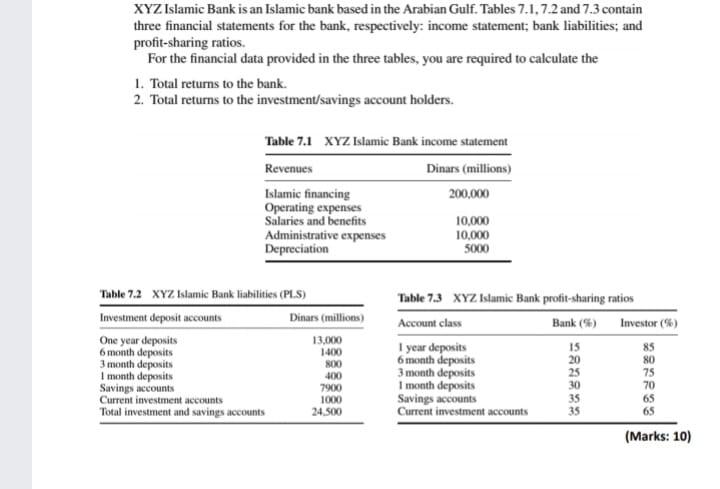

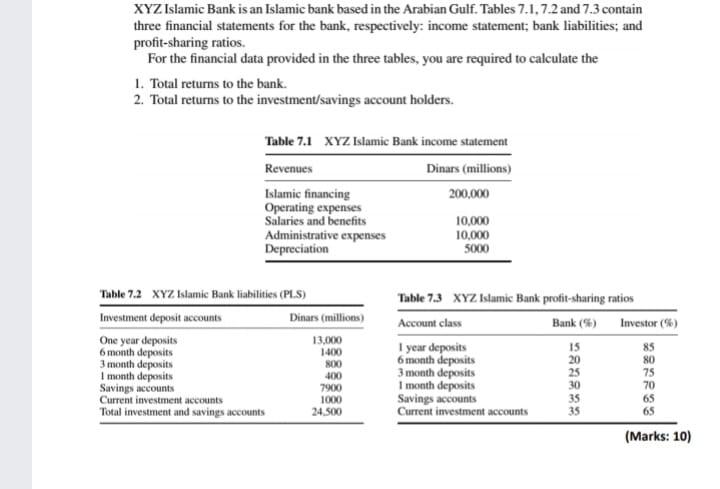

XYZ Islamic Bank is an Islamic bank based in the Arabian Gulf. Tables 7.1.7.2 and 7.3 contain three financial statements for the bank, respectively: income statement; bank liabilities, and profit-sharing ratios. For the financial data provided in the three tables, you are required to calculate the 1. Total returns to the bank. 2. Total returns to the investment/savings account holders. Table 7.1 XYZ Islamic Bank income statement Revenues Dinars (millions) Islamic financing 200,000 Operating expenses Salaries and benefits 10,000 Administrative expenses 10,000 Depreciation 5000 "Table 7.2 XYZ Islamic Bank liabilities (PLS) Investment deposit accounts Dinars (millions One year deposits 13,000 6 month deposits 1400 3 month deposits 800 1 month deposits 400 Savings accounts 7900 Current investment accounts 1000 Total investment and savings accounts 24.500 Table 7.3 XYZ Islamic Bank profit-sharing ratios Account class Bank (5) Investor (%) I year deposits 15 85 6 month deposits 20 80 3 month deposits 75 1 month deposits 70 Savings accounts 65 Current investment accounts 35 65 (Marks: 10) XYZ Islamic Bank is an Islamic bank based in the Arabian Gulf. Tables 7.1.7.2 and 7.3 contain three financial statements for the bank, respectively: income statement; bank liabilities, and profit-sharing ratios. For the financial data provided in the three tables, you are required to calculate the 1. Total returns to the bank. 2. Total returns to the investment/savings account holders. Table 7.1 XYZ Islamic Bank income statement Revenues Dinars (millions) Islamic financing 200,000 Operating expenses Salaries and benefits 10,000 Administrative expenses 10,000 Depreciation 5000 "Table 7.2 XYZ Islamic Bank liabilities (PLS) Investment deposit accounts Dinars (millions One year deposits 13,000 6 month deposits 1400 3 month deposits 800 1 month deposits 400 Savings accounts 7900 Current investment accounts 1000 Total investment and savings accounts 24.500 Table 7.3 XYZ Islamic Bank profit-sharing ratios Account class Bank (5) Investor (%) I year deposits 15 85 6 month deposits 20 80 3 month deposits 75 1 month deposits 70 Savings accounts 65 Current investment accounts 35 65 (Marks: 10)