Answered step by step

Verified Expert Solution

Question

1 Approved Answer

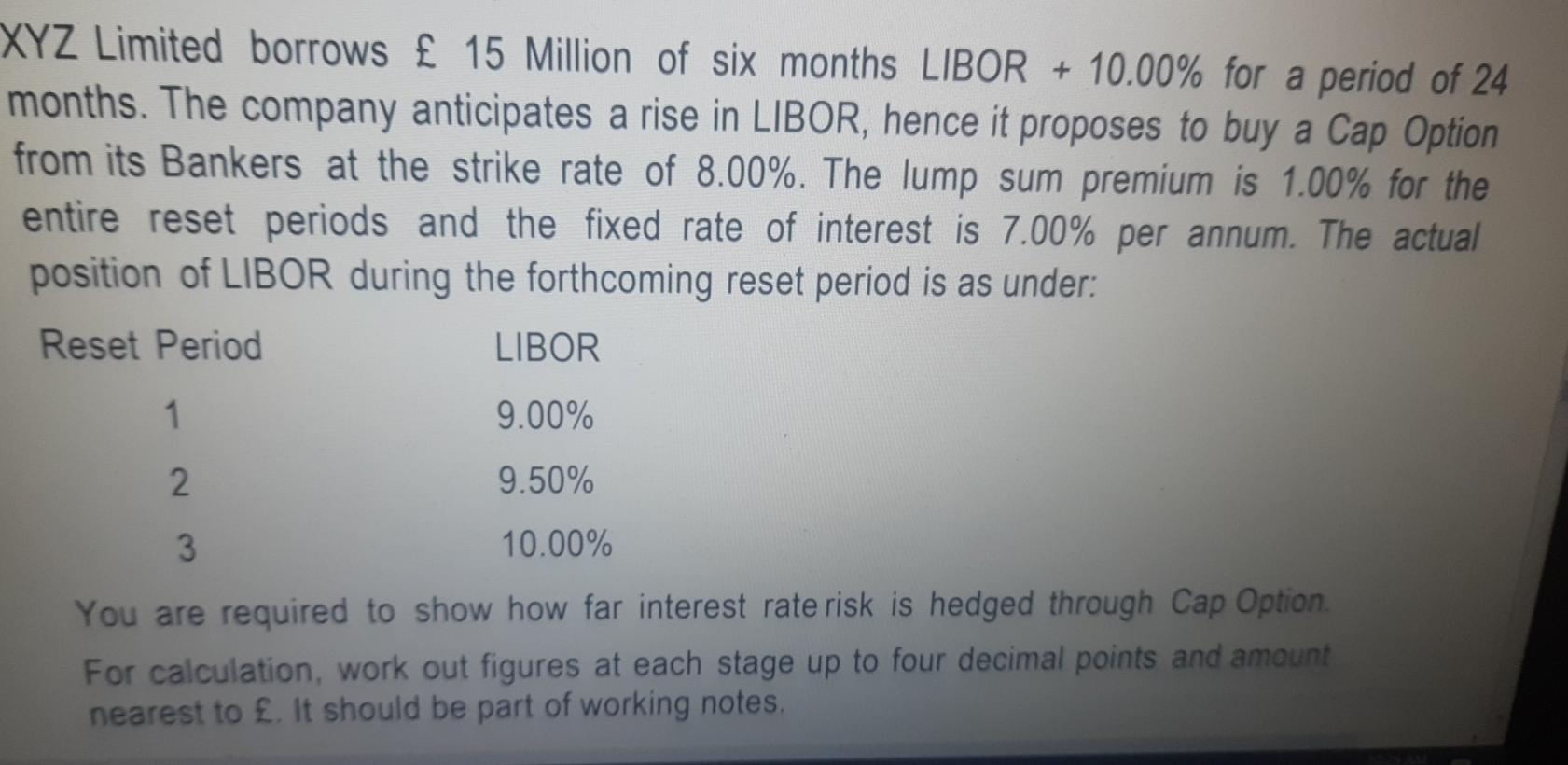

XYZ Limited borrows 15 Million of six months LIBOR + 10.00% for a period of 24 months. The company anticipates a rise in LIBOR, hence

XYZ Limited borrows 15 Million of six months LIBOR + 10.00% for a period of 24 months. The company anticipates a rise in LIBOR, hence it proposes to buy a Cap Option from its Bankers at the strike rate of 8.00%. The lump sum premium is 1.00% for the entire reset periods and the fixed rate of interest is 7.00% per annum. The actual position of LIBOR during the forthcoming reset period is as under: Reset Period LIBOR 1 9.00% 2. 9.50% 3 10.00% You are required to show how far interest rate risk is hedged through Cap Option. For calculation, work out figures at each stage up to four decimal points and amount nearest to . It should be part of working notes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started