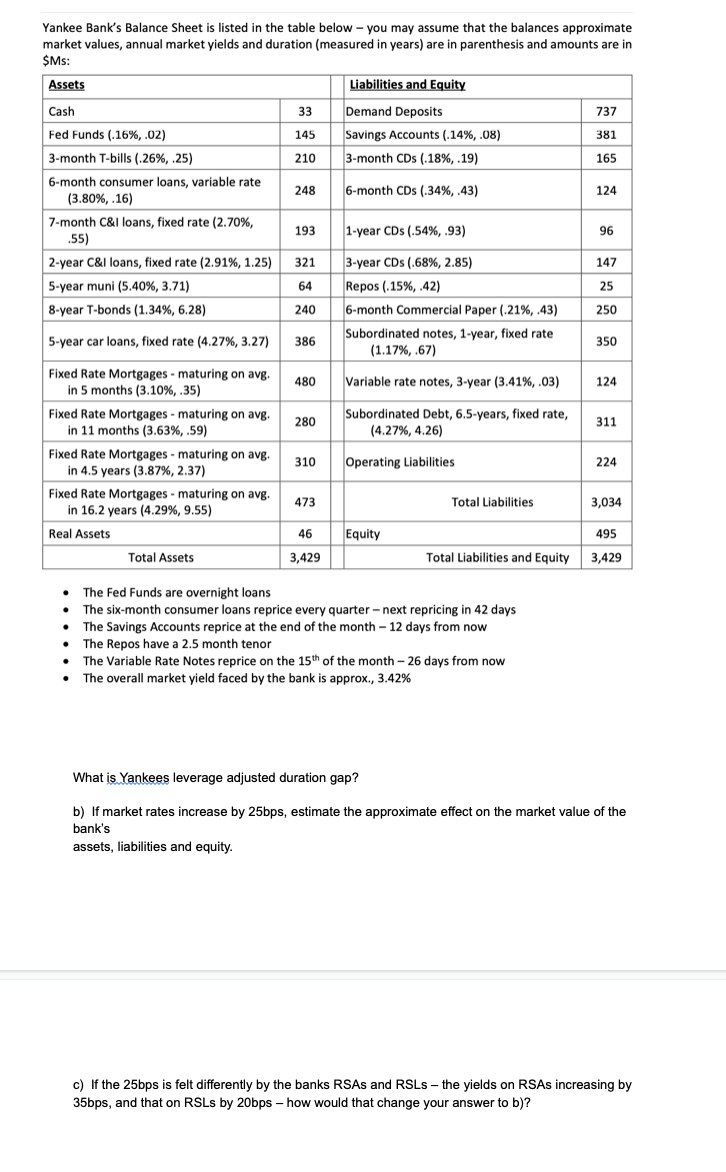

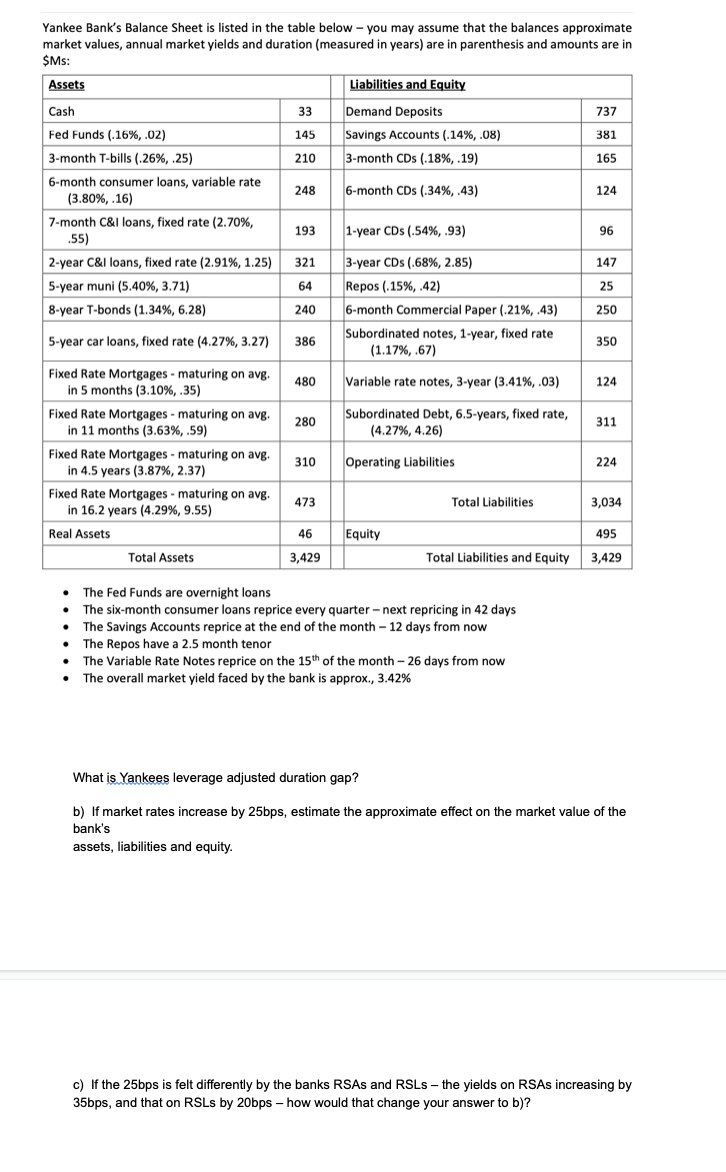

Yankee Bank's Balance Sheet is listed in the table below - you may assume that the balances approximate market values, annual market yields and duration (measured in years) are in parenthesis and amounts are in $Ms: Assets Liabilities and Equity Cash 33 737 145 Demand Deposits Savings Accounts (14%,.08) 3-month CDs (18%,.19) 381 210 165 248 6-month CDs (.34%,.43) 124 Fed Funds (.16%, .02) 3-month T-bills (.26%,.25) 6-month consumer loans, variable rate (3.80%,.16) 7-month C&I loans, fixed rate (2.70%, .55) 2-year C&I loans, fixed rate (2.91%, 1.25) 5-year muni (5.40%, 3.71) 8-year T-bonds (1.34%, 6.28) 193 1- 1-year CDs (.54%,.93) 96 321 147 64 25 240 3-year CDs (.68%, 2.85) Repos (15%,.42) 6-month Commercial Paper (21%,.43) Subordinated notes, 1-year, fixed rate (1.17%,.67) 250 5-year car loans, fixed rate (4.27%, 3.27) 386 350 480 Variable rate notes, 3-year (3.41%,.03) 124 280 Subordinated Debt, 6.5-years, fixed rate, (4.27%, 4.26) 311 Fixed Rate Mortgages - maturing on avg. in 5 months (3.10%,.35) Fixed Rate Mortgages. maturing on avg. in 11 months (3.63%,.59) Fixed Rate Mortgages - maturing on avg. in 4.5 years (3.87%, 2.37) Fixed Rate Mortgages - maturing on avg. in 16.2 years (4.29%, 9.55) Real Assets Total Assets 310 Operating Liabilities 224 473 Total Liabilities 3,034 46 Equity 495 3,429 Total Liabilities and Equity 3,429 . The Fed Funds are overnight loans The six-month consumer loans reprice every quarter - next repricing in 42 days The Savings Accounts reprice at the end of the month - 12 days from now The Repos have a 2.5 month tenor The Variable Rate Notes reprice on the 15th of the month - 26 days from now The overall market yield faced by the bank is approx., 3.42% . What is Yankees leverage adjusted duration gap? b) If market rates increase by 25bps, estimate the approximate effect on the market value of the bank's assets, liabilities and equity. c) If the 25bps is felt differently by the banks RSAs and RSLs - the yields on RSAs increasing by 35bps, and that on RSLs by 20bps - how would that change your answer to b)? Yankee Bank's Balance Sheet is listed in the table below - you may assume that the balances approximate market values, annual market yields and duration (measured in years) are in parenthesis and amounts are in $Ms: Assets Liabilities and Equity Cash 33 737 145 Demand Deposits Savings Accounts (14%,.08) 3-month CDs (18%,.19) 381 210 165 248 6-month CDs (.34%,.43) 124 Fed Funds (.16%, .02) 3-month T-bills (.26%,.25) 6-month consumer loans, variable rate (3.80%,.16) 7-month C&I loans, fixed rate (2.70%, .55) 2-year C&I loans, fixed rate (2.91%, 1.25) 5-year muni (5.40%, 3.71) 8-year T-bonds (1.34%, 6.28) 193 1- 1-year CDs (.54%,.93) 96 321 147 64 25 240 3-year CDs (.68%, 2.85) Repos (15%,.42) 6-month Commercial Paper (21%,.43) Subordinated notes, 1-year, fixed rate (1.17%,.67) 250 5-year car loans, fixed rate (4.27%, 3.27) 386 350 480 Variable rate notes, 3-year (3.41%,.03) 124 280 Subordinated Debt, 6.5-years, fixed rate, (4.27%, 4.26) 311 Fixed Rate Mortgages - maturing on avg. in 5 months (3.10%,.35) Fixed Rate Mortgages. maturing on avg. in 11 months (3.63%,.59) Fixed Rate Mortgages - maturing on avg. in 4.5 years (3.87%, 2.37) Fixed Rate Mortgages - maturing on avg. in 16.2 years (4.29%, 9.55) Real Assets Total Assets 310 Operating Liabilities 224 473 Total Liabilities 3,034 46 Equity 495 3,429 Total Liabilities and Equity 3,429 . The Fed Funds are overnight loans The six-month consumer loans reprice every quarter - next repricing in 42 days The Savings Accounts reprice at the end of the month - 12 days from now The Repos have a 2.5 month tenor The Variable Rate Notes reprice on the 15th of the month - 26 days from now The overall market yield faced by the bank is approx., 3.42% . What is Yankees leverage adjusted duration gap? b) If market rates increase by 25bps, estimate the approximate effect on the market value of the bank's assets, liabilities and equity. c) If the 25bps is felt differently by the banks RSAs and RSLs - the yields on RSAs increasing by 35bps, and that on RSLs by 20bps - how would that change your answer to b)