Question

XYZ Ltd. manufactures two products and applies overhead on the basis of direct labour hours. Budgeted overhead and direct labour hours for 2022 are 2,000,000

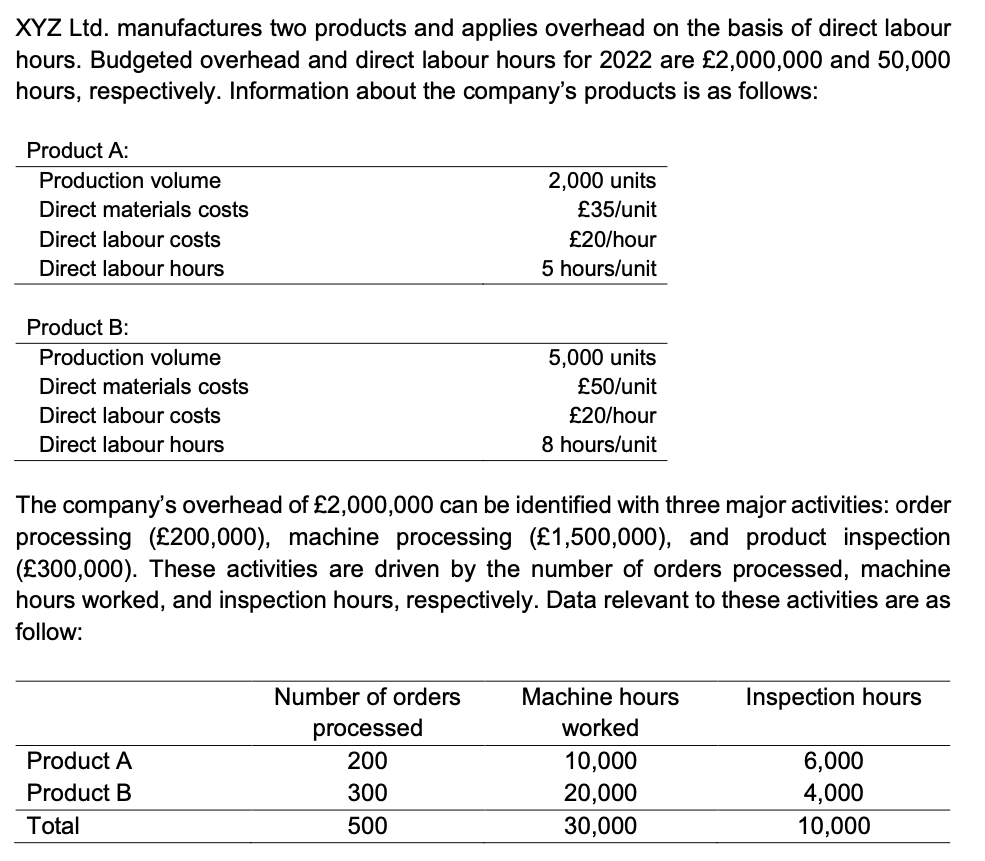

XYZ Ltd. manufactures two products and applies overhead on the basis of direct labour hours. Budgeted overhead and direct labour hours for 2022 are 2,000,000 and 50,000 hours, respectively. Information about the companys products is as follows:

REQUIRED: Please note: a maximum word count applies to some parts of this question.

REQUIRED: Please note: a maximum word count applies to some parts of this question.

(1a) Using the information provided above:

(i) Calculate the total contribution. Using the contribution, calculate the break-even point in units and break-even point sales in pounds.

(ii) Define the margin of safety in words and provide an example of a firm where it was important particularly during the pandemic. Based on the definition, calculate the margin of safety.

(iii) The company received an order for 1,000 units at a price of 200. There will be no increase in fixed costs, but variable costs will increase by 10 per unit because of packaging expenses. Determine the projected increase or decrease in profits from the order, assuming there are no opportunity costs.

(1b) List THREE main assumptions you made in (a).

Discuss how your assumptions may affect your conclusions from the analysis in (a).

Regarding your answers above, provide TWO actual examples where unrealistic assumptions mislead managers decisions.

XYZ Ltd. manufactures two products and applies overhead on the basis of direct labour hours. Budgeted overhead and direct labour hours for 2022 are 2,000,000 and 50,000 hours, respectively. Information about the company's products is as follows: Product A: Production volume Direct materials costs Direct labour costs Direct labour hours 2,000 units 35/unit 20/hour 5 hours/unit Product B: Production volume Direct materials costs Direct labour costs Direct labour hours 5,000 units 50/unit 20/hour 8 hours/unit The company's overhead of 2,000,000 can be identified with three major activities: order processing (200,000), machine processing (1,500,000), and product inspection (300,000). These activities are driven by the number of orders processed, machine hours worked, and inspection hours, respectively. Data relevant to these activities are as follow: Inspection hours Product A Product B Total Number of orders processed 200 300 500 Machine hours worked 10,000 20,000 30,000 6,000 4,000 10,000 XYZ Ltd. manufactures two products and applies overhead on the basis of direct labour hours. Budgeted overhead and direct labour hours for 2022 are 2,000,000 and 50,000 hours, respectively. Information about the company's products is as follows: Product A: Production volume Direct materials costs Direct labour costs Direct labour hours 2,000 units 35/unit 20/hour 5 hours/unit Product B: Production volume Direct materials costs Direct labour costs Direct labour hours 5,000 units 50/unit 20/hour 8 hours/unit The company's overhead of 2,000,000 can be identified with three major activities: order processing (200,000), machine processing (1,500,000), and product inspection (300,000). These activities are driven by the number of orders processed, machine hours worked, and inspection hours, respectively. Data relevant to these activities are as follow: Inspection hours Product A Product B Total Number of orders processed 200 300 500 Machine hours worked 10,000 20,000 30,000 6,000 4,000 10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started