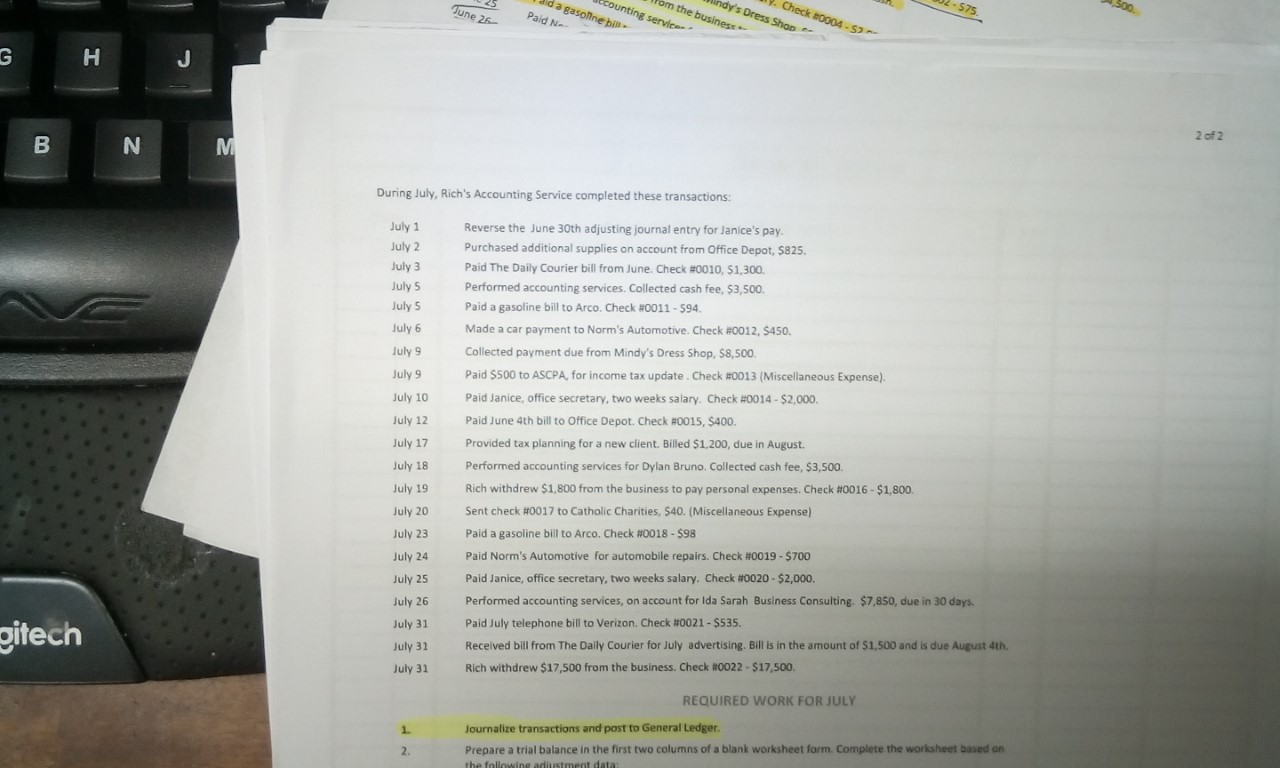

y. Check #0004-S Windy's Dress Shop om the business Occounting service did a gasoline bi Paid N. 25 Tune 26 2 of 2 During July, Rich's Accounting Service completed these transactions: July 1 July 2 July 3 July 5 July 5 July 6 July 9 July 9 July 10 July 12 July 17 July 18 July 19 July 20 July 23 July 24 July 25 July 26 July 31 July 31 July 31 Reverse the June 30th adjusting journal entry for Janice's pay. Purchased additional supplies on account from Office Depot, $825. Paid The Daily Courier bill from June. Check #0010, 51,300 Performed accounting services. Collected cash fee, $3,500. Paid a gasoline bill to Arco. Check #0011 - 594 Made a car payment to Norm's Automotive. Check #0012, $450. Collected payment due from Mindy's Dress Shop, $8,500 Paid $500 to ASCPA, for income tax update. Check #0013 (Miscellaneous Expense). Paid Janice, office secretary, two weeks salary. Check #0014 - $2,000. Paid June 4th bill to Office Depot. Check #0015, $400. Provided tax planning for a new client. Billed $1.200, due in August Performed accounting services for Dylan Bruno Collected cash fee, $3,500. Rich withdrew $1,800 from the business to pay personal expenses. Check #0016 - $1,800. Sent check #0017 to Catholic Charities, $40. (Miscellaneous Expense) Paid a gasoline bill to Arco. Check #0018 - 598 Paid Norm's Automotive for automobile repairs. Check #0019 - $700 Paid Janice, office secretary, two weeks salary. Check #0020 - $2,000. Performed accounting services, on account for Ida Sarah Business Consulting. $7,850, due in 30 days. Paid July telephone bill to Verizon. Check #0021 - $535. Received bill from The Daily Courier for July advertising. Bili is in the amount of $1,500 and is due August 4th Rich withdrew $17,500 from the business. Check #0022-517.500. gitech REQUIRED WORK FOR JULY Journalize transactions and post to General Ledger. Prepare a trial balance in the first two columns of a blank worksheet form. Complete the worksheel based on 2. the following adiuustment data y. Check #0004-S Windy's Dress Shop om the business Occounting service did a gasoline bi Paid N. 25 Tune 26 2 of 2 During July, Rich's Accounting Service completed these transactions: July 1 July 2 July 3 July 5 July 5 July 6 July 9 July 9 July 10 July 12 July 17 July 18 July 19 July 20 July 23 July 24 July 25 July 26 July 31 July 31 July 31 Reverse the June 30th adjusting journal entry for Janice's pay. Purchased additional supplies on account from Office Depot, $825. Paid The Daily Courier bill from June. Check #0010, 51,300 Performed accounting services. Collected cash fee, $3,500. Paid a gasoline bill to Arco. Check #0011 - 594 Made a car payment to Norm's Automotive. Check #0012, $450. Collected payment due from Mindy's Dress Shop, $8,500 Paid $500 to ASCPA, for income tax update. Check #0013 (Miscellaneous Expense). Paid Janice, office secretary, two weeks salary. Check #0014 - $2,000. Paid June 4th bill to Office Depot. Check #0015, $400. Provided tax planning for a new client. Billed $1.200, due in August Performed accounting services for Dylan Bruno Collected cash fee, $3,500. Rich withdrew $1,800 from the business to pay personal expenses. Check #0016 - $1,800. Sent check #0017 to Catholic Charities, $40. (Miscellaneous Expense) Paid a gasoline bill to Arco. Check #0018 - 598 Paid Norm's Automotive for automobile repairs. Check #0019 - $700 Paid Janice, office secretary, two weeks salary. Check #0020 - $2,000. Performed accounting services, on account for Ida Sarah Business Consulting. $7,850, due in 30 days. Paid July telephone bill to Verizon. Check #0021 - $535. Received bill from The Daily Courier for July advertising. Bili is in the amount of $1,500 and is due August 4th Rich withdrew $17,500 from the business. Check #0022-517.500. gitech REQUIRED WORK FOR JULY Journalize transactions and post to General Ledger. Prepare a trial balance in the first two columns of a blank worksheet form. Complete the worksheel based on 2. the following adiuustment data