Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*Year is not included* - Please help me with this one! I'm from the Philippines :) 8-11 The next four (4) questions are based on

*Year is not included* - Please help me with this one! I'm from the Philippines :)

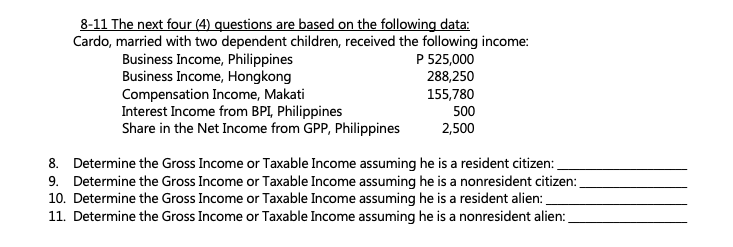

8-11 The next four (4) questions are based on the following data: Cardo, married with two dependent children, received the following income: Business Income, Philippines P 525,000 Business Income, Hongkong 288,250 Compensation Income, Makati 155,780 Interest Income from BPI, Philippines 500 Share in the Net Income from GPP, Philippines 2,500 8. Determine the Gross Income or Taxable Income assuming he is a resident citizen: 9. Determine the Gross Income or Taxable income assuming he is a nonresident citizen: 10. Determine the Gross Income or Taxable Income assuming he is a resident alien: 11. Determine the Gross Income or Taxable Income assuming he is a nonresident alienStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started