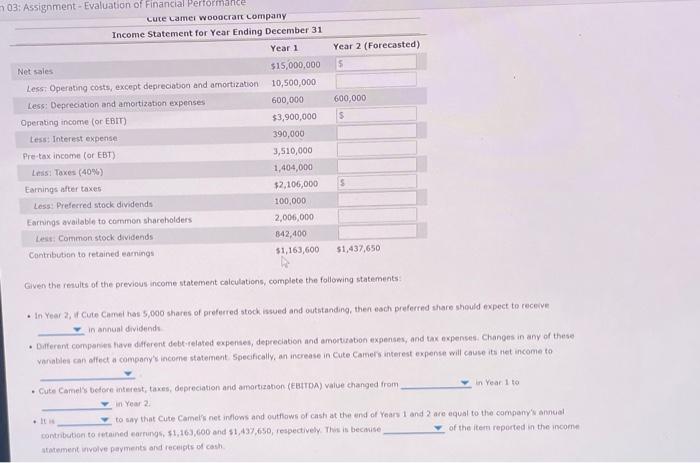

Year 2 (Forecasted) 5 600,000 S 03: Assignment - Evaluation of Financial Performance cute camer Wooncrart company Income Statement for Year Ending December 31 Year 1 Net sales $15,000,000 Less: Operating costs, except depreciation and amortization 10,500,000 Less: Depreciation and amortization expenses 600,000 Operating income (or EBIT) $3,900,000 Less Interest expense 390,000 Pretax income (or EBT) 3,510,000 Less Taxes (40%) 1,404,000 Earnings after taxes $2,106,000 Less: Preferred stock dividends 100,000 Earnings available to common shareholders 2,006,000 Less Common stock dividends 842,400 Contribution to retained earnings $1,163,600 S $1,437,650 Given the results of the previous income statement calculations, complete the following statements: In Years Cute Camel has 5,000 shares of preferred stock issued and outstanding, then each preferred share should expect to receive in annual dividende Diferent companies have different debt related expenses depreciation and amortuabon expenses, and tax expenses Changes in any of these vanables can affect a company income statement Specifically, an increase in Cute Camely interest expense will cause its net income to . Cute Camely before interest, taxes, depreciation and amortization (EBITDA) value changed from in roar 1 to in Year 2 to say that Cute Camel's net inflows and outflows of cash at the end of Years 1 and 2 are equal to the company annual contribution to retained earrings $1,163,600 and 51,497,680, respectively. This is because of the item reported in the income statement involve payments and receipts of cash Year 2 (Forecasted) 5 600,000 S 03: Assignment - Evaluation of Financial Performance cute camer Wooncrart company Income Statement for Year Ending December 31 Year 1 Net sales $15,000,000 Less: Operating costs, except depreciation and amortization 10,500,000 Less: Depreciation and amortization expenses 600,000 Operating income (or EBIT) $3,900,000 Less Interest expense 390,000 Pretax income (or EBT) 3,510,000 Less Taxes (40%) 1,404,000 Earnings after taxes $2,106,000 Less: Preferred stock dividends 100,000 Earnings available to common shareholders 2,006,000 Less Common stock dividends 842,400 Contribution to retained earnings $1,163,600 S $1,437,650 Given the results of the previous income statement calculations, complete the following statements: In Years Cute Camel has 5,000 shares of preferred stock issued and outstanding, then each preferred share should expect to receive in annual dividende Diferent companies have different debt related expenses depreciation and amortuabon expenses, and tax expenses Changes in any of these vanables can affect a company income statement Specifically, an increase in Cute Camely interest expense will cause its net income to . Cute Camely before interest, taxes, depreciation and amortization (EBITDA) value changed from in roar 1 to in Year 2 to say that Cute Camel's net inflows and outflows of cash at the end of Years 1 and 2 are equal to the company annual contribution to retained earrings $1,163,600 and 51,497,680, respectively. This is because of the item reported in the income statement involve payments and receipts of cash