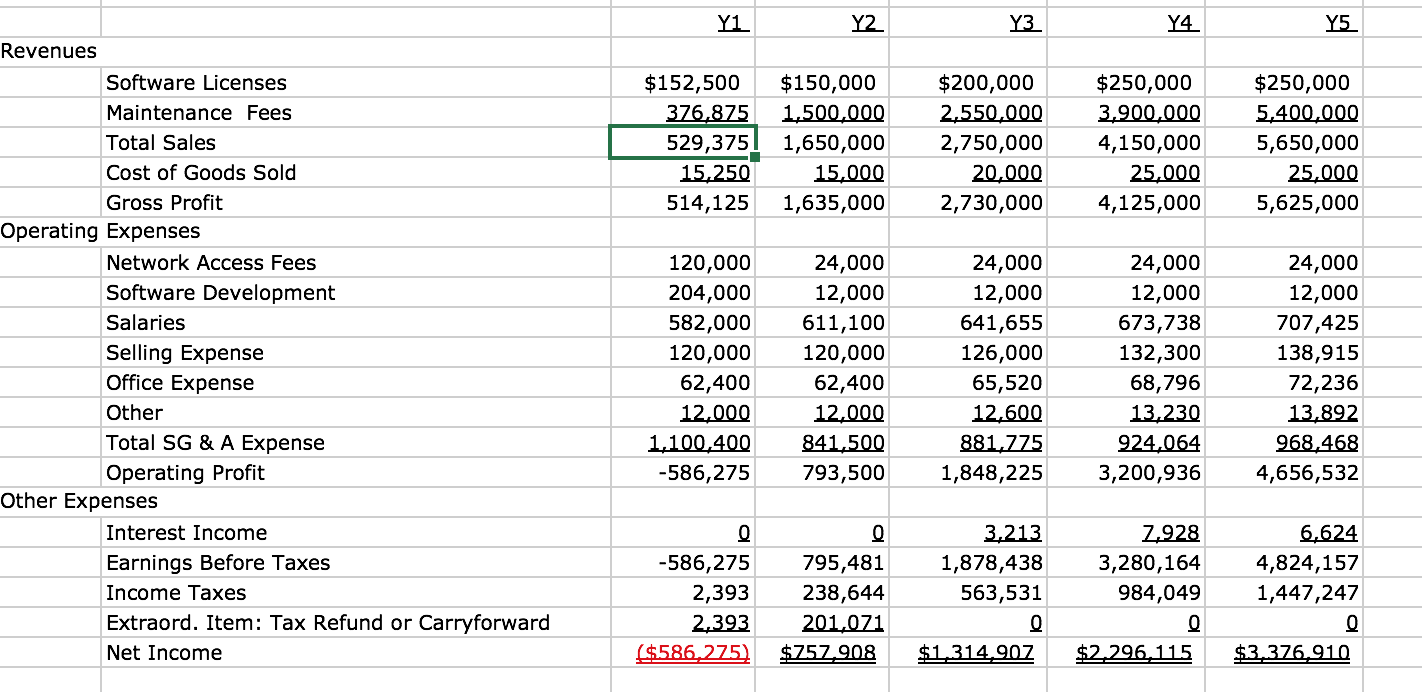

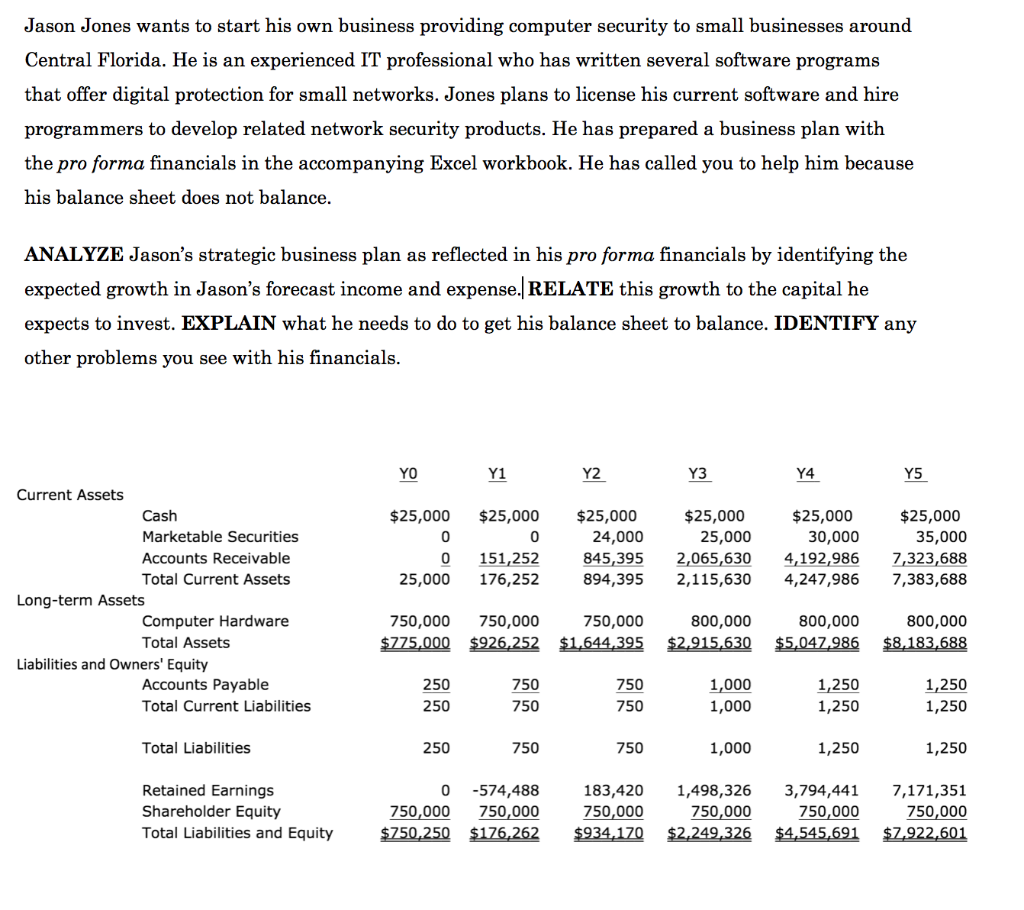

Y1 Y2 Y3 Y4 Y5 $152,500 $150,000 376.875 1.500.000 529,375l 1,650,000 15,250 15.000 514,125 1,635,000 $200,000 2,550.000 2,750,000 20.000 2,730,000 $250,000 3.900.000 4,150,000 25,000 4,125,000 $250,000 5.400.000 5,650,000 25,000 5,625,000 Revenues Software Licenses Maintenance Fees Total Sales Cost of Goods Sold Gross Profit Operating Expenses Network Access Fees Software Development Salaries Selling Expense Office Expense Other Total SG & A Expense Operating Profit Other Expenses Interest Income Earnings Before Taxes Income Taxes Extraord. Item: Tax Refund or Carryforward Net Income 120,000 24,000 204,000 12,000 582,000 611,100 120,000 120,000 62,40062,400 12.000 12.000 1,100,400 841,500 -586,275 793,500 24,000 12,000 641,655 126,000 65,520 12.600 881,775 1,848,225 24,000 12,000 673,738 132,300 68,796 13.230 924,064 3,200,936 24,000 12,000 707,425 138,915 72,236 13,892 968,468 4,656,532 O 0 795,481 238,644 201,071 $757,908 3.213 1,878,438 563,531 7,928 3,280,164 984,049 6,624 4,824,157 1,447,247 -586,275 2,393 2.393 ($586,275) $1,314,907 $2,296,115 $3.376,910 Jason Jones wants to start his own business providing computer security to small businesses around Central Florida. He is an experienced IT professional who has written several software programs that offer digital protection for small networks. Jones plans to license his current software and hire programmers to develop related network security products. He has prepared a business plan with the pro forma financials in the accompanying Excel workbook. He has called you to help him because his balance sheet does not balance. ANALYZE Jason's strategic business plan as reflected in his pro forma financials by identifying the expected growth in Jason's forecast income and expense. RELATE this growth to the capital he expects to invest. EXPLAIN what he needs to do to get his balance sheet to balance. IDENTIFY any other problems you see with his financials. YO Y1 Y2 Y3 Y4 Y5 $25,000 $25,000 $25,000 24,000 845,395 894,395 $25,000 25,000 2,065,630 2,115,630 $25,000 30,000 4,192,986 4,247,986 $25,000 35,000 7,323,688 7,383,688 151,252 176,252 25,000 Current Assets Cash Marketable Securities Accounts Receivable Total Current Assets Long-term Assets Computer Hardware Total Assets Liabilities and Owners' Equity Accounts Payable Total Current Liabilities 750,000 $775,000 750,000 $926,252 750,000 $1.644,395 800,000 $2.915,630 800,000 $5,047,986 800,000 $8.183.688 250 250 750 750 750 750 1,000 1,000 1,250 1,250 1,250 1,250 Total Liabilities 250 750 750 1,000 1,250 1,250 3,794,441 Retained Earnings Shareholder Equity Total Liabilities and Equity 0 750,000 $750,250 -574,488 750,000 $176,262 183,420 750,000 $934,170 1,498,326 750,000 $2,249,326 7,171,351 750,000 $7,922,601 $4,545,691 Y1 Y2 Y3 Y4 Y5 $152,500 $150,000 376.875 1.500.000 529,375l 1,650,000 15,250 15.000 514,125 1,635,000 $200,000 2,550.000 2,750,000 20.000 2,730,000 $250,000 3.900.000 4,150,000 25,000 4,125,000 $250,000 5.400.000 5,650,000 25,000 5,625,000 Revenues Software Licenses Maintenance Fees Total Sales Cost of Goods Sold Gross Profit Operating Expenses Network Access Fees Software Development Salaries Selling Expense Office Expense Other Total SG & A Expense Operating Profit Other Expenses Interest Income Earnings Before Taxes Income Taxes Extraord. Item: Tax Refund or Carryforward Net Income 120,000 24,000 204,000 12,000 582,000 611,100 120,000 120,000 62,40062,400 12.000 12.000 1,100,400 841,500 -586,275 793,500 24,000 12,000 641,655 126,000 65,520 12.600 881,775 1,848,225 24,000 12,000 673,738 132,300 68,796 13.230 924,064 3,200,936 24,000 12,000 707,425 138,915 72,236 13,892 968,468 4,656,532 O 0 795,481 238,644 201,071 $757,908 3.213 1,878,438 563,531 7,928 3,280,164 984,049 6,624 4,824,157 1,447,247 -586,275 2,393 2.393 ($586,275) $1,314,907 $2,296,115 $3.376,910 Jason Jones wants to start his own business providing computer security to small businesses around Central Florida. He is an experienced IT professional who has written several software programs that offer digital protection for small networks. Jones plans to license his current software and hire programmers to develop related network security products. He has prepared a business plan with the pro forma financials in the accompanying Excel workbook. He has called you to help him because his balance sheet does not balance. ANALYZE Jason's strategic business plan as reflected in his pro forma financials by identifying the expected growth in Jason's forecast income and expense. RELATE this growth to the capital he expects to invest. EXPLAIN what he needs to do to get his balance sheet to balance. IDENTIFY any other problems you see with his financials. YO Y1 Y2 Y3 Y4 Y5 $25,000 $25,000 $25,000 24,000 845,395 894,395 $25,000 25,000 2,065,630 2,115,630 $25,000 30,000 4,192,986 4,247,986 $25,000 35,000 7,323,688 7,383,688 151,252 176,252 25,000 Current Assets Cash Marketable Securities Accounts Receivable Total Current Assets Long-term Assets Computer Hardware Total Assets Liabilities and Owners' Equity Accounts Payable Total Current Liabilities 750,000 $775,000 750,000 $926,252 750,000 $1.644,395 800,000 $2.915,630 800,000 $5,047,986 800,000 $8.183.688 250 250 750 750 750 750 1,000 1,000 1,250 1,250 1,250 1,250 Total Liabilities 250 750 750 1,000 1,250 1,250 3,794,441 Retained Earnings Shareholder Equity Total Liabilities and Equity 0 750,000 $750,250 -574,488 750,000 $176,262 183,420 750,000 $934,170 1,498,326 750,000 $2,249,326 7,171,351 750,000 $7,922,601 $4,545,691