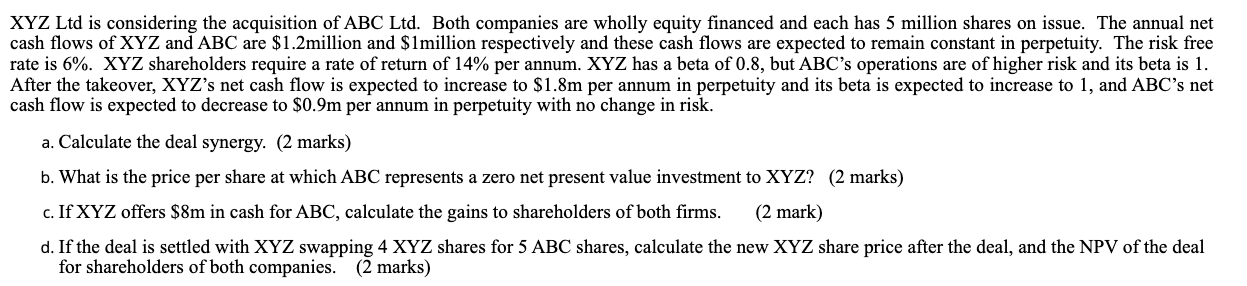

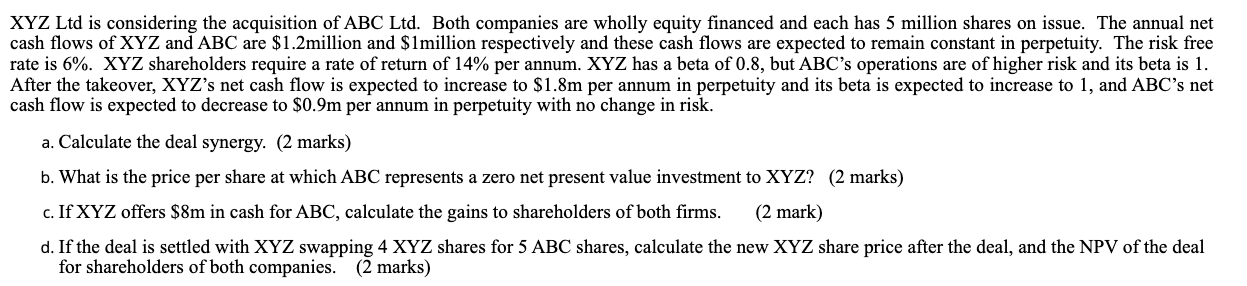

XYZ Ltd is considering the acquisition of ABC Ltd. Both companies are wholly equity financed and each has 5 million shares on issue. The annual net cash flows of XYZ and ABC are $1.2million and $1million respectively and these cash flows are expected to remain constant in perpetuity. The risk free rate is 6%. XYZ shareholders require a rate of return of 14% per annum. XYZ has a beta of 0.8, but ABC's operations are of higher risk and its beta is 1. After the takeover, XYZ's net cash flow is expected to increase to $1.8m per annum in perpetuity and its beta is expected to increase to 1, and ABC's net cash flow is expected to decrease to $0.9m per annum in perpetuity with no change in risk. a. Calculate the deal synergy. (2 marks) b. What is the price per share at which ABC represents a zero net present value investment to XYZ? (2 marks) c. If XYZ offers $8m in cash for ABC, calculate the gains to shareholders of both firms. (2 mark) d. If the deal is settled with XYZ swapping 4 XYZ shares for 5 ABC shares, calculate the new XYZ share price after the deal, and the NPV of the deal for shareholders of both companies. (2 marks) XYZ Ltd is considering the acquisition of ABC Ltd. Both companies are wholly equity financed and each has 5 million shares on issue. The annual net cash flows of XYZ and ABC are $1.2million and $1million respectively and these cash flows are expected to remain constant in perpetuity. The risk free rate is 6%. XYZ shareholders require a rate of return of 14% per annum. XYZ has a beta of 0.8, but ABC's operations are of higher risk and its beta is 1. After the takeover, XYZ's net cash flow is expected to increase to $1.8m per annum in perpetuity and its beta is expected to increase to 1, and ABC's net cash flow is expected to decrease to $0.9m per annum in perpetuity with no change in risk. a. Calculate the deal synergy. (2 marks) b. What is the price per share at which ABC represents a zero net present value investment to XYZ? (2 marks) c. If XYZ offers $8m in cash for ABC, calculate the gains to shareholders of both firms. (2 mark) d. If the deal is settled with XYZ swapping 4 XYZ shares for 5 ABC shares, calculate the new XYZ share price after the deal, and the NPV of the deal for shareholders of both companies. (2 marks)