Answered step by step

Verified Expert Solution

Question

1 Approved Answer

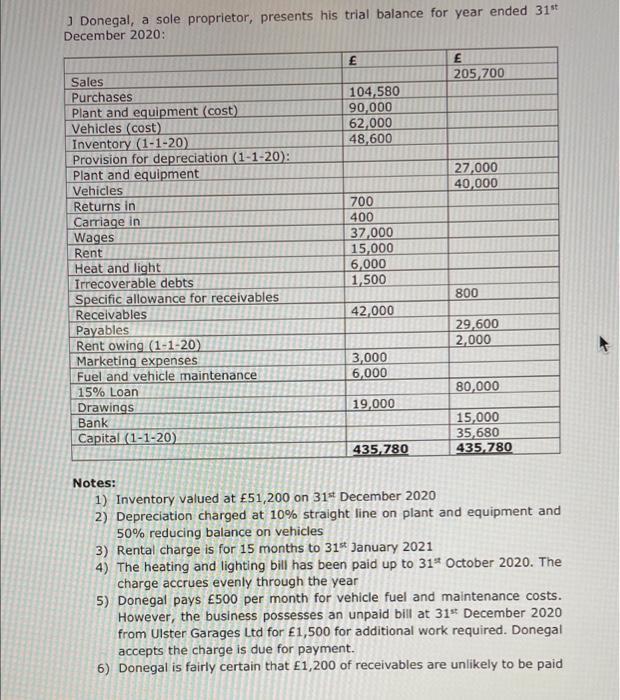

J Donegal, a sole proprietor, presents his trial balance for year ended 31st December 2020: Sales Purchases: Plant and equipment (cost) Vehicles (cost) Inventory

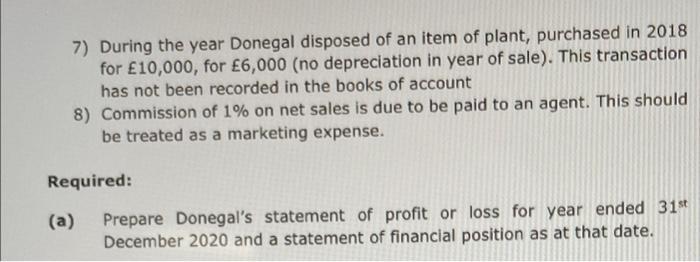

J Donegal, a sole proprietor, presents his trial balance for year ended 31st December 2020: Sales Purchases: Plant and equipment (cost) Vehicles (cost) Inventory (1-1-20) Provision for depreciation (1-1-20): Plant and equipment Vehicles Returns in Carriage in Wages Rent Heat and light Irrecoverable debts Specific allowance for receivables Receivables Payables Rent owing (1-1-20) Marketing expenses Fuel and vehicle maintenance 15% Loan Drawings Bank Capital (1-1-20) 104,580 90,000 62,000 48,600 700 400 37,000 15,000 6,000 1,500 42,000 3,000 6,000 19,000 435,780 205,700 27,000 40,000 800 29,600 2,000 80,000 15,000 35,680 435,780 Notes: 1) Inventory valued at 51,200 on 31st December 2020 2) Depreciation charged at 10% straight line on plant and equipment and 50% reducing balance on vehicles 3) Rental charge is for 15 months to 31st January 2021 4) The heating and lighting bill has been paid up to 31st October 2020. The charge accrues evenly through the year 5) Donegal pays 500 per month for vehicle fuel and maintenance costs. However, the business possesses an unpaid bill at 31st December 2020 from Ulster Garages Ltd for 1,500 for additional work required. Donegal accepts the charge is due for payment. 6) Donegal is fairly certain that 1,200 of receivables are unlikely to be paid 7) During the year Donegal disposed of an item of plant, purchased in 2018 for 10,000, for 6,000 (no depreciation in year of sale). This transaction has not been recorded in the books of account 8) Commission of 1% on net sales is due to be paid to an agent. This should be treated as a marketing expense. Required: (a) Prepare Donegal's statement of profit or loss for year ended 31st December 2020 and a statement of financial position as at that date.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started