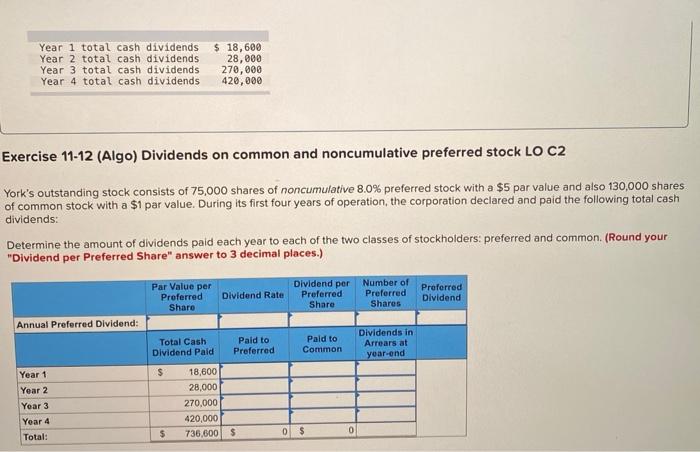

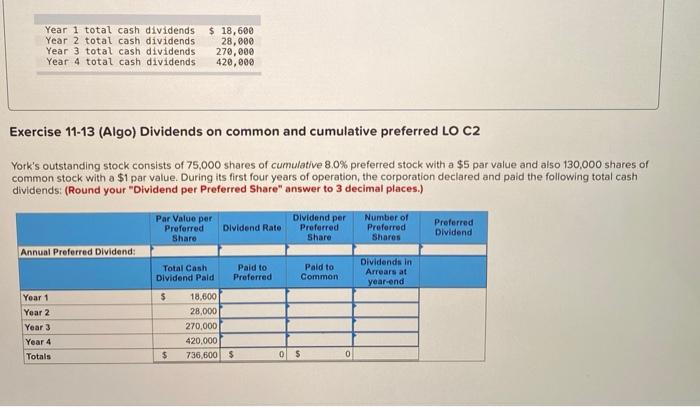

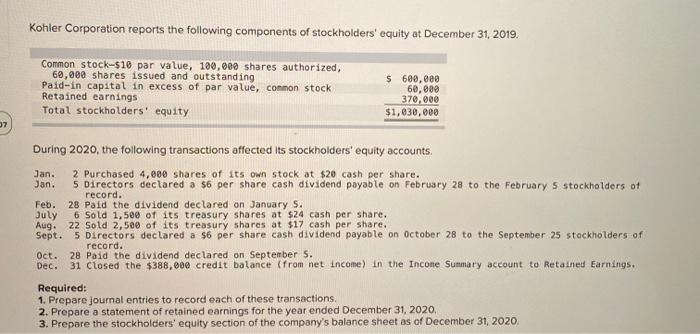

Year 1 total cash dividends Year 2 total cash dividends Year 3 total cash dividends Year 4 total cash dividends $ 18, 600 28,000 270,000 420,000 Exercise 11-12 (Algo) Dividends on common and noncumulative preferred stock LO C2 York's outstanding stock consists of 75,000 shares of noncumulative 8.0% preferred stock with a $5 par value and also 130,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends: Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. (Round your "Dividend per Preferred Share" answer to 3 decimal places.) Par Value per Proferred Share Dividend Rate Dividend per Number of Preferred Preferred Share Shares Preferred Dividend Annual Preferred Dividend: Total Cash Dividend Paid Paid to Preferred Paid to Common Dividends in Arrears at year-end $ Year 1 Year 2 Year 3 Year 4 Total: 18,600 28,000 270,000 420,000 736.600 $ $ 0 0 $ Year 1 total cash dividends Year 2 total cash dividends Year 3 total cash dividends Year 4 total cash dividends $ 18,600 28,000 270,000 420,000 Exercise 11-13 (Algo) Dividends on common and cumulative preferred LO C2 York's outstanding stock consists of 75,000 shares of cumulative 8.0% preferred stock with a $5 par value and also 130,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends: (Round your "Dividend per Preferred Share" answer to 3 decimal places.) Par Value per Preferred Share Dividend Rate Dividend per Preferred Share Number of Preferred Shares Preferred Dividend Annual Preferred Dividend: Paid to Preferred Paid to Common Dividends in Arrears at year end Year 1 Year 2 Year 3 Year 4 Totals Total Cash Dividend Pald $ 18,000 28.000 270,000 420.000 $ 736,800 0 $ 0 Kohler Corporation reports the following components of stockholders' equity at December 31, 2019. Common stock-$10 par value, 100,000 shares authorized, 60,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 600,000 60,000 370.000 $1,630,000 07 During 2020, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 4,000 shares of its own stock at $20 cash per share. Jan. s Directors declared a $6 per share cash dividend payable on February 28 to the February 5 stockholders of record. Feb. 28 Paid the dividend declared on January 5. July 6 Sold 1,500 of its treasury shares at $24 cash per share. Aug. 22 Sold 2,500 of its treasury shares at $17 cash per share. Sept. 5 Directors declared a $6 per share cash dividend payable on October 28 to the September 25 stockholders of record. Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the $388,000 credit balance (from net income) in the Incone Summary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions. 2. Prepare a statement of retained earnings for the year ended December 31, 2020, 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2020