Question

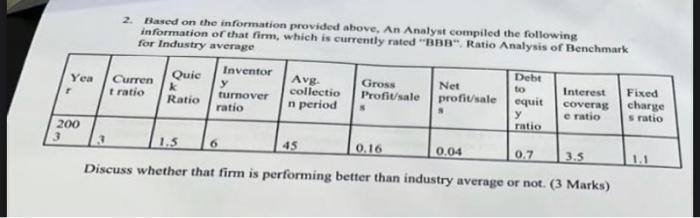

Yea 3 r 200 3 2. Based on the information provided above, An Analyst compiled the following information of that firm, which is currently

Yea 3 r 200 3 2. Based on the information provided above, An Analyst compiled the following information of that firm, which is currently rated "BBB". Ratio Analysis of Benchmark for Industry average Curren t ratio Quic k Ratio Inventor y turnover ratio Avg. collectio n period 6 Gross Profit/sale 45 Net profit/sale 0.16 S 1.5 Discuss whether that firm is performing better than industry average or not. (3 Marks) Debt to 0.04 equit y ratio Interest coverag e ratio 0.7 3.5 Fixed charge s ratio

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To assess whether the firm is performing better than the industry average based on the provided ratio analysis we need to compare each ratio with the corresponding industry benchmark Heres an analysis ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fixed Income Analysis

Authors: Barbara S. Petitt

5th Edition

1119850541, 978-1119850540

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App