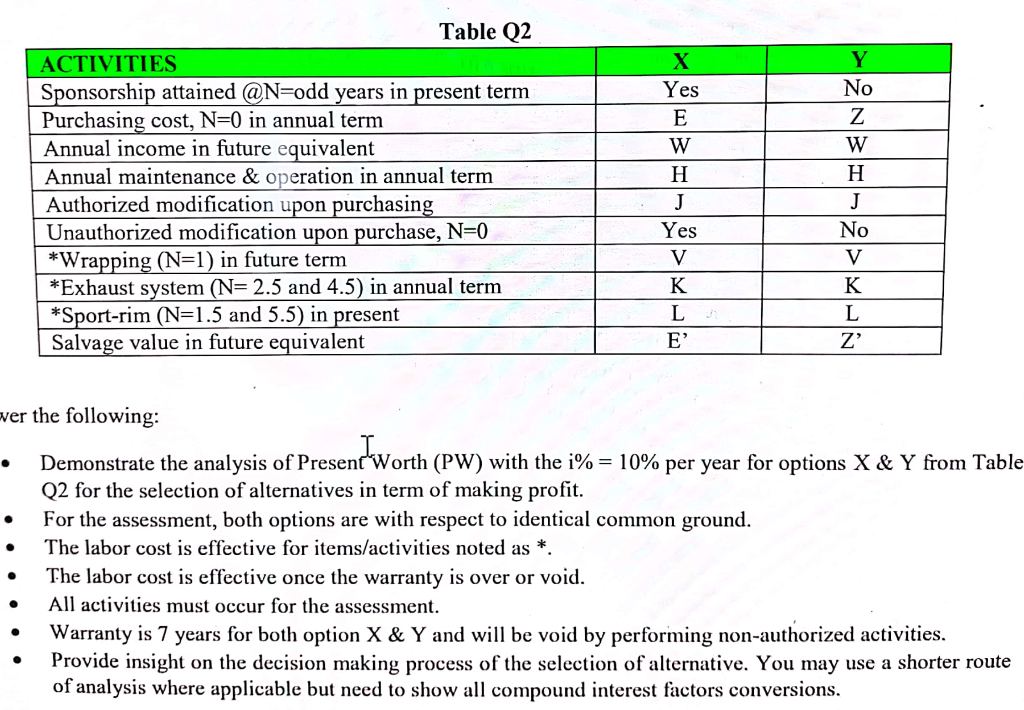

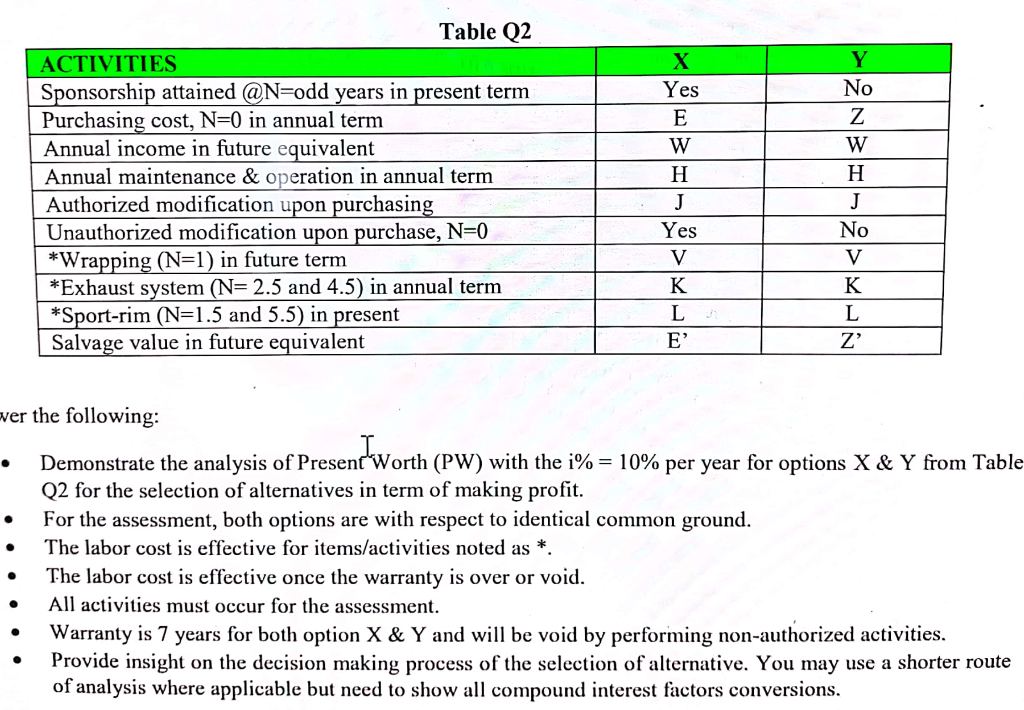

Y No Table Q2 ACTIVITIES Sponsorship attained @N=odd years in present term Purchasing cost, N=0 in annual term Annual income in future equivalent Annual maintenance & operation in annual term Authorized modification upon purchasing Unauthorized modification upon purchase, N=0 *Wrapping (N=1) in future term *Exhaust system (N= 2.5 and 4.5) in annual term *Sport-rim (N=1.5 and 5.5) in present Salvage value in future equivalent X Yes E W H J Yes V K L E' Z W H J No V K L Z' over the following: Demonstrate the analysis of Present Worth (PW) with the i% = 10% per year for options X & Y from Table . Q2 for the selection of alternatives in term of making profit. For the assessment, both options are with respect to identical common ground. The labor cost is effective for items/activities noted as *. The labor cost is effective once the warranty is over or void. All activities must occur for the assessment. Warranty is 7 years for both option X & Y and will be void by performing non-authorized activities. Provide insight on the decision making process of the selection of alternative. You may use a shorter route of analysis where applicable but need to show all compound interest factors conversions. Y No Table Q2 ACTIVITIES Sponsorship attained @N=odd years in present term Purchasing cost, N=0 in annual term Annual income in future equivalent Annual maintenance & operation in annual term Authorized modification upon purchasing Unauthorized modification upon purchase, N=0 *Wrapping (N=1) in future term *Exhaust system (N= 2.5 and 4.5) in annual term *Sport-rim (N=1.5 and 5.5) in present Salvage value in future equivalent X Yes E W H J Yes V K L E' Z W H J No V K L Z' over the following: Demonstrate the analysis of Present Worth (PW) with the i% = 10% per year for options X & Y from Table . Q2 for the selection of alternatives in term of making profit. For the assessment, both options are with respect to identical common ground. The labor cost is effective for items/activities noted as *. The labor cost is effective once the warranty is over or void. All activities must occur for the assessment. Warranty is 7 years for both option X & Y and will be void by performing non-authorized activities. Provide insight on the decision making process of the selection of alternative. You may use a shorter route of analysis where applicable but need to show all compound interest factors conversions