Answered step by step

Verified Expert Solution

Question

1 Approved Answer

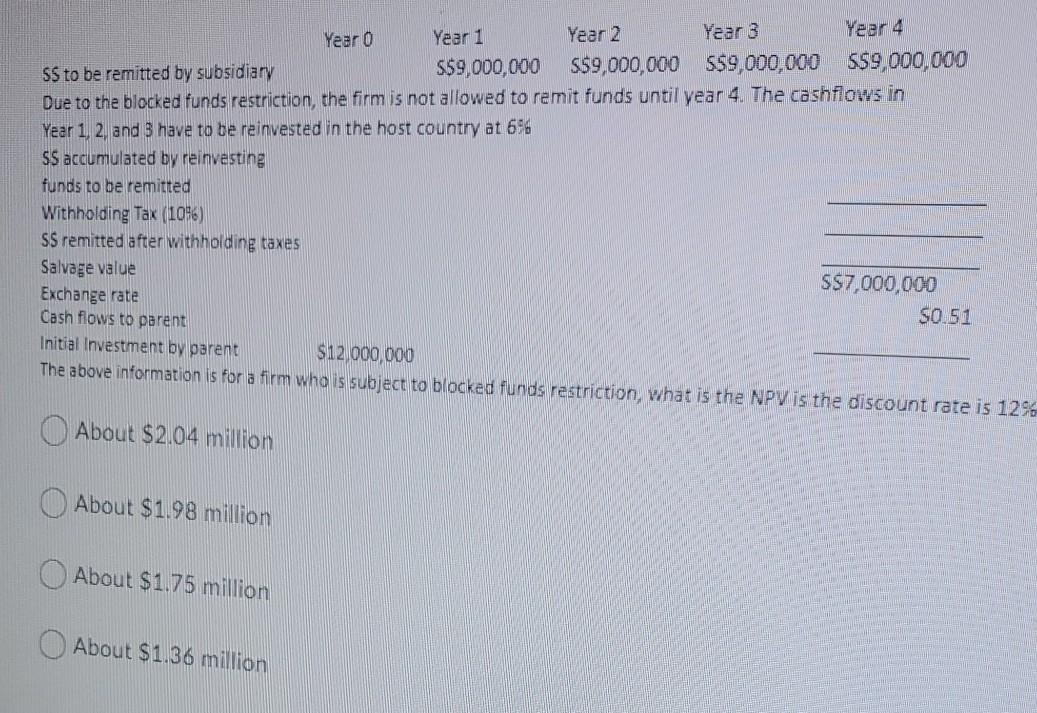

Year 1 Year 0 Year 2 Year 3 Year 4 SS to be remitted by subsidiary S$9,000,000 $$9,000,000 $$9,000,000 $59,000,000 Due to the blocked funds

Year 1 Year 0 Year 2 Year 3 Year 4 SS to be remitted by subsidiary S$9,000,000 $$9,000,000 $$9,000,000 $59,000,000 Due to the blocked funds restriction, the firm is not allowed to remit funds until year 4. The cashflows in Year 1, 2 and 3 have to be reinvested in the host country at 696 SS accumulated by reinvesting funds to be remitted Withholding Tax (1086) SS remitted after withholding taxes Salvage value SS7,000,000 Exchange rate Cash flows to parent SO 51 Initial Investment by parent $12,000,000 The above information is for a firm who is subject to blocked funds restriction, what is the NPV is the discount rate is 12% About $2.04 million About $1.98 million About $1.75 million About $1,36 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started