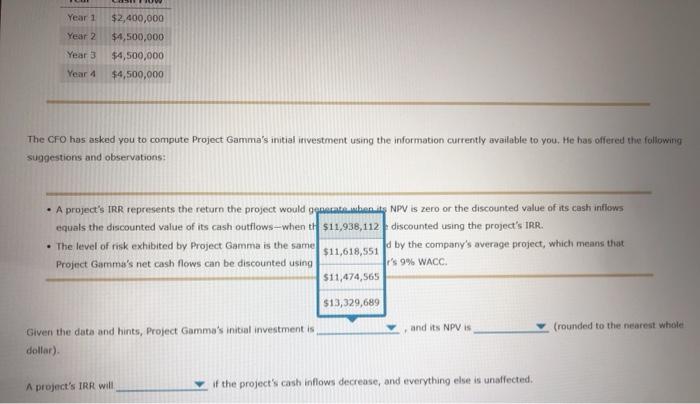

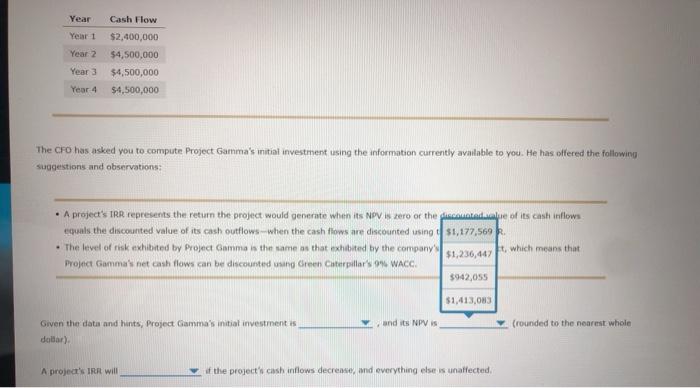

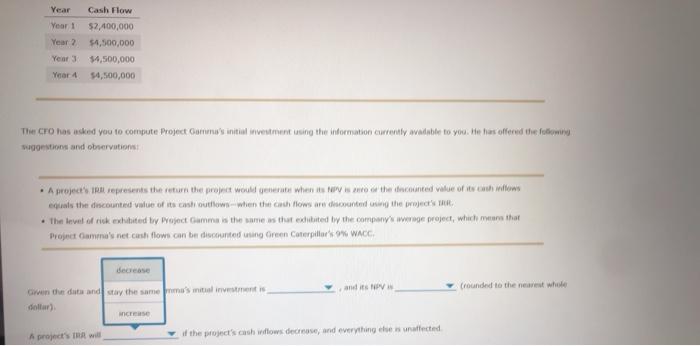

Year 1 $2,400,000 Year 2 Year 3 $4,500,000 $4,500,000 $4,500,000 Vear a The CFO has asked you to compute Project Gamma's initial investment using the information currently available to you. He has offered the following suggestions and observations: A project's IRR represents the return the project would get when NPV is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows-when th $11,938, 112 discounted using the project's IRR. The level of risk exhibited by Project Gamma is the same d by the company's average project, which means that $11,618,551 Project Gamma's net cash flows can be discounted using 'S 9% WACC $11,474,565 $13,329,689 and its NPV IS (rounded to the nearest whole Given the data and hints, Project Gamma's initial investment is dollar). A project's IRR will if the project's cash inflows decrease, and everything else is unaffected. Year Year 1 Year 2 Cash Flow $2,400,000 $4,500,000 $4,500,000 $4,500,000 Year 3 Year 4 The CFO has asked you to computer Project Gamma's initial investment using the information currently available to you. He has offered the following suggestions and observations: A project's RR represents the return the project would generate when its NPV is zero or the Quote of its cash inflows equals the discounted value of its cash outflows-when the cash flows are discounted using $1,177,569 The level of risk exhibited by Project Gamma is the same as that exhibited by the company's $1,236,447 t, which means that Project Gamma's net cash flows can be discounted using Green Caterpillar's 91 WACO. $942,055 $1,413,083 and its NPV is (rounded to the nearest whole Given the data and hints, Project Gamma's initial investment is dolar) A project's IRR will of the project's cash inflows decrease, and everything else is unaffected Year Year! Year 2 Cash Flow $2,400,000 54,500,000 $4,500,000 $4,500,000 Year 3 Year 4 The CrO has asked you to compute Project Comma's initial investment in the information currently, wadable to you. He has offered the flow suggestions and observations A project's represents the return the project would generate when it NPV is the counted value of its chillows quals the discounted value of its cost outflow-when the courth flows are discounted in the projects The level of rick exhibited by Project Gamma is the same as the exhibited by the company's age project, which means that Project Gammynet cash flows can be discounted using Green Caterpillar's WACC decrease and its (rounded to the nearest whole Gwon the data and stay the same as mitalini dollar) MICIES A project's will of the project's chows decrease, and everything else affected