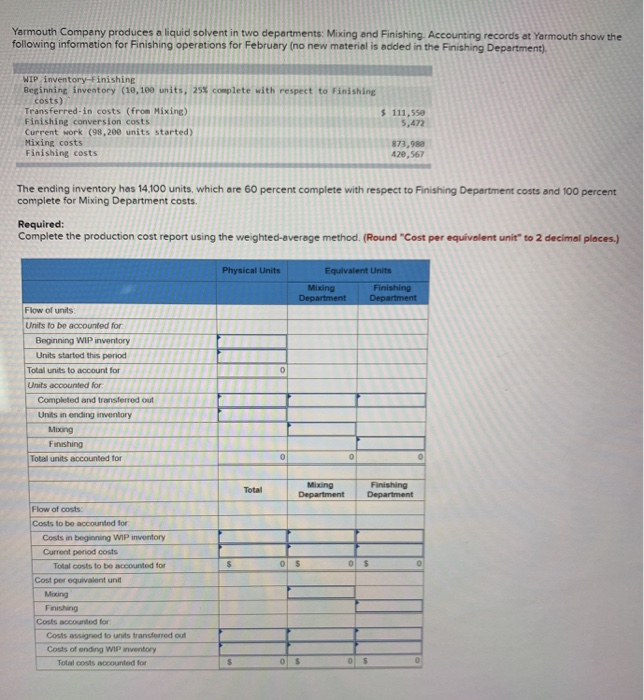

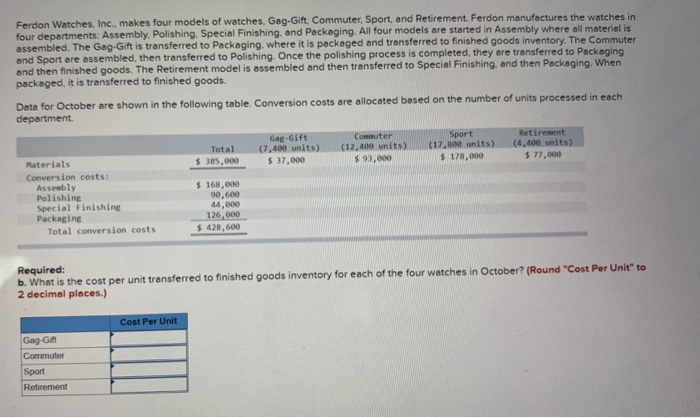

Yarmouth Company produces a liquid solvent in two departments: Mixing and Finishing Accounting records at Yarmouth show the following information for Finishing operations for February (no new material is added in the Finishing Department). WIP inventory-Finishing Beginning inventory (10,100 units, 25% complete with respect costs) Transferred-in costs (from Mixing Finishing conversion costs Current work (98,200 units started Mixing costs Finishing costs 111,550 5.472 171.000 420,567 The ending inventory has 14.100 units, which are 60 percent complete with respect to Finishing Department costs and 100 percent complete for Mixing Department costs. Required: Complete the production cost report using the weighted-average method. (Round "Cost per equivalent unit to 2 decimal places.) Physical Units Equivalent Units Mixing Finishing Department Department Flow of units Units to be accounted for Beginning WIP inventory Units started this period Total units to account for Units accounted for Completed and transferred out Units in ending inventory Finishing Total units accounted for O ng Fishing Department Department Flow of costs Costs to be accounted for Costs in beginning WIP inventory Current period costs Total costs to be accounted for Cost per equivalent unit Mixing OSOS Costs accounted for Costs assigned to units transferred out Costs of ending WP inventory Ferdon Watches, Inc., makes four models of watches, Gag-Gift, Commuter, Sport, and Retirement. Ferdon manufactures the watches in four departments: Assembly, Polishing. Special Finishing and Packaging. All four models are started in Assembly where all materialis assembled. The Gag-Gift is transferred to Packaging, where it is packaged and transferred to finished goods inventory. The Commuter and Sport are assembled, then transferred to Polishing. Once the polishing process is completed, they are transferred to Packaging and then finished goods. The Retirement model is assembled and then transferred to Special Finishing and then Packaging. When packaged, it is transferred to finished goods. Data for October are shown in the following table Conversion costs are allocated based on the number of units processed in each department Total $385,000 Gag-Gift (7,400 units) $37,000 Commuter (12,400 units) $ 93,000 Sport (17.899 units) $ 178,000 Retirement (4,400 units) $77,000 Materials Conversion costs: Assembly Polishing Special Finishing Packaging Total conversion costs $168.000 90,600 44,000 126,000 $426,600 Required: b. What is the cost per unit transferred to finished goods inventory for each of the four watches in October? (Round "Cost Per Unit" to 2 decimal places.) Cost Per Unit Gag-Gift Commuter Retirement