Year 1997 1998 1999 2000 2001 The following table presents historical percentage returns for the Company A and Company B along with the percentage

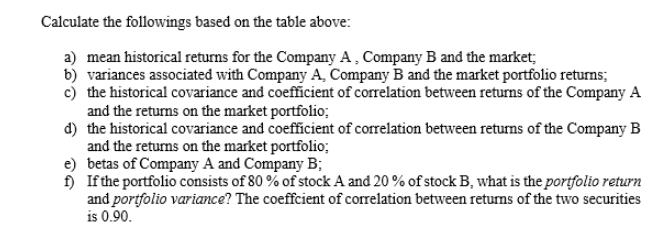

Year 1997 1998 1999 2000 2001 The following table presents historical percentage returns for the Company A and Company B along with the percentage returns on the market portfolio (index): Company A 14% 19 -16 3 20 Company B %13 7 -5 1 11 Market 12% 10 -12 1 15 Calculate the followings based on the table above: a) mean historical returns for the Company A, Company B and the market; b) variances associated with Company A, Company B and the market portfolio returns; c) the historical covariance and coefficient of correlation between returns of the Company A and the returns on the market portfolio: d) the historical covariance and coefficient of correlation between returns of the Company B and the returns on the market portfolio; e) betas of Company A and Company B; f) If the portfolio consists of 80% of stock A and 20% of stock B, what is the portfolio return and portfolio variance? The coeffcient of correlation between returns of the two securities is 0.90.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the requested values well use the given historical percentage returns for Company A Company B and the market portfolio Lets go step by step a Mean Historical Returns The mean historical r...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started