Answered step by step

Verified Expert Solution

Question

1 Approved Answer

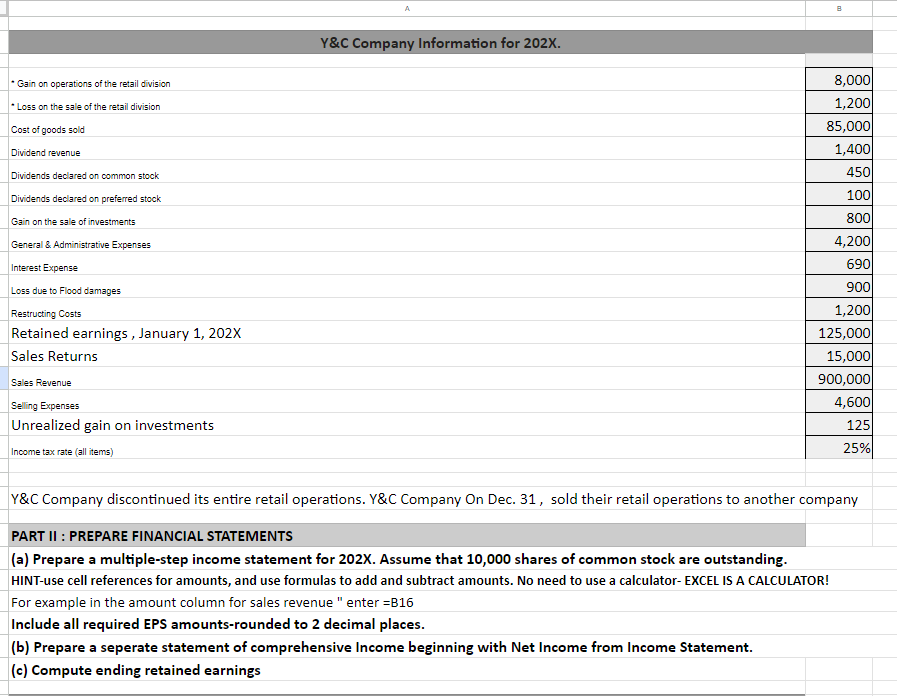

Y &C Company Information for 202X. - Gain on operations of the retail division - Loss on the sale of the retail division Cost of

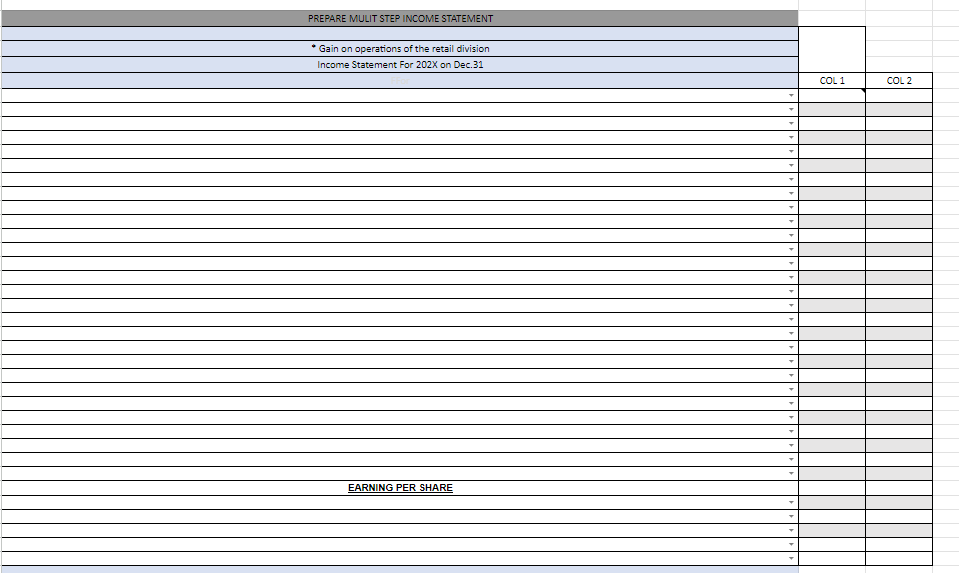

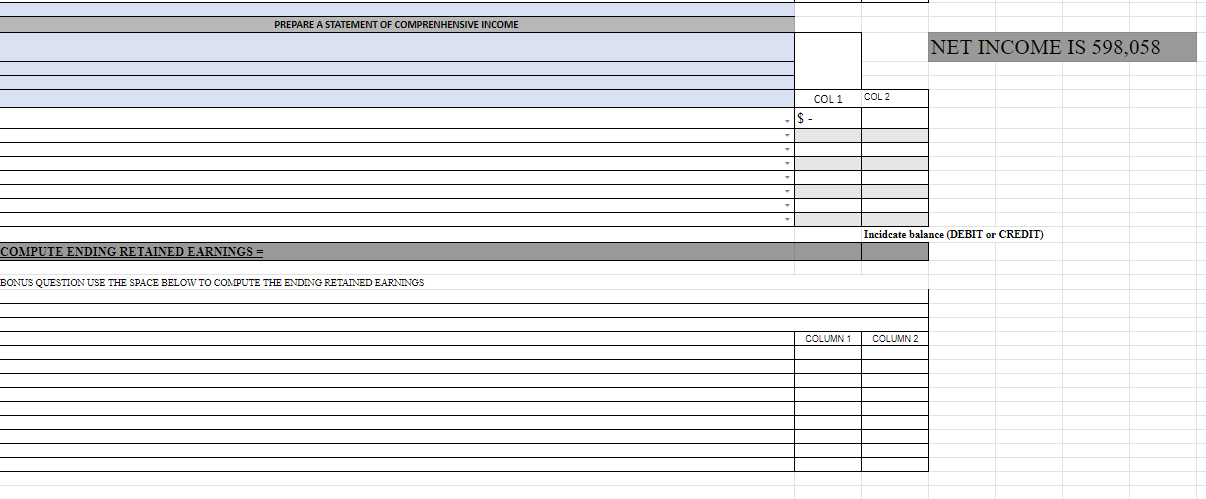

Y \&C Company Information for 202X. - Gain on operations of the retail division - Loss on the sale of the retail division Cost of goods sold Dividend revenue Dividends declared on common stock Dividends declared on preferred stock Gain on the sale of investments General \&. Administrative Expenses Interest Expense Loss due to Flood damages Restructing Costs Retained earnings, January 1,202X Sales Returns Sales Revenue Selling Expenses Unrealized gain on investments Income tax rate (all items) \begin{tabular}{|r|} \hline 8,000 \\ \hline 1,200 \\ \hline 85,000 \\ \hline 1,400 \\ \hline 450 \\ \hline 100 \\ \hline 800 \\ \hline 4,200 \\ \hline 690 \\ \hline 900 \\ \hline 1,200 \\ \hline 125,000 \\ \hline 15,000 \\ \hline 900,000 \\ \hline 4,600 \\ \hline 125 \\ \hline 25% \\ \hline \end{tabular} Y\&C Company discontinued its entire retail operations. Y\&C Company On Dec. 31 , sold their retail operations to another company PART II : PREPARE FINANCIAL STATEMENTS (a) Prepare a multiple-step income statement for 202X. Assume that 10,000 shares of common stock are outstanding. HINT-use cell references for amounts, and use formulas to add and subtract amounts. No need to use a calculator- EXCEL IS A CALCULATOR! For example in the amount column for sales revenue " enter =B16 Include all required EPS amounts-rounded to 2 decimal places. (b) Prepare a seperate statement of comprehensive Income beginning with Net Income from Income Statement. (c) Compute ending retained earnings

Y \&C Company Information for 202X. - Gain on operations of the retail division - Loss on the sale of the retail division Cost of goods sold Dividend revenue Dividends declared on common stock Dividends declared on preferred stock Gain on the sale of investments General \&. Administrative Expenses Interest Expense Loss due to Flood damages Restructing Costs Retained earnings, January 1,202X Sales Returns Sales Revenue Selling Expenses Unrealized gain on investments Income tax rate (all items) \begin{tabular}{|r|} \hline 8,000 \\ \hline 1,200 \\ \hline 85,000 \\ \hline 1,400 \\ \hline 450 \\ \hline 100 \\ \hline 800 \\ \hline 4,200 \\ \hline 690 \\ \hline 900 \\ \hline 1,200 \\ \hline 125,000 \\ \hline 15,000 \\ \hline 900,000 \\ \hline 4,600 \\ \hline 125 \\ \hline 25% \\ \hline \end{tabular} Y\&C Company discontinued its entire retail operations. Y\&C Company On Dec. 31 , sold their retail operations to another company PART II : PREPARE FINANCIAL STATEMENTS (a) Prepare a multiple-step income statement for 202X. Assume that 10,000 shares of common stock are outstanding. HINT-use cell references for amounts, and use formulas to add and subtract amounts. No need to use a calculator- EXCEL IS A CALCULATOR! For example in the amount column for sales revenue " enter =B16 Include all required EPS amounts-rounded to 2 decimal places. (b) Prepare a seperate statement of comprehensive Income beginning with Net Income from Income Statement. (c) Compute ending retained earnings Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started