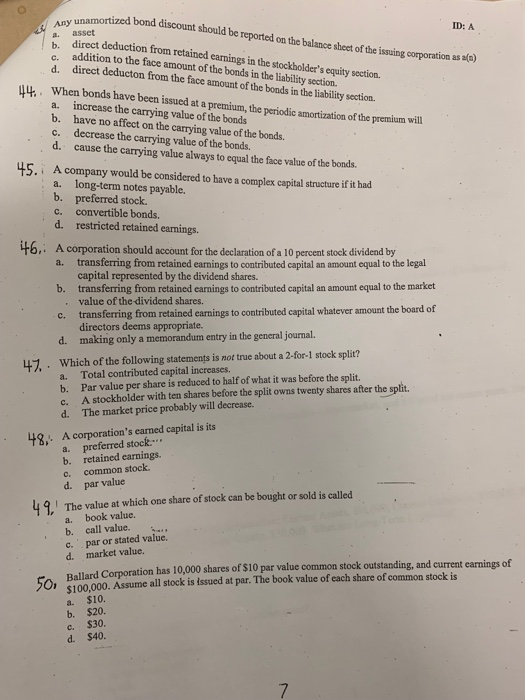

y unamortized bond discount should Any ID: A be reported on the balance sheet of the issing corporation as sla) a. asset direct deduction from retained earnings in the stockholder's equity section. addition to the face amount of the bonds in the liability section. d. direct deducton from the face amount of the bonds in the liability section. 4,, When bonds have been issued at a premium, the periodic amortization of the premium will increase the carrying value of the bonds a. b. have no affect on the carrying value of the bonds. c. decrease the carrying value of the bonds. d. cause the carrying value always to equal the face value of the bonds. 45. A company would be considered to have a complex capital structure if t had a. long-term notes payable. b. preferred stock. c. convertible bonds. d. restricted retained earnings. 6, A corporation should account for the declaration of a 10 percent stock dividend by a. transferring from retained earnings to contributed capital an amount equal to the legal capital represented by the dividend shares. b. transferring from retained earnings to contributed capital an amount equal to the market value of the dividend shares. c. transferring from retained earnings to contributed capital whatever amounthe board of directors deems appropriate. d. making only a memorandum entry in the general journal. Which of the following statements is not true about a 2-for-1 stock split? a. Total contributed capital increases. b. Par value per share is reduced to half of what it was before the split. c. A stockholder with ten shares before the split owns twenty shares after the split d. The market price probably will decrease. 47. A corporation's earned capital is its a. preferred stock.. b. retained earnings. c. common stock d. par value 48,. 49, The value at which one share of stock can be bought or sold is called a. book value. b. call value. c. par or stated value. d. market value. o. Ballard Corporation has 10,000 shares of $10 par value common stock outstanding, and current earnings of 50 $100,000. Assume all stock is Issued at par. The book value of each share of common stock is a. $10 b. $20. c, $30 d. $40