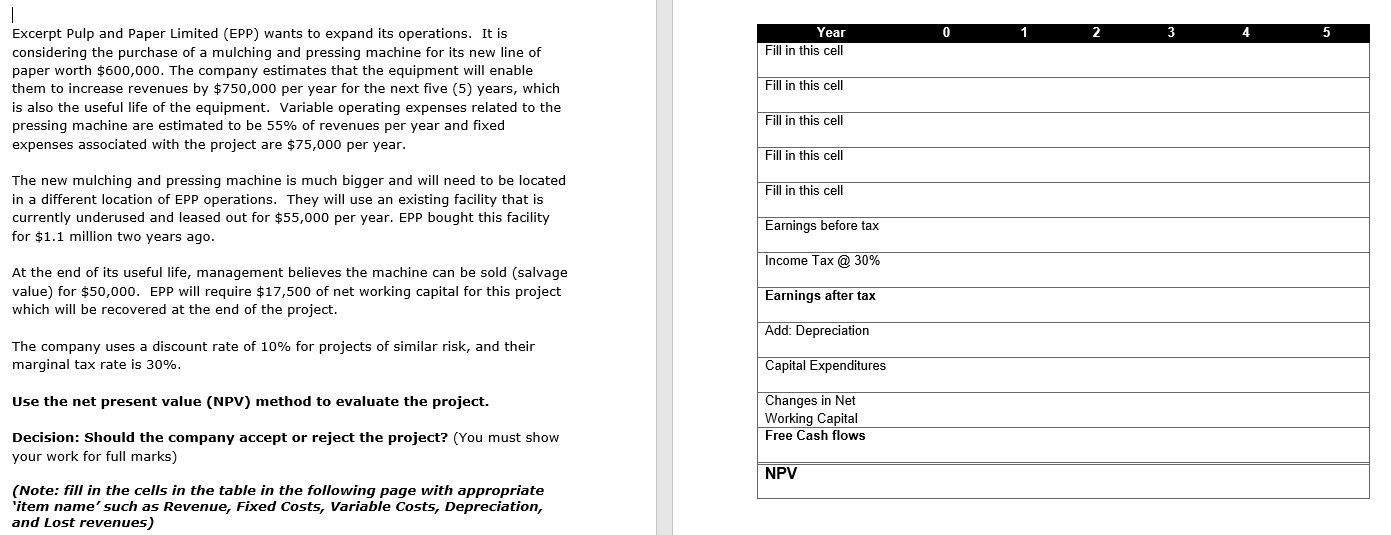

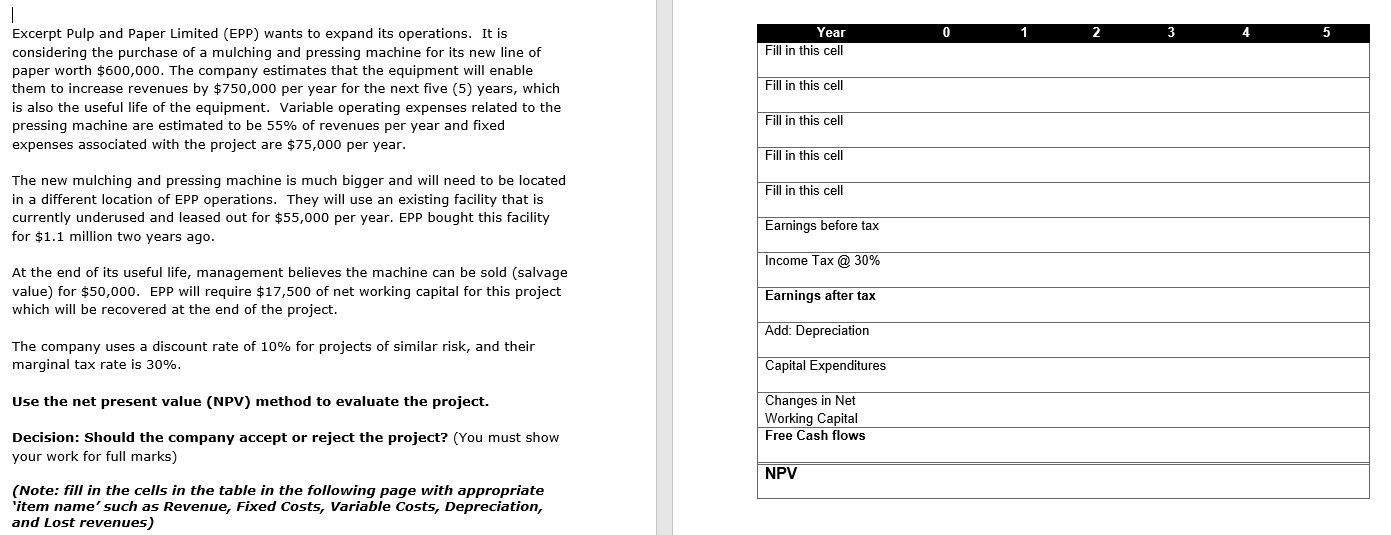

Year Fill in this cell Excerpt Pulp and Paper Limited (EPP) wants to expand its operations. It is considering the purchase of a mulching and pressing machine for its new line of paper worth $600,000. The company estimates that the equipment will enable them to increase revenues by $750,000 per year for the next five (5) years, which is also the useful life of the equipment. Variable operating expenses related to the pressing machine are estimated to be 55% of revenues per year and fixed expenses associated with the project are $75,000 per year. Fill in this cell Fill in this cell Fill in this cell Fill in this cell The new mulching and pressing machine is much bigger and will need to be located in a different location of EPP operations. They will use an existing facility that is currently underused and leased out for $55,000 per year. EPP bought this facility for $1.1 million two years ago. Earnings before tax Income Tax @ 30% At the end of its useful life, management believes the machine can be sold (salvage value) for $50,000. EPP will require $17,500 of net working capital for this project which will be recovered at the end of the project. Earnings after tax Add: Depreciation The company uses a discount rate of 10% for projects of similar risk, and their marginal tax rate is 30%. Capital Expenditures Use the net present value (NPV) method to evaluate the project. Changes in Net Working Capital Free Cash flows Decision: Should the company accept or reject the project? (You must show your work for full marks) NPV (Note: fill in the cells in the table in the following page with appropriate 'item name' such as Revenue, Fixed Costs, Variable Costs, Depreciation, and Lost revenues) Year Fill in this cell Excerpt Pulp and Paper Limited (EPP) wants to expand its operations. It is considering the purchase of a mulching and pressing machine for its new line of paper worth $600,000. The company estimates that the equipment will enable them to increase revenues by $750,000 per year for the next five (5) years, which is also the useful life of the equipment. Variable operating expenses related to the pressing machine are estimated to be 55% of revenues per year and fixed expenses associated with the project are $75,000 per year. Fill in this cell Fill in this cell Fill in this cell Fill in this cell The new mulching and pressing machine is much bigger and will need to be located in a different location of EPP operations. They will use an existing facility that is currently underused and leased out for $55,000 per year. EPP bought this facility for $1.1 million two years ago. Earnings before tax Income Tax @ 30% At the end of its useful life, management believes the machine can be sold (salvage value) for $50,000. EPP will require $17,500 of net working capital for this project which will be recovered at the end of the project. Earnings after tax Add: Depreciation The company uses a discount rate of 10% for projects of similar risk, and their marginal tax rate is 30%. Capital Expenditures Use the net present value (NPV) method to evaluate the project. Changes in Net Working Capital Free Cash flows Decision: Should the company accept or reject the project? (You must show your work for full marks) NPV (Note: fill in the cells in the table in the following page with appropriate 'item name' such as Revenue, Fixed Costs, Variable Costs, Depreciation, and Lost revenues)