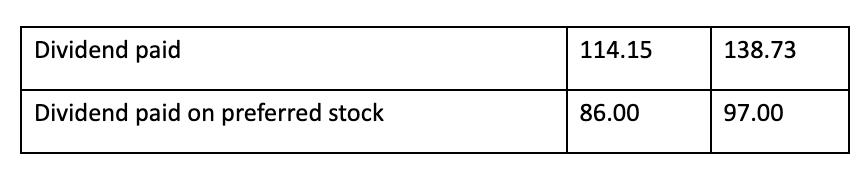

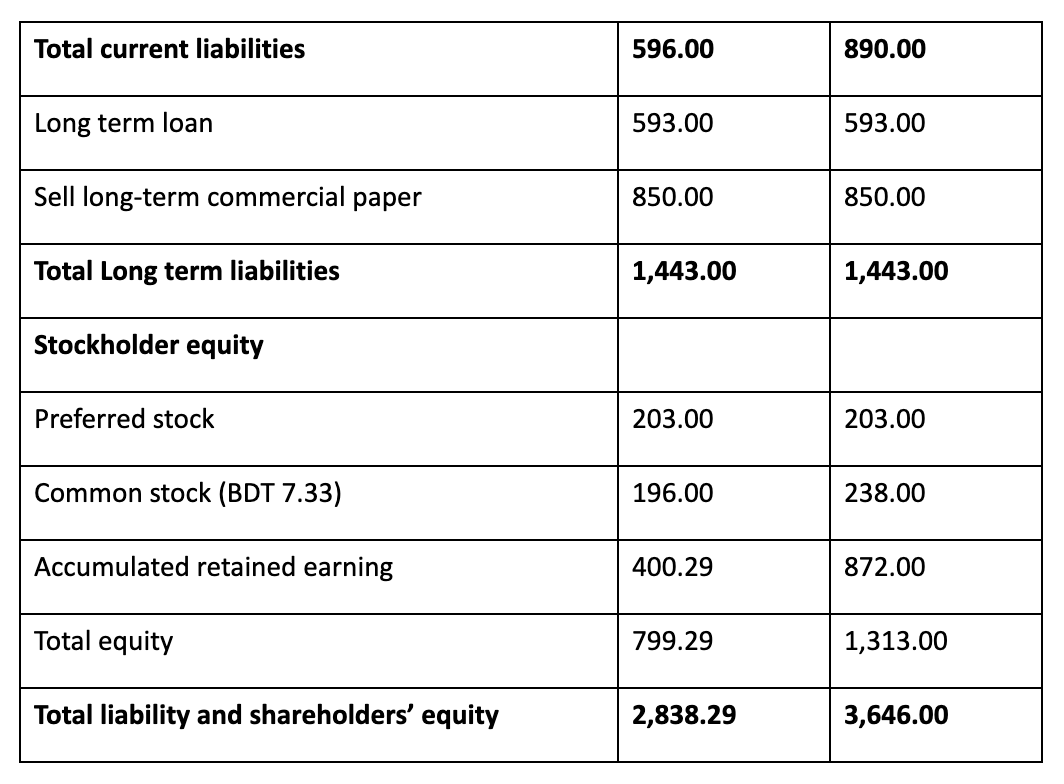

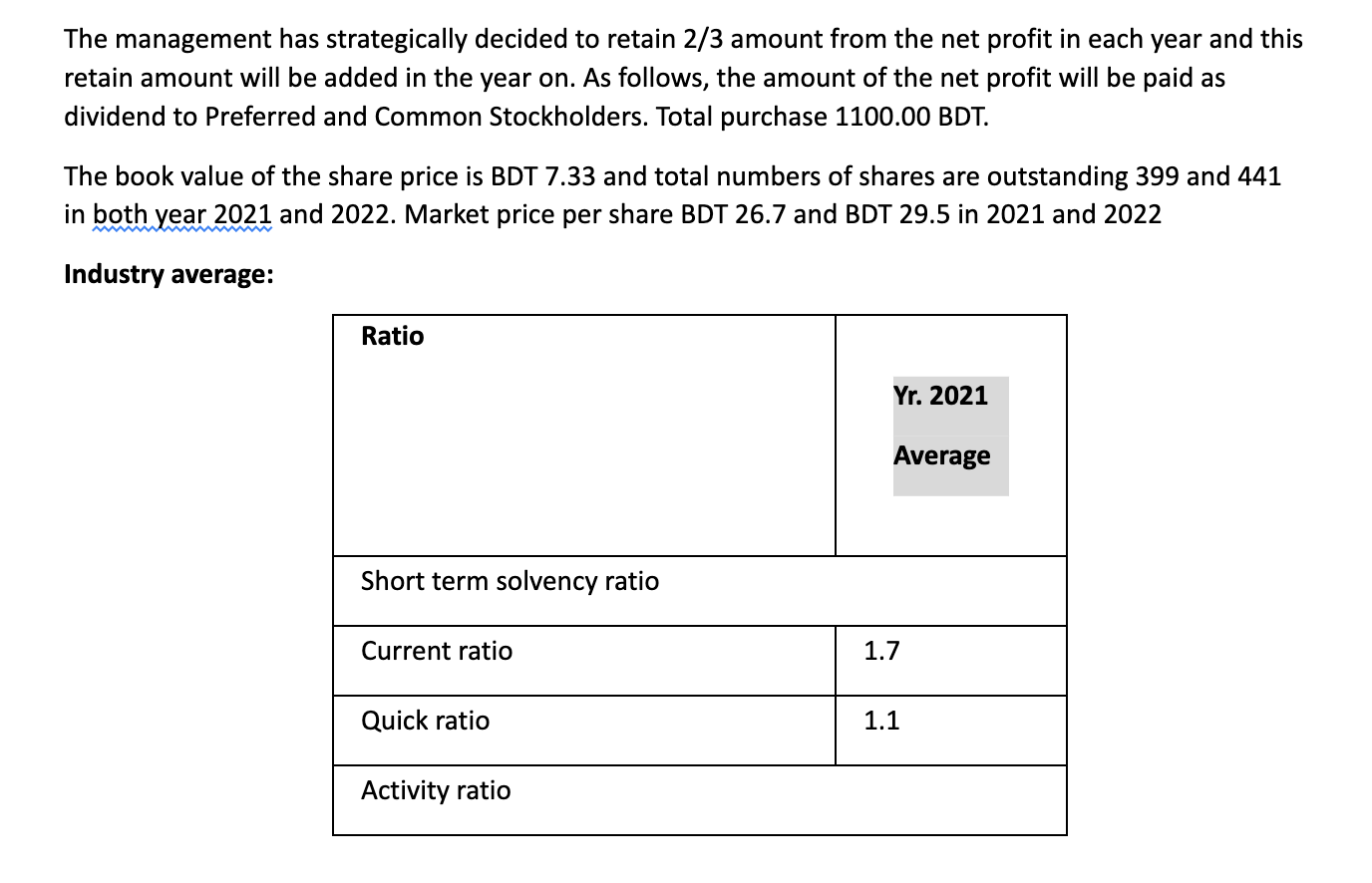

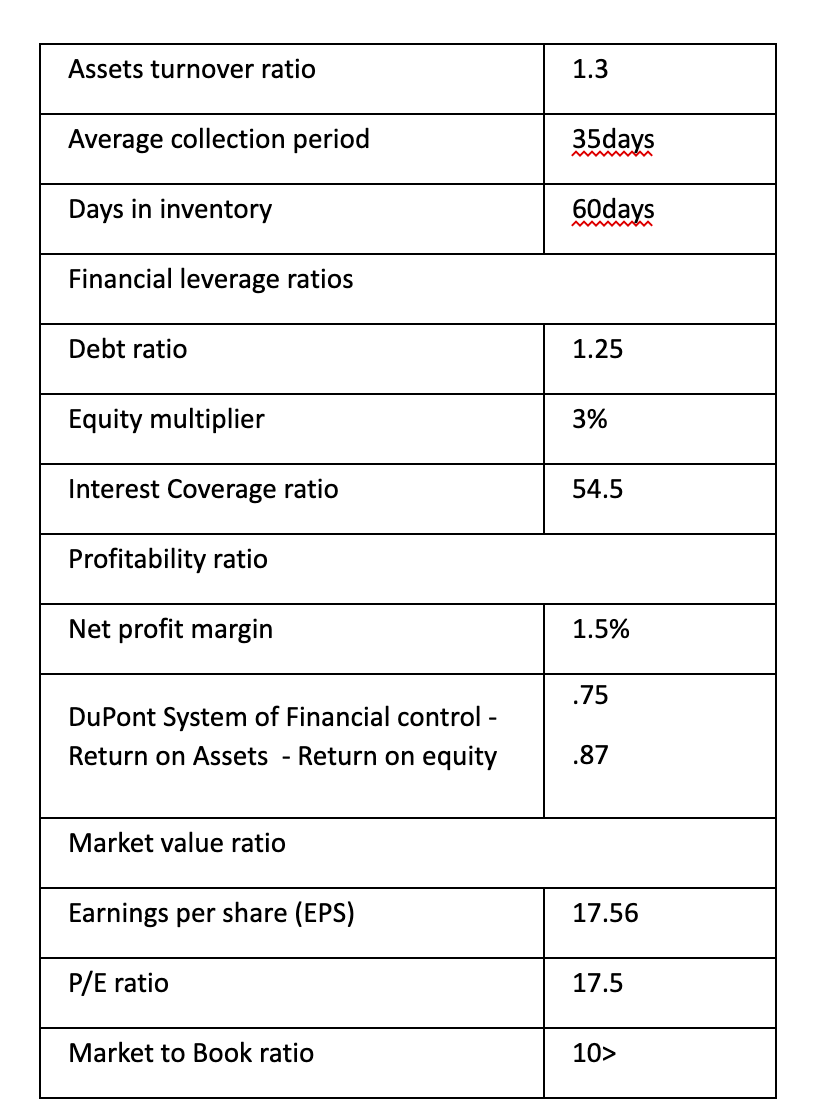

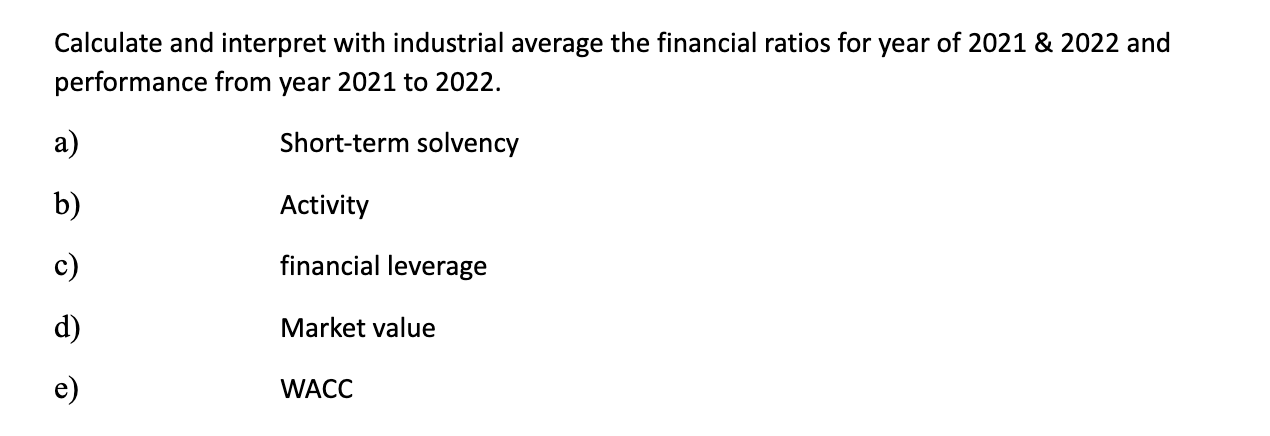

XYZ is a trading company of various consumer goods. Management of the company strategically decides to expand approximately 32% of their business volume from 2023 per year. As per the decision, the management asks the finance manager to analyze the 2021 and 2022 financial report by comparing industrial average to justify present performance of the organization and develop a financial strategy to materialize the future growth. As per the strategic intention of management the finance manager decides to analyze the Income statement, Balance sheet of 2021 and 2022 and prepare an analytical report by using all financial ratios and industry average. \begin{tabular}{|l|l|l|} \hline Income Statement & \multicolumn{2}{|l|}{ BDT million } \\ \hline Particulars & 2020 & 2021 \\ \hline Total Operating revenue & 3,578.00 & 4,262.00 \\ \hline less: Cost of Goods Sold & 1,140.00 & 1,340.00 \\ \hline GROSS PROFIT & 2,438.00 & 2,922.00 \\ \hline less: Selling Expenses & 725.00 & 250.00 \\ \hline Less: General and Administrative Expenses & 755.00 & 815.00 \\ \hline Less: Depreciation Expense & 389.00 & 445.00 \\ \hline Less: Other Operating Expenses & 85.00 & 75.00 \\ \hline Total Operating Expenses & 1,954.00 & 1,337.00 \\ \hline Other Income & 655.00 & 29.00 \\ \hline Earning before interest and taxes & 1,139.00 & 1,366.00 \\ \hline less: Interest and Other Expenses & 256.00 & 326.00 \\ \hline PRE-TAX INCOME & 883.00 & 1,040.00 \\ \hline Income Tax (32\%) & & \\ \hline Current Tax & 282.56 & 332.80 \\ \hline Retained INCOME & 707.20 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline Dividend paid & 114.15 & 138.73 \\ \hline Dividend paid on preferred stock & 86.00 & 97.00 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline Total current liabilities & 596.00 & 890.00 \\ \hline Long term loan & 593.00 & 593.00 \\ \hline Sell long-term commercial paper & 850.00 & 850.00 \\ \hline Total Long term liabilities & 1,443.00 & 1,443.00 \\ \hline Stockholder equity & 203.00 & 203.00 \\ \hline Preferred stock & 196.00 & 238.00 \\ \hline Common stock (BDT 7.33) & 400.29 & 872.00 \\ \hline Accumulated retained earning & 2,838.29 & 3996 \\ \hline Total equity & & \\ \hline Total liability and shareholders' equity & & \\ \hline \end{tabular} The management has strategically decided to retain 2/3 amount from the net profit in each year and this retain amount will be added in the year on. As follows, the amount of the net profit will be paid as dividend to Preferred and Common Stockholders. Total purchase 1100.00 BDT. The book value of the share price is BDT 7.33 and total numbers of shares are outstanding 399 and 441 in both year 2021 and 2022. Market price per share BDT 26.7 and BDT 29.5 in 2021 and 2022 Industry average: Calculate and interpret with industrial average the financial ratios for year of 2021&2022 and performance from year 2021 to 2022. a) Short-term solvency b) Activity c) financial leverage d) Market value e) WACC