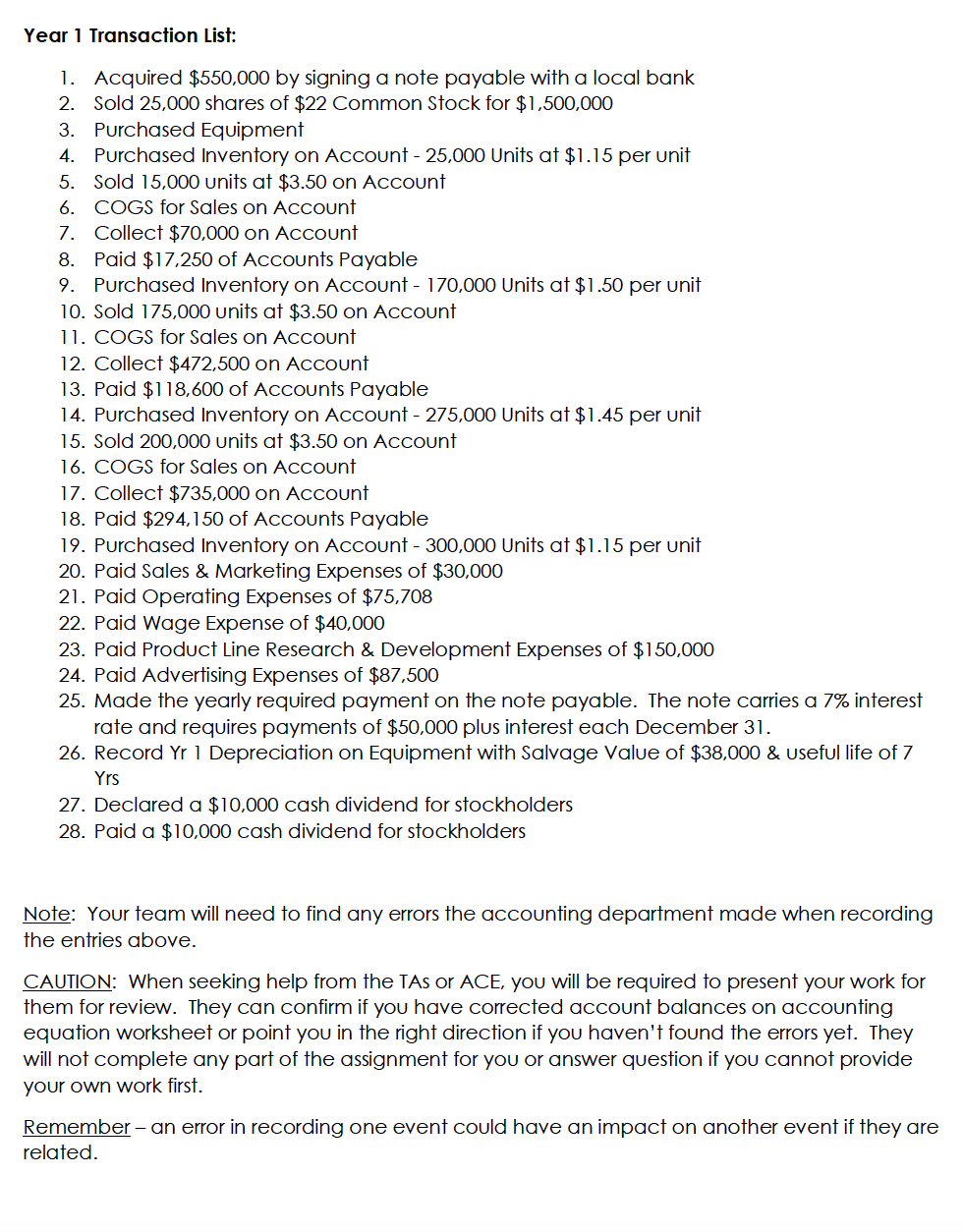

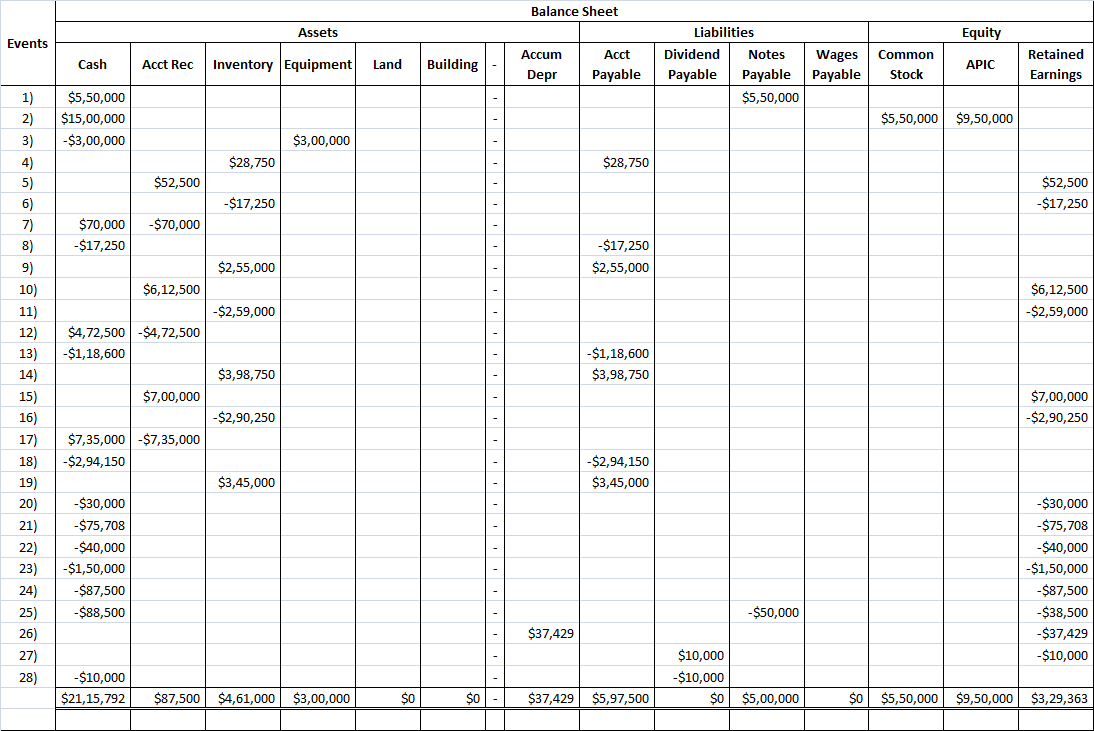

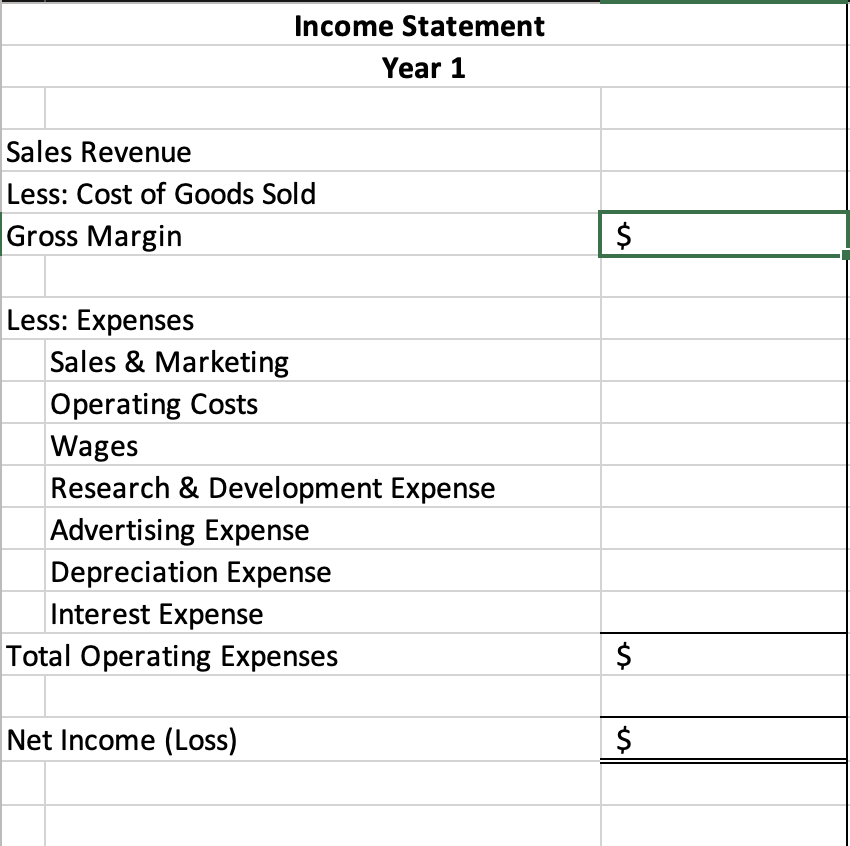

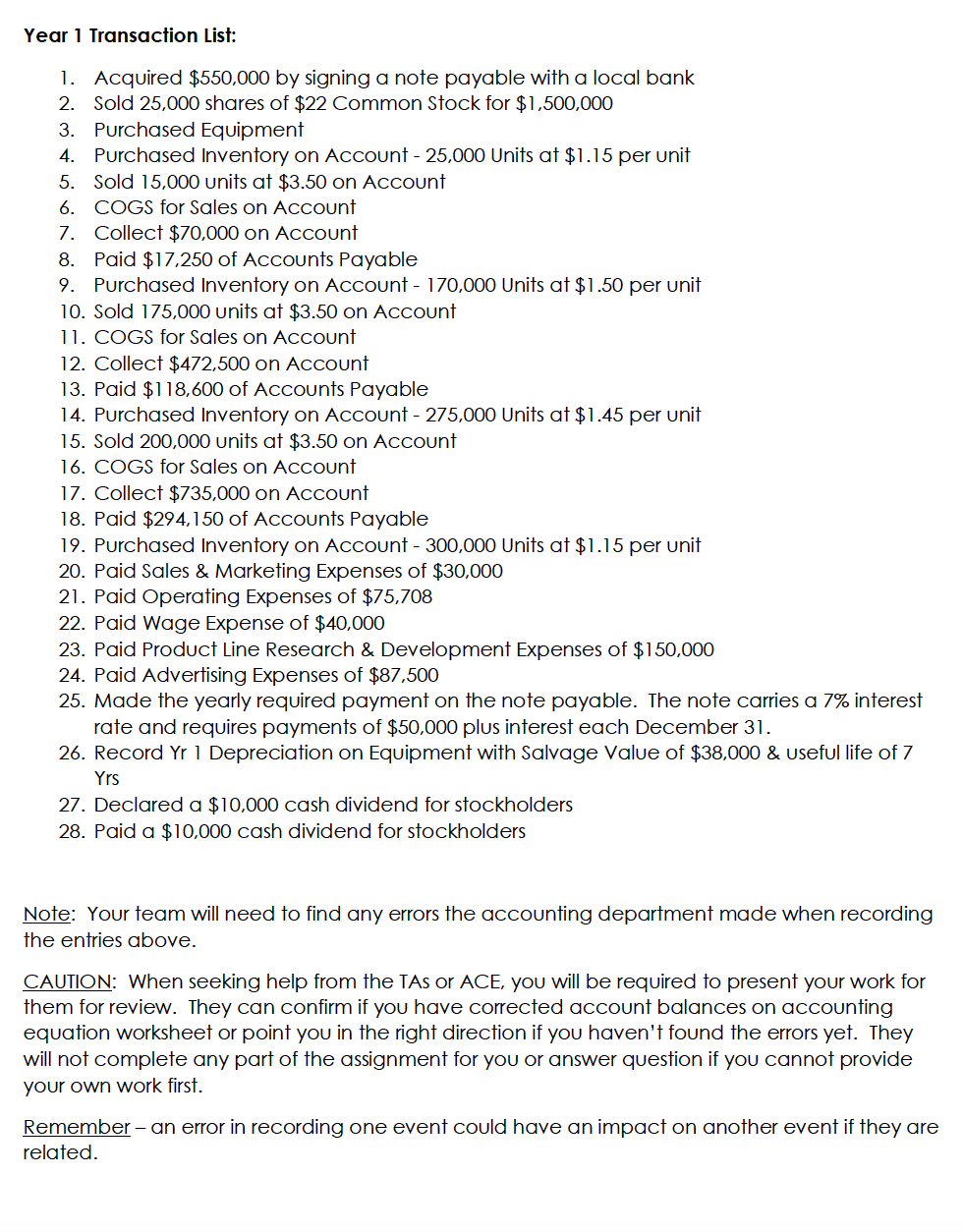

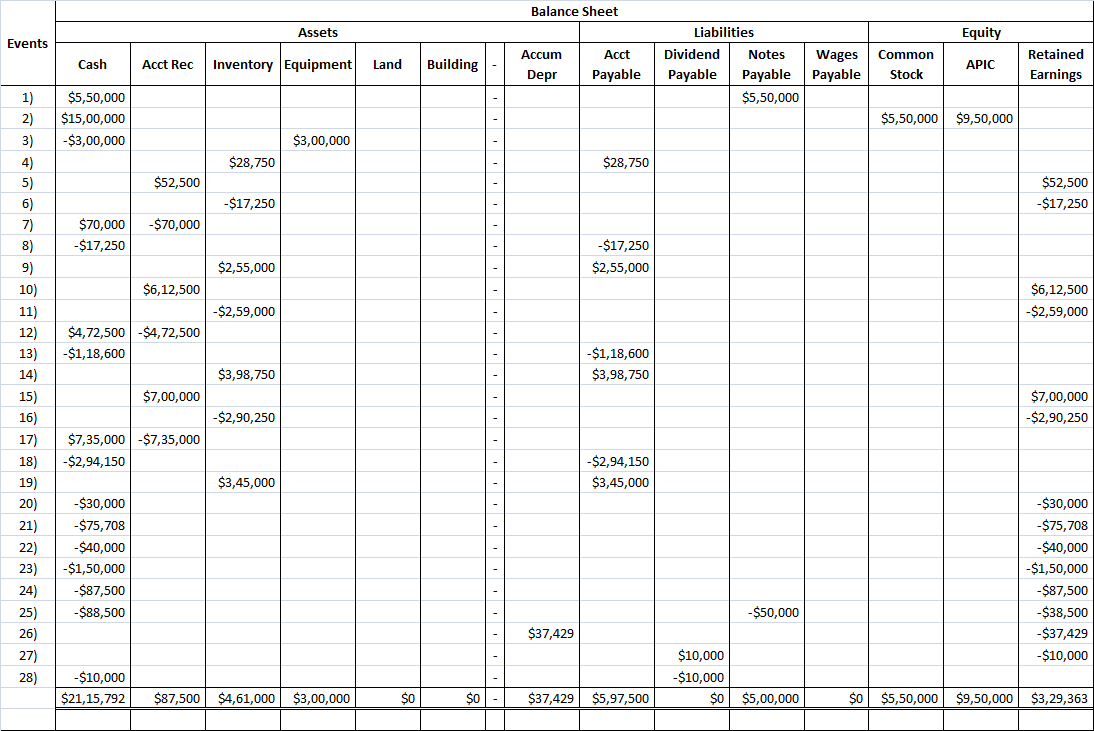

Year 1 Transaction List: 1. Acquired $550,000 by signing a note payable with a local bank 2. Sold 25,000 shares of $22 Common Stock for $1,500,000 3. Purchased Equipment 4. Purchased Inventory on Account - 25,000 Units at $1.15 per unit 5. Sold 15,000 units at $3.50 on Account 6. COGS for Sales on Account 7. Collect $70,000 on Account 8. Paid $17,250 of Accounts Payable 9. Purchased Inventory on Account - 170,000 Units at $1.50 per unit 10. Sold 175,000 units at $3.50 on Account 11. COGS for Sales on Account 12. Collect $472,500 on Account 13. Paid $118,600 of Accounts Payable 14. Purchased Inventory on Account - 275,000 Units at $1.45 per unit 15. Sold 200,000 units at $3.50 on Account 16. COGS for Sales on Account 17. Collect $735,000 on Account 18. Paid $294,150 of Accounts Payable 19. Purchased Inventory on Account - 300,000 Units at $1.15 per unit 20. Paid Sales & Marketing Expenses of $30,000 21. Paid Operating Expenses of $75,708 22. Paid Wage Expense of $40,000 23. Paid Product Line Research & Development Expenses of $150,000 24. Paid Advertising Expenses of $87,500 25. Made the yearly required payment on the note payable. The note carries a 7% interest rate and requires payments of $50,000 plus interest each December 31. 26. Record Yr 1 Depreciation on Equipment with Salvage Value of $38,000 & Useful life of 7 Yrs 27. Declared a $10,000 cash dividend for stockholders 28. Paid a $10,000 cash dividend for stockholders Note: Your team will need to find any errors the accounting department made when recording the entries above. CAUTION: When seeking help from the TAS or ACE, you will be required to present your work for them for review. They can confirm if you have corrected account balances on accounting equation worksheet or point you in the right direction if you haven't found the errors yet. They will not complete any part of the assignment for you or answer question if you cannot provide your own work first. Remember - an error in recording one event could have an impact on another event if they are related. Balance Sheet Assets Equity Events Accum Cash Acct Rec Inventory Equipment Land Building Acct Payable Liabilities Dividend Notes Wages Payable Payable Payable $5,50,000 Common Stock APIC Retained Earnings Depr $5,50,000 $15,00,000 -$3,00,000 $5,50,000 $9,50,000 $3,00,000 $28,750 $28,750 $52,500 $52,500 -$17,250 -$17,250 -$70,000 $70,000 -$17,250 -$17,250 $2,55,000 $2,55,000 $6,12,500 $6,12,500 -$2,59,000 -$2,59,000 $4,72,500 $4,72,500 -$1,18,600 -$1,18,600 $3,98,750 $3,98,750 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) 14) 15) 16) 17) 18) 19) 20) 21) 22) 23) 24) 25) 26) 27) 28) $7,00,000 $7,00,000 -$2,90,250 -$2,90,250 $7,35,000-$7,35,000 -$2,94,150 -$2,94,150 $3,45,000 $3,45,000 -$30,000 -$75,708 -$40,000 $1,50,000 -$87,500 -$88,500 -$30,000 $75,708 -$40,000 -$1,50,000 -$87,500 $38,500 -$37,429 -$10,000 -$50,000 $37,429 $10,000 $21,15,792 $10,000 $10,000 $0 $5,00,000 $87,500 $4,61,000 $3,00,000 $0 SO $37,429 $5,97,500 $0 $5,50,000 $9,50,000 $3,29,363 Income Statement Year 1 Sales Revenue Less: Cost of Goods Sold Gross Margin $ Less: Expenses Sales & Marketing Operating Costs Wages Research & Development Expense Advertising Expense Depreciation Expense Interest Expense Total Operating Expenses $ Net Income (Loss) $