Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Year 0 1 2 3 4 Project A -27 5 10 15 20 Cumulative Cash flows -27 -22 -12 3 23 Payback Period = Year

| Year | 0 | 1 | 2 | 3 | 4 |

| Project A | -27 | 5 | 10 | 15 | 20 |

| Cumulative Cash flows | -27 | -22 | -12 | 3 | 23 |

| Payback Period = Year before cash flows become positive + (- Cumulative cash flow of Year 3/Cash flow of Project A for Year 4) | 2.25 | Years | |||

| Year | 0 | 1 | 2 | 3 | 4 |

| Project B | -27 | 20 | 10 | 8 | 6 |

| Cumulative Cash flows | -27 | -7 | 3 | 11 | 17 |

| Payback Period = Year before cash flows become positive + (- Cumulative cash flow of Year 1/Cash flow of Project A for Year 2) | 1.70 | Years |

Regular Payback perod of A = 2.25 Regular Payback perod of B = 1.70

| Discount rate | 11% | ||||

| Year | 0 | 1 | 2 | 3 | 4 |

| Project A | -27 | 5 | 10 | 15 | 20 |

| Discounted Cash = Cash flow/(1+discount rate)^n | -27 | 4.504505 | 8.116224 | 10.96787 | 13.17462 |

| Cumulative Discounted Cash flow | -27 | -22.4955 | -14.3793 | -3.4114 | 9.763219 |

| Discounted Payback Period = Year before cash flows become positive + (- Discounted Cumulative cash flow of Year 3/Cash flow of Project A for Year 4) | 3.26 | Years | |||

| Discount rate | 11% | ||||

| Year | 0 | 1 | 2 | 3 | 4 |

| Project B | -27 | 20 | 10 | 8 | 6 |

| Discounted Cash = Cash flow/(1+discount rate)^n | -27 | 18.01802 | 8.116224 | 5.849531 | 3.952386 |

| Cumulative Discounted Cash flow | -27 | -8.98198 | -0.86576 | 4.983773 | 8.936159 |

| Discounted Payback Period = Year before cash flows become positive + (- Discounted Cumulative cash flow of Year 2/Cash flow of Project A for Year 3) | 2.15 | Years |

Discounted Payback Period of A = 3.26 Discounted Payback Period of B = 2.15

| A | B | C | D | E | ||

| Year | 0 | 1 | 2 | 3 | 4 | |

| 1 | Project A | -27 | 5 | 10 | 15 | 20 |

| 2 | Discount rate | 11% | ||||

| NPV | 9.76 | NPV(A2,B1:E1)+A1 | ||||

| A | B | C | D | E | ||

| Year | 0 | 1 | 2 | 3 | 4 | |

| 1 | Project B | -27 | 20 | 10 | 8 | 6 |

| 2 | Discount rate | 11% | ||||

| NPV | 8.94 | NPV(A2,B1:E1)+A1 | ||||

Since they are independent project both projects should be undertaken.

| A | B | C | D | E | ||

| Year | 0 | 1 | 2 | 3 | 4 | |

| 1 | Project A | -27 | 5 | 10 | 15 | 20 |

| 2 | Discount rate | 5% | ||||

| NPV | 16.24 | NPV(A2,B1:E1)+A1 | ||||

| A | B | C | D | E | ||

| Year | 0 | 1 | 2 | 3 | 4 | |

| 1 | Project B | -27 | 20 | 10 | 8 | 6 |

| 2 | Discount rate | 5% | ||||

| NPV | 12.96 | NPV(A2,B1:E1)+A1 | ||||

Since they are mutually exclusive projects Project A should be undertaken as it has higher NPV

| A | B | C | D | E | ||

| Year | 0 | 1 | 2 | 3 | 4 | |

| 1 | Project A | -27 | 5 | 10 | 15 | 20 |

| 2 | Discount rate | 15% | ||||

| NPV | 6.21 | NPV(A2,B1:E1)+A1 | ||||

| A | B | C | D | E | ||

| Year | 0 | 1 | 2 | 3 | 4 | |

| 1 | Project B | -27 | 20 | 10 | 8 | 6 |

| 2 | Discount rate | 15% | ||||

| NPV | 6.64 | NPV(A2,B1:E1)+A1 | ||||

Since they are mutually exclusive projects Project B should be undertaken as it has higher NPV.

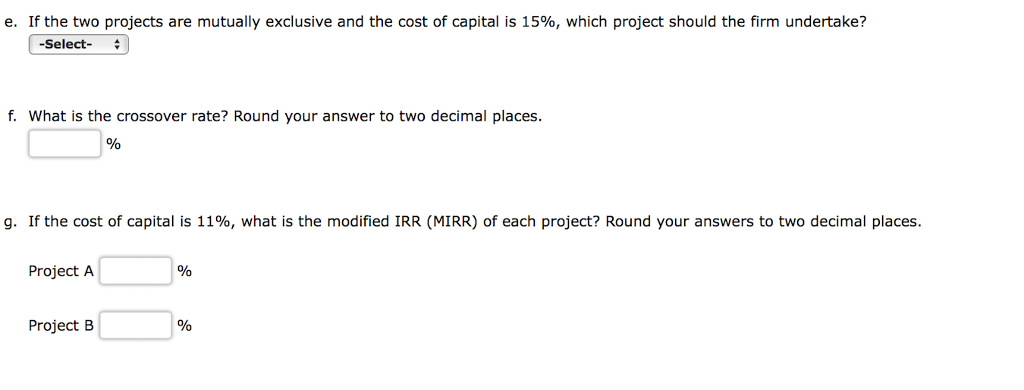

I need e-g please

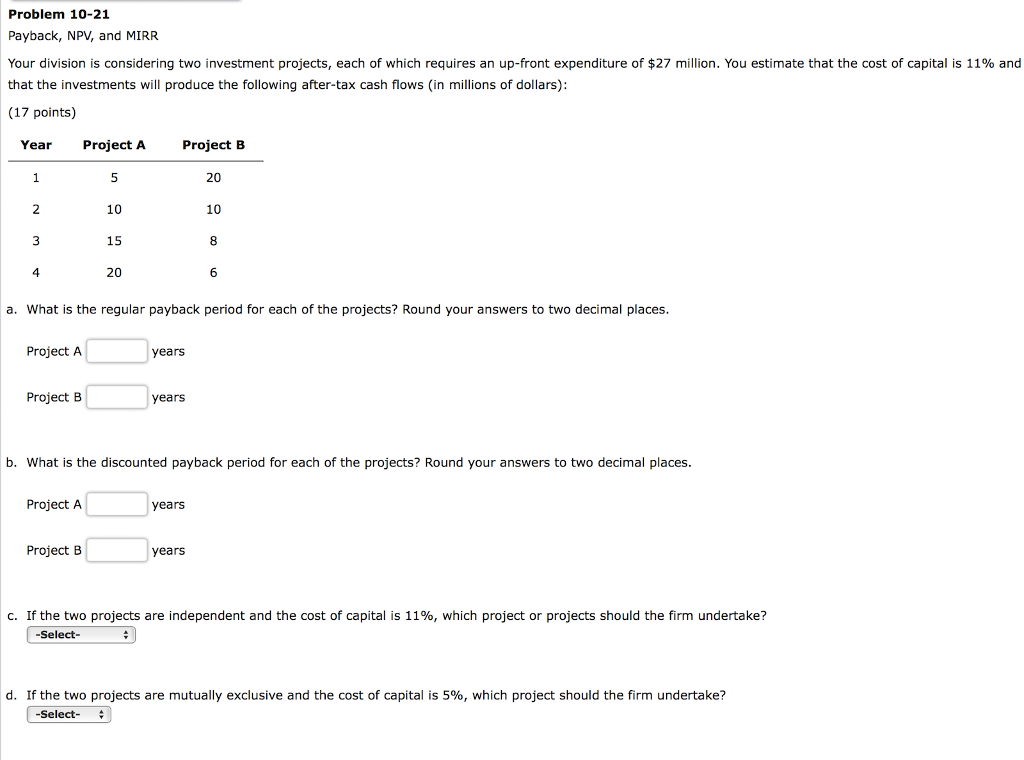

Problem 10-21 Payback, NPV, and MIRR Your division is considering two investment projects, each of which requires an up-front expenditure of$27 million. You estimate that the cost of capital is 11% and that the investments will produce the following after-tax cash flows (in millions of dollars): (17 points) Project A Project B 20 10 8 6 Year 10 15 20 4 a. What is the regular payback period for each of the projects? Round your answers to two decimal places Project A years Project B years b. What is the discounted payback period for each of the projects? Round your answers to two decimal places. Project A years Project B years c. If the two projects are independent and the cost of capital is 11%, which project or projects should the firm undertake? Select d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? -Select

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started